The price of Brent crude ended the week at $86.81 after closing the previous week at $86.24. The price movement aligned with our expectations that the price of Brent crude would move sideways last week. The price of WTI ended the week at $83.19 after closing the previous week at $82.82. The price of DME Oman ended the week at $88.01 after closing the previous week at $87.57. (Source: Shutterstock.com)

The price of Brent crude ended the week at $86.81 after closing the previous week at $86.24. The price movement aligned with our expectations that the price of Brent crude would move sideways last week. The price of WTI ended the week at $83.19 after closing the previous week at $82.82. The price of DME Oman ended the week at $88.01 after closing the previous week at $87.57.

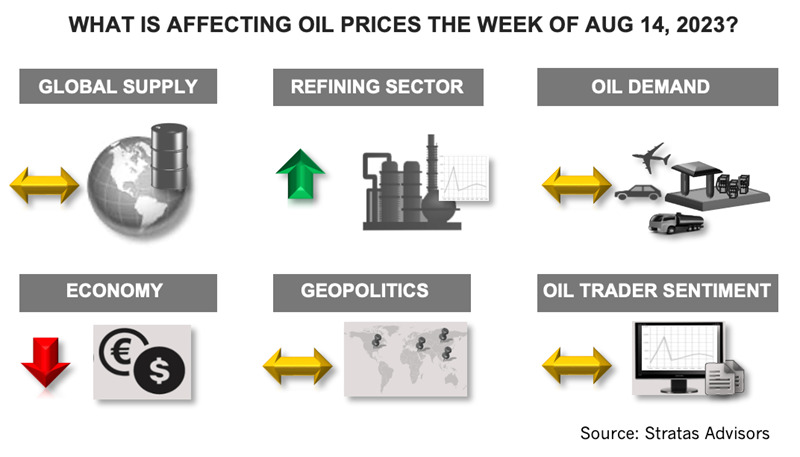

Looking forward, we are expecting that after the runup in prices during 3Q, oil prices will moderate in 4Q, despite the concerns being raised about the future impact of the production cuts by OPEC+ members on global crude inventories. Based on our projected demand and supply for 4Q, we are forecasting a deficit of 1.11 million bbl/d in 4Q. The deficit in 4Q will be 1.95 million bbl/d with the current supply trends (including Saudi Arabia extending its voluntary cut of 1.0 million bbl/d through the end of the year). Even if the additional deficit in 4Q comes to be, global crude inventories (OECD and non-OECD) would be essentially the same as the pre-COVID levels and still more than crude inventories in 2022. Additionally, we think it is unlikely that a supply deficit of this level will be sustainable, given that the effective spare capacity of OPEC+ increased to 5.71 million bbl/d with the additional production cuts that took place in July.

That said, there are upside risks associated with our forecast stemming from geopolitical developments that have the potential to disrupt crude production and crude exports, including the ongoing Russia-Ukraine conflict leading to future attacks on oil-related infrastructure and the tensions with Iran leading to further interference with ships passing through the Strait of Hormuz. These risks, however, are being partially offset by the ability of sanctioned producers to expand production. Russia is now producing more crude oil than Saudi Arabia with Saudi Arabia crude production falling to around 9.0 million bbl/d in July, while Russia’s production is around 9.4 million bbl/d. Besides Russia, other sanctioned producers are increasingly able to skirt the sanctions; Iran’s production has increased to around 3.0 million bbl/d and Venezuela’s production has increased to more than 800,000 bbl/d.

As such, we still hold that the downside risk associated with the global economy is greater than the upside risk.

- Data released last week indicated that the US Consumer Price Index in July increased to 3.2% (on an annual rate) from 3.0% in June. The core inflation, which excludes food and energy prices decreased to 4.7% from 4.8% in June and the inflation rate, excluding housing, food and energy prices is now around 2.5%. At this point, the case can be made that the Federal Reserve should not raise interest rates any further; however, even if the Federal Reserve does not increase rates further, it is unlikely that the Federal Reserve will decrease rates in the near term. The relatively high interest rates will continue to cause stress for US consumers, who are facing record-level debt and record-level interest rates. Furthermore, real wages were increasing less than inflation from April of 2021 until this July. During that period, the US consumer lost significant purchasing power (around 15%). The US government is also facing fiscal challenges. US debt is 113% of the gross domestic product with interest payments rising and exceeding USD 1.0 trillion per annum, which is greater than the miliary budget of the US. While the US is unlikely to have a debt crisis for several reasons, including that the US is borrowing in its own currency, the increasing debt levels and interest payments will be a negative factor for future economic growth because of the need to increase tax revenue at some point or let the US dollar depreciate significantly.

- Concerns about China’s economy were reinforced by the data released last week indicating that consumer prices in China decreased by 0.3% in July and producer prices decreased by 4.4%, which is the first time that both indexes decreased together since November 2020. Instead of increasing spending, Chinese consumer are saving at increasing levels. Additionally, China’s economy continues to be hampered by an over-leveraged real estate sector and weak exports, which decreased by 14.5% in July from the previous year. China’s exports to the US decreased by 23.1% and exports to the EU decreased by 20.6%. So far this year, China’s exports are 5.0% lower than during 2022 (China’s imports are also lower by 7.6%).

- Europe continues to be hindered by elevated inflation, increasing interest rates and is likely to face further energy-related challenges in the coming months. The Euro has weakened against the US dollar from 1.124 in the middle of July to 1.095. Germany’s economy continues to struggle because of weakness in the manufacturing and construction sectors coupled with slower growth in exports.

For the upcoming week, we are expecting that the price of Brent crude oil will be under pressure.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

New Permian Math: Vital Energy and 42 Horseshoe Wells

2024-05-10 - Vital Energy anticipates making 42 double-long, horseshoe-shaped wells where straight lines would have made 84 wells. The estimated savings: $140 million.

SM Energy Targets Prolific Dean in New Northern Midland Play

2024-05-09 - KeyBanc Capital Markets reports SM Energy’s wells “measure up well to anything being drilled in the Midland Basin by anybody today.”

Vår Selling Norne Assets to DNO

2024-05-08 - In exchange for Vår’s producing assets in the Norwegian Sea, DNO is paying $51 million and transferring to Vår its 22.6% interest in the Ringhorne East unit in the North Sea.

Crescent Energy: Bigger Uinta Frac Now Making 60% More Boe

2024-05-10 - Crescent Energy also reported companywide growth in D&C speeds, while well costs have declined 10%.

SLB OneSubsea JV to Kickstart North Sea Development

2024-05-07 - SLB OneSubsea, a joint venture including SLB and Subsea7, have been awarded a contract by OKEA that will develop the Bestla Project offshore Norway.