(Source: Shutterstock)

The price of Brent crude ended the week at $93.93 after closing the previous week at $90.65. The price of WTI ended the week at $90.77 after closing the previous week at $87.51. The price of DME Oman ended the week at $95.28 after closing the previous week at $91.85.

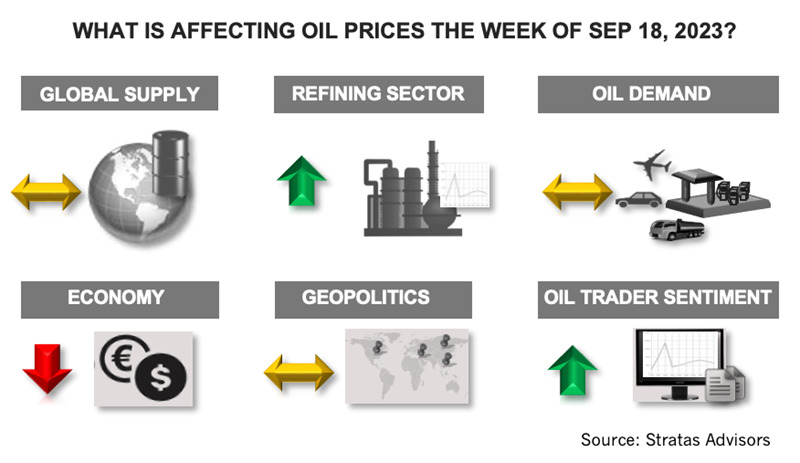

The increases in prices were driven by the extension of the supply cuts from OPEC+, plus the temporary disruptions to crude exports from Libya stemming from the recent flooding—and from some increased optimism about China’s economic growth and oil demand. The price increases also occurred despite the increase in U.S. oil-related inventories. The EIA reported that U.S. crude inventories increased by 3.96 MMbbl and product inventories changed as follows:

- Gasoline inventories increased by 56 MMbbl

- Diesel inventories increased by 3.93 MMbbl

- Jet fuel inventories decreased by 0.717 MMbbl

Libya’s oil exports have now returned with Libya’s ports (Es Sidra, Ras Lanuf and Zueitina) having reopening by the middle of last week. Additionally, U.S. oil production has reached 12.9 MMbbl/d, which is an increase of 800,000 bbl/d from one year ago, and the highest level since March 2020 when U.S. production was at 13.0 MMbbl/d. Nonetheless, global oil demand is outpacing global supply, and is expected to do so through the rest of the year.

However, we still think that concerns about the global economy will be a counterforce on oil prices.

Last week, the latest inflation data for the U.S. were released and showed that inflation is still well above the 2.0% target set by the Federal Reserve, The Producer Price Index increased by 0.7% in August, while the Consumer Price Index increased by 0.6%, which is the highest level since the first half of 2022. The core inflation numbers, which strip out food and energy were more favorable but with both the core PPI and CPI increasing by 0.3% during August. The lingering inflation complicates monetary policy, and while the Federal Reserve may feel the need to increase interest rates, the risk of doing so is increasing. One of those risks is associated with consumers, which are being squeezed by declining purchasing power that is translating into increased debt levels. Credit card balances exceed $1.0 trillion dollars at the end of the second quarter while the average interest rate is running around 21%. Overall household debt now stands around $17.0 trillion and has increased by $2.9 trillion since the end of 2019. The restart of student-loan payments on Oct. 1 is not going to help, given that the average student-loan borrower will need to make a monthly payment of $250, which, in total, will represent about $100 billion over the coming year. Furthermore, the U.S. savings rate is at a very low level (only 3.5% in July), which is less than half during the period from 2015 to 2019. During the next Federal Reserve meeting scheduled for Sept. 19 and 20, we are expecting that the Federal Reserve will keep rates unchanged.

While there is some increasing optimism about China and China oil demand, the economic data is still signaling weakness. In July, China’s manufacturing production grew at only 3.7% in comparison to last July, and slower than in June (4.4% increase). Meanwhile, automotive production decreased by 3.8% and cement production decreased by 5.7%.

The situation is not improving in Europe, as indicated by the EU reducing its forecast for economic growth for 2023 to 0.8% from the previous forecast of 1.1% and economic growth for 2024 to 1.3% from 1.6%.

We think that another counterforce on rising oil prices is that Saudi Arabia will be facing a decision on how much longer to extend its voluntary supply cut, while other producers, including Iran, are increasing their exports. For the upcoming week, however, we are expecting that oil prices will trend upwards with traders adding to their net long positions. The price of Brent is already at the highest level of the year and the next resistance level is around $95.00.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

U.S. Shale-catters to IPO Australian Shale Explorer on NYSE

2024-05-04 - Tamboran Resources Corp. is majority owned by Permian wildcatter Bryan Sheffield and chaired by Haynesville and Eagle Ford discovery co-leader Dick Stoneburner.