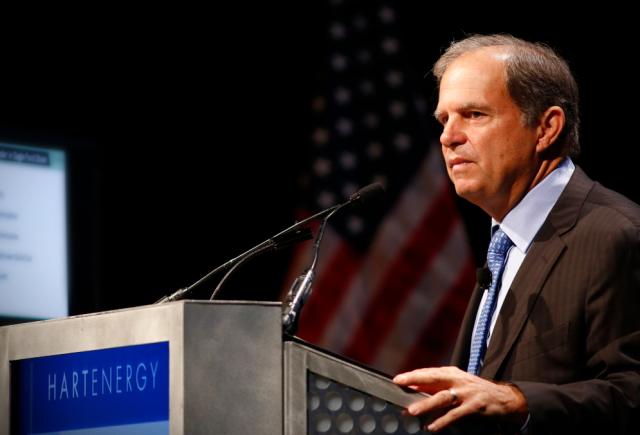

Scott Sheffield speaking at one of Hart Energy’ DUG Conference & Exhibitions. (Source: Hart Energy)

The CEO of Pioneer Natural Resources Co., Scott Sheffield, on Feb. 20 called on energy investors to sell shares or pull funding from companies that have rates of natural gas flaring.

The practice of burning off natural gas produced alongside more profitable oil has become a top issue for investors, who are focused on sustainability measures and already are frustrated by a decade of poor financial returns in oil and gas. Flaring has surged with U.S. oil output, but can worsen climate change by releasing CO₂.

If producers in the Permian Basin, the top U.S. shale field, cannot drop flaring rates below 2% of gas produced by the first half of next year, when new pipelines would have come online, Sheffield asked investors in public shares, bonds or private equity firms to "end up either not doing business or sell whatever you have in regard to that company."

The idea, Sheffield said during an earnings call, came out of a late January workshop in Austin, Texas, coordinated between Columbia University and the University of Texas at Austin, which brought together producers, pipeline companies, policymakers, non-governmental organizations, academics and analysts to talk about Permian Basin flaring. The workshop was invitation-only, but Columbia plans to release a report on it.

Companies attending agreed to share best practices, better report data to state agencies in Texas and New Mexico and set flaring targets, Sheffield said.

"I think it's important to remove that black eye on the Permian Basin going forward," said Sheffield, who in November first called for companies to limit flaring.

RELATED:

Texas Regulator Names Companies With Highest Flaring Rate

Other executives that have spoken out against high flaring rates include Matt Gallagher, CEO of Parsley Energy Inc., and the head of Royal Dutch Shell's Permian Basin operations, Amir Gerges, who said this month that the region needs "regulatory requirements that incentivize reduction in flaring."

On Feb. 18, one of Texas' oil and gas regulators defended flaring rates, which average around 5% in the Permian but also released a report naming companies with the worst records and said he would hold public meetings on the topic.

Several Permian Basin producers reported financial results this week, including Concho Resources Inc., which said it dropped its flaring rate to 1.6% last year from 3.6% in 2017.

“There's a lot of push, obviously, on the industry and from within the industry to continue to move that number down,” Concho CEO Tim Leach said Feb. 19.

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.