Though natural gas and NGL prices have been decoupling from oil prices for the past several years as the shale revolution helped increase the relationship between U.S. markets with their global counterparts, the sudden downturn in crude prices have pulled the entire hydrocarbon sector down with it.

This downturn was caused by macroeconomic concerns, primarily based on an unequal supply and demand equation caused by increased production out of the Middle East and Africa and lower economic growth rates in Europe that have caused the U.S. dollar to strengthen. “Because oil is denominated in dollars, a stronger dollar leads to lower oil prices,” Moody’s Investors Service said in a recent research report.

West Texas Intermediate (WTI) crude closed the week of Oct. 20 a shade above $80.00 per barrel (/bbl), its lowest value in more than two years. It is too early to tell whether this price downturn is a short-lived event or one that will have a longer-lasting impact on the market. Moody’s anticipates that current prices will be improved upon on a long-term basis, but stated that they could fall further.

“Despite growing supply, particularly in the U.S., longer-term pricing should remain north of $80, primarily due to expected growth in global demand. However, over the next several months we could easily see prices dip into the $70s,” the rating agency said in the report. The agency’s price assumptions of $85/bbl for WTI and $90/bbl for Brent along with its stress case price of $60/bbl remain unchanged.

As the week drew to a close there were positives on this front as the Dow Jones Industrial Average gained nearly 217 points, the NASDAQ Index gained 70 points and the S&P 500 Index gained 24 points on Oct. 23 after corporate earnings were reported at a higher-than-expected rate. In addition, fears over the possible spread of Ebola in the U.S. have subsided and lessened fears that travel could be restricted and lead to lower fuel demands.

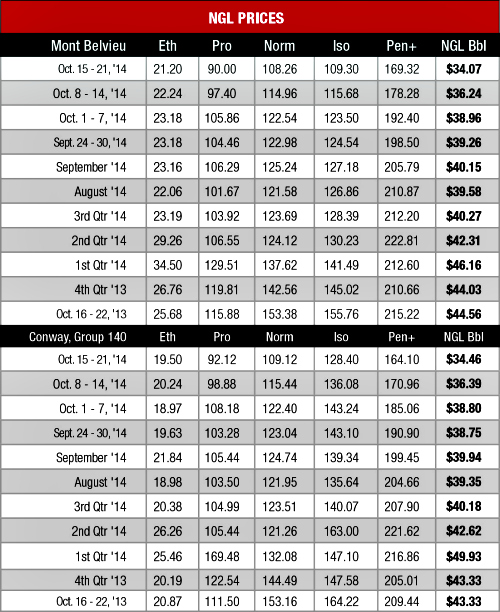

NGL prices plunged along with crude prices, but still remain the petrochemical industry’s preferred feedstock over naphtha. This is a situation that is likely to remain the same unless WTI prices fall below $70/bbl.

Ethane prices were largely unchanged at 21 cents per gallon (/gal) at Mont Belvieu and 20 cents/gal at Conway as the market remains in flux until full cracking capacity resumes early next year. Cracking capacity was increased as ExxonMobil Corp. brought its Baytown Olefins Plant No. 2 back online after a 40-day scheduled maintenance. It is expected that Chevron Phillips Chemical Co.’s Unit 22 plant in Sweeny, Texas, will return to service the week of Oct. 27.

Record LPG exports have not been able to overcome strong propane storage builds as prices have been decreasing the last few weeks with heating and crop-drying demand yet to firmly take hold. The Mont Belvieu price fell 8% to 90 cents/gal, its lowest price since it was 88 cents/gal the week of July 3, 2013. The Conway price was a little stronger as it fell 7% to 92 cents/gal, its lowest price since it was 91 cents/gal the week of July 31, 2013.

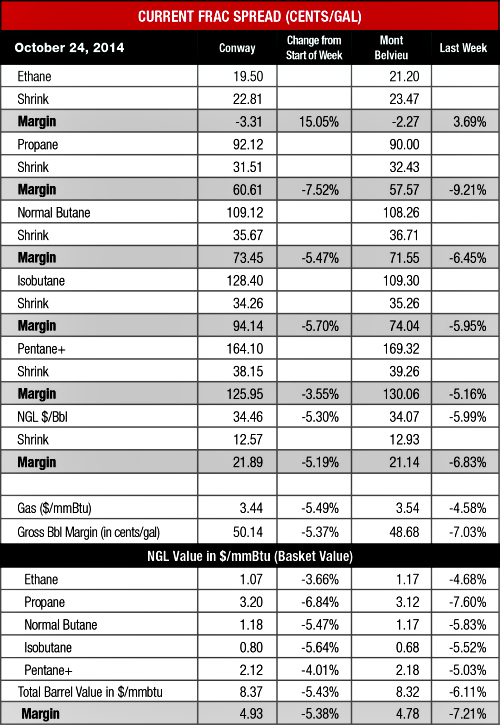

Natural gas prices are experiencing their own price decreases as heating demand is limited and supplies continue to steadily grow. The Conway price fell 6% to $3.44 per million Btu (/MMBtu) while the Mont Belvieu was down 5% to $3.54/MMBtu. Although prices are expected to climb this coming winter with the stronger-than-normal heating demand, the season isn’t expected to be as cold as this past winter, according to Barclays Capital.

“As we march towards the winter, seasonal weather-driven shifts in demand sources will be critical, and in the near term, warmer weather in the West and Southwest could be offset by cooler weather in the Northeast toward the end of near-term weather forecasts,” the investment firm said in its Natural Gas Market Outlook for Oct. 17, 2014 while noting that this coming winter is expected to be 2% to 3% cooler than normalized winters.

Lower gas prices helped to soften the blow of weaker NGL prices on frac spread margins as the largest drop in margin was for propane at less than a 10% decrease at both hubs. The most profitable NGL to make at both hubs was C5+ at $1.26/gal at Conway and $1.30/gal at Mont Belvieu. This was followed, in order, by isobutane at 94 cents/gal at Conway and 74 cents/gal at Mont Belvieu; butane at 74 cents/gal at Conway and 72 cents/gal at Mont Belvieu; propane at 61 cents/gal at Conway and 58 cents/gal at Mont Belveiu; and ethane at negative 3 cents/gal at Conway and negative 2 cents/gal at Mont Belvieu.

Natural gas storage levels increased 94 billion cubic feet to 3.393 trillion cubic feet (Tcf) the week of Oct. 17 from 3.299 Tcf the previous week according to the U.S. Energy Information Administration. This was 9% below the 3.729 Tcf reported last year at the same time and the five-year average of 3.731 Tcf.

Recommended Reading

Scout Taps Trades, Farm-Outs, M&A for Uinta Basin Growth

2024-11-27 - With M&A activity all around its Utah asset, private producer Scout Energy Partners aims to grow larger in the emerging Uinta horizontal play.

Gran Tierra Enters Montney Shale JV with Logan Energy

2024-11-27 - In addition to its joint venture with Logan Energy Corp., Gran Tierra Energy Inc. also announced a seventh successful discovery well in Ecuador.

Japan’s Toyo to Buy Houston Area Solar Module Production Facility

2024-11-26 - Toyo says it plans to start production of 1 GW of annual module capacity by mid-2025 and reach 2.5 GW by the end of 2025.

DNOW Closes Cash Acquisition of Water Service Company Trojan Rentals

2024-11-26 - DNOW Inc.’s acquisition of Trojan Rentals LLC is its third purchase aimed at providing a holistic water management solution to the market, the company said.

Valveworks Adds Choke Product Offerings with Lancaster Acquisition

2024-11-25 - Valveworks USA is acquiring Lancaster Flow Automation to add choke and flow-control automation technology to its product offerings.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.