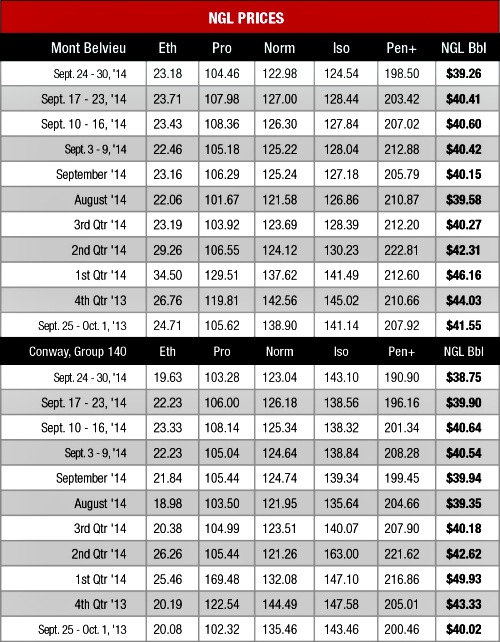

NGL prices took a downturn as September came to a close. The shoulder season is firmly entrenched and infrastructure outages continue to plague the industry.

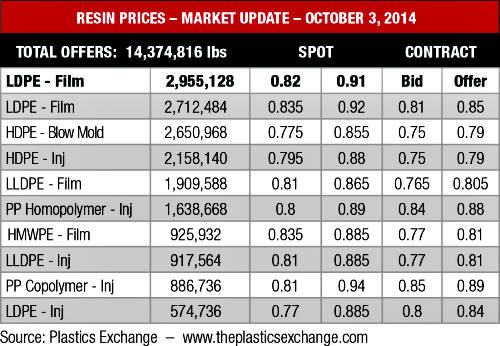

Ethane cracking capacity has been hampered by planned and unplanned turnarounds this year. Both The Williams Cos. Inc.’s Geismar, La., cracker and Chevron Phillips Chemical Co.’s Port Arthur, Texas, plants remain down, but ExxonMobil Corp.’s Baytown, Texas, Olefins Plant No. 2 undertook an unplanned 40-day turnaround the first week of October.

It is anticipated that all three facilities will be back online by the end of the month or beginning of November. However, at least three more plants will undergo turnarounds in fourth-quarter 2014 and first-quarter 2015. These include the 800 million pound per year expansion of LyondellBasell Industries NV’s La Porte, Texas, plant that is scheduled to be in-service in the fourth quarter; Formosa Plastics Corp.’s Point Comfort, Texas, Olefins 1 cracker, which moved back its five-week turnaround from early September to late October; Chevron Phillips Chemical’s Cedar Bayou cracker in Baytown is likely to push back its planned turnaround into next year; Dow Chemical Co. is also expected to postpone the planned turnaround for its LHC-8 cracker in Freeport, Texas, from mid-October to first-quarter 2015.

Given the number of outages, it is likely that domestic cracking capacity will remain challenged until early next year. Further pushback on ethane prices this week was felt after the U.S. Energy Information Administration (EIA) announced that ethane stock levels increased more than 1.8 million barrels (bbl) to nearly 40 million bbl in July, the most recent data available. This represented an all-time high inventory level, which may be broken this fall and will require time to work off.

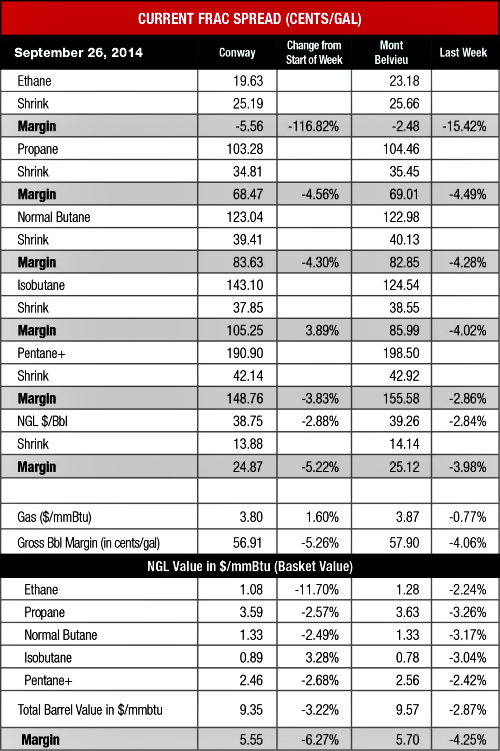

Conway E-P mix took the biggest hit since the hub has a limited market for the product on a normal basis, so constraints are especially rough. The price fell 12% to 20 cents per gallon (/gal), its lowest price in nearly two months. This resulted in the frac spread falling by more than twice in value to negative 6 cents/gal.

Mont Belvieu ethane fared better with a 2% drop in value to 23 cents/gal, which is in the range it has been trading for much of the past three months. The 15% drop in frac spread value also wasn’t as bad as it was in the Midcontinent.

Propane prices took a 3% tumble at both hubs, but it appears that crop drying demand has begun. “Reports from the major corn growing states indicate that the harvest is just underway and that the corn crop in some states has a high moisture content,” according to En*Vantage’s Weekly Energy Report for Oct. 2. The company estimates that nearly 13 million bbl of propane will be needed to meet crop drying demand this season with peak demand hitting in mid to late October.

Once demand kicks into gear it is likely that Conway prices will have a premium over Mont Belvieu prices, which could run throughout the winter heating season as propane makes up a larger heating market in the Midwest. As it currently stands, Mont Belvieu prices have a slightly greater value—the Gulf Coast price was $1.05/gal compared to $1.03/gal at Conway.

En*Vantage cautions that price improvements will only take hold with a normal or cold winter due to the record storage levels for propane. “If winter fuel demand for propane falls short, the only hope is that Sunoco Logistics [Partners LP]’s Nederland, Texas, propane export terminal is at its 200,000 bbl/d capacity when it comes online in the first quarter of 2015,” the report said.

Crude prices are now just above $90/bbl, which is having a negative impact on heavy NGL prices. The downturn in crude is due to increased production out of the Middle East and Africa along with improvements in the U.S. dollar. However, there are indications of improvements on the horizon, namely low U.S. storage levels for crude and the likelihood that production will drop in foreign markets while demand will increase.

Should crude prices rally, C5+ will follow suit and surge past $2.00/gal. As it stands, C5+ prices fell below that threshold at both hubs and are in danger of falling below $1.90/gal as well without improvements in crude prices.

The theoretical NGL bbl price fell 3% at both hubs with the Conway price at $38.75/bbl with a 5% drop in margin to $24.87/bbl and the Mont Belvieu price at $39.26/bbl with a 4% drop in margin to $25.12/bbl. The most profitable NGL to make at both hubs remained C5+ despite its downturn with the Conway margin at $1.49/gal and the Mont Belvieu margin at $1.56/gal. This was followed, in order, by isobutane at $1.05/gal at Conway and 86 cents/gal at Mont Belvieu; butane at 84 cents/gal at Conway and 83 cents/gal at Mont Belvieu; propane at 69 cents/gal at Conway and Mont Belvieu; and ethane at negative 6 cents/gal at Conway and negative 3 cents/gal at Mont Belvieu.

Natural gas storage levels increased 112 billion cubic feet to 3.1 trillion cubic feet (Tcf) from 2.988 Tcf the week of Sept. 26, the most recent data available from the EIA. This was 11% below the 3.473 Tcf figure posted last year at the same time and 11% below the five-year average of 3.499 Tcf. However, heating demand should remain challenged the week of Oct. 8 as the National Weather Service’s forecast anticipates warmer-than-normal temperatures throughout much of the country.

Recommended Reading

Utica Oil E&P Infinity Natural Resources Latest to File for IPO

2024-10-05 - Utica Shale E&P Infinity Natural Resources has not yet set a price or disclosed the number of shares it intends to offer.

Quantum’s VanLoh: New ‘Wave’ of Private Equity Investment Unlikely

2024-10-10 - Private equity titan Wil VanLoh, founder of Quantum Capital Group, shares his perspective on the dearth of oil and gas exploration, family office and private equity funding limitations and where M&A is headed next.

BKV Prices IPO at $270MM Nearly Two Years After First Filing

2024-09-25 - BKV Corp. priced its common shares at $18 each after and will begin trading on Sept. 26, about two years after the Denver company first filed for an IPO.

Exclusive: How E&Ps Yearning Capital can Stand Out to Family Offices

2024-10-15 - 3P Energy Capital’s Founder and Managing Partner Christina Kitchens shares insight on the “educational process” of operators looking at opportunities in the U.S. and how E&Ps looking for capital can interest family offices, in this Hart Energy Exclusive interview.

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

2024-09-20 - After buying more than 13.4 million Comstock shares in August, analysts wonder if Dallas Cowboys owner Jerry Jones might split the tackles and run downhill toward a go-private buyout of the Haynesville Shale gas producer.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.