While the rest of the NGL barrel (bbl) has experienced price depreciations related to the shoulder season and decreased values for West Texas Intermediate (WTI) crude oil, propane prices improved the first week of October based on seasonal and LPG export demand.

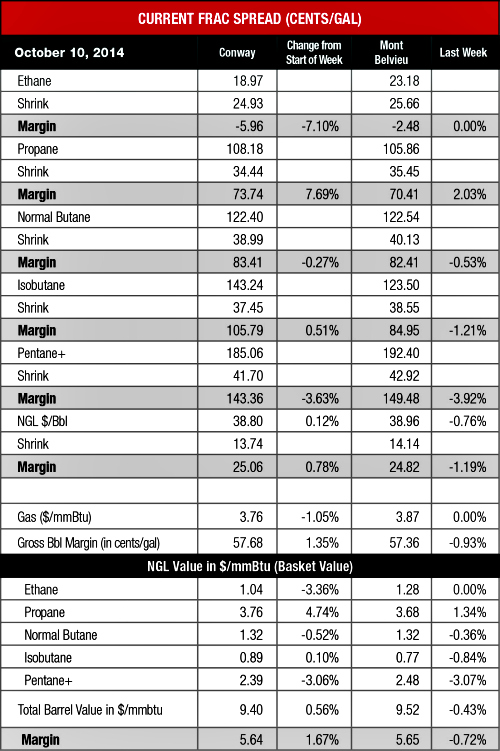

The Conway price rose 5% to $1.08/gal, its highest price since mid-April, as the Midcontinent market prepares for increased heating and crop drying demand. The Mont Belvieu price rose 1% to $1.06 per gallon (/gal).

Last month, the U.S. Department of Agriculture forecast that U.S. farmers will harvest a record crop of corn and soybean, which should result in greater demand for propane for crop drying, especially if forecasts for cold and rainy weather in the Midcontinent prove to be true.

However, En*Vantage stated that propane could be facing a steep price correction if heating demand doesn’t match the same levels as last year. “U.S. propane inventories hit another record high of 78 million bbl, with most of the surplus on the Gulf Coast. … Even though crop drying demand should be strong, it is going to take strong winter fuel demand to work down excess propane inventories,” the firm said in its Weekly Energy Report for Oct. 9.

Indeed, the U.S. Energy Information Administration (EIA) released its short-term energy outlook and stated Midwest propane inventories at the end of September were 15% greater than at the same time last year, which caused the agency to forecast significantly lower heating bills for Midwest homes this coming winter.

Consequently a price correction could occur even with strong LPG export demand, as En*Vantage anticipates 400,00 bbl/d of LPG export, but with a thinner arb to Europe and Asia based on lower crude prices and the narrowing of the Brent to WTI price spread.

Ethane, the other light NGL, is facing a more dire price outlook. There is little doubt that the market will remain challenged until early 2015 at the earliest after yet another ethane cracker—Chevron Phillips Chemical’s Sweeny, Texas, No. 22 plant—went down for unplanned repairs. This increased the percentage of total domestic cracking capacity currently offline to more than 12%. For the week, prices fell 3% to 19 cents/gal at Conway—the hub’s lowest price in two months—while the Mont Belvieu market held firm at 23 cents/gal.

Heavy NGL prices followed crude prices as they fell across the board at both hubs, aside from a very marginal price gain for Conway isobutane. The most significant price decreases were for C5+, which was down 3% at both hubs with a price of $1.85/gal at Conway and $1.92/gal at Mont Belvieu. Both were the lowest prices since July 2012 when Mont Belvieu was $1.90/gal the week of July 25, 2012, and Conway was $1.82/gal the week of July 11, 2012.

Despite these dramatic downturns, C5+ remained the most profitable NGL to make at both hubs with the Mont Belvieu price at $1.50/gal and the Conway price at $1.43/gal. This was followed, in order, by isobutane at 85 cents/gal at Mont Belvieu and $1.06/gal at Conway; butane at 82 cents/gal at Mont Belvieu and 83 cents/gal at Conway; propane at 70 cents/gal at Mont Belvieu and 74 cents/gal at Conway; and ethane at negative 3 cents/gal at Mont Belvieu and negative 6 cents/gal at Conway.

Natural gas storage levels continued to increase as the EIA reported a 105 billion cubic feet increase for the week of Oct. 3. This pushed storage levels to 3.205 trillion cubic feet (Tcf) from 3.1 Tcf the previous week. Inventories are 10% below the 3.564 Tcf figure posted last year at the same time and 11% off the five-year average of 3.583 Tcf.

These storage levels are causing a depressed forecast for gas prices this winter as not only is there not much difference from last year’s levels, but the EIA also stated that there is likely to be less withdrawn from storage.

“Even if this winter is as cold as last year’s, the net withdrawal from natural gas inventories over the heating season would not be as large as last winter’s drawdown because domestic gas production this winter is expected to be significantly higher than it was last winter,” the agency said in its short-term energy outlook.

Recommended Reading

Hot Permian Pie: Birch’s Scorching New Dean Wells in Dawson County

2024-10-15 - Birch Resources is continuing its big-oil-well streak in the Dean formation in southern Dawson County with two new wells IP’ing up to 2,768 bbl/d.

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

SM, Crescent Testing New Benches in Oily, Stacked Uinta Basin

2024-11-05 - The operators are landing laterals in zones in the estimated 17 stacked benches in addition to the traditional Uteland Butte.

Falcon, Tamboran Spud Second Well in Australia’s Beetaloo

2024-11-25 - Falcon Oil & Gas Ltd., with joint venture partner Tamboran, have spud a second well in the Shenandoah South Pilot Project in the Beetaloo.

McKinsey: Big GHG Mitigation Opportunities for Upstream Sector

2024-11-22 - Consulting firm McKinsey & Co. says a cooperative effort of upstream oil and gas companies could reduce the world’s emissions by 4% by 2030.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.