The question for NGL prices isn’t when they will recover, but how far they will fall before the end of the year. The market will likely find out in the next month just how much crude and liquids have decoupled as some of the NGL headwinds begin to dissipate with ethane cracking near full capacity and heating demand at its peak.

While it is possible that the crude market will also improve with increased gasoline demand based on lower oil prices, OPEC’s current strategy of oversaturating the market with crude will likely take a longer time to restore balance to crude prices.

So far crude and NGL prices have plummeted at similar paces this fall, which indicates that decoupling theories were overblown for the past several years. However, it is just as likely that prices have decoupled and are simply following a similar trajectory the past few months based on different events.

Heavy NGL prices have undoubtedly been affected by the downturn in the value of crude, but may see a slight turnaround as refiners increase their demand for isobutane to make winter-grade gasoline.

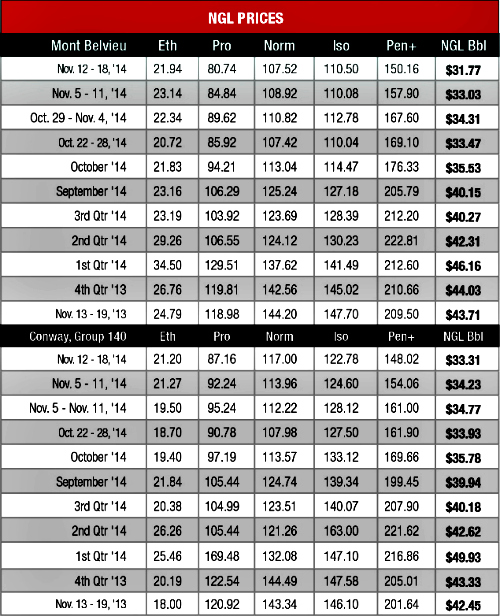

Isobutane fell 15% to 79 cents per gallon (/gal) at Mont Belvieu, the hub’s lowest price since it was 71 cents/gal the week of Dec. 23, 2008. The Conway price fared a little better as it was down 12% to 95 cents/gal, its lowest price since it was 89 cents/gal the week of May 6, 2009.

Butane prices fell at similar rates at each hub as the Mont Belvieu price was down 15% to 78 cents/gal and the Conway price was down 14% to 89 cents/gal. The Texas price was the lowest it has been since it was 77 cents/gal the week of March 11, 2009 while the Kansas price was the lowest since it was the same price the week of Aug. 26, 2009.

The NGL with the lowest drop in value was the one with the closest relationship to crude: C5+, which fell 8% to $1.31/gal at Mont Belvieu and 11% to $1.29/gal at Conway. The Kansas price was the lowest it has been since it was $1.21/gal the week of July 8, 2009 while the Texas price was the lowest it has been since it was $1.29 the week of July 15, 2009.

The largest price decrease for any NGL was for ethane, which has an enormous stock overhang to work off with cracking capacity having been constrained for nearly all of 2014 due to planned and unplanned plant turnarounds.

Prices fell 20% to 16 cents/gal at Mont Belvieu, its lowest price since Hart Energy began tabulating NGL prices on a weekly basis more than 15 years ago. The Conway price fell 1% to 15 cents/gal.

The limited price differential between the hubs is a strong indication of widespread rejection due to oversupply. These plants are being brought back online but it is likely that prices will remain challenged until supply and demand level out in mid-2015.

Propane prices also fell to their lowest levels in years as heating and crop-drying demand has been limited throughout the country. The Mont Belvieu price fell 17% to 58 cents/gal, its lowest price since it held the same value the week of Dec. 3, 2008, and the Conway price was down 21% to 57 cents/gal, its lowest level since it was the same price the week of July 11, 2012.

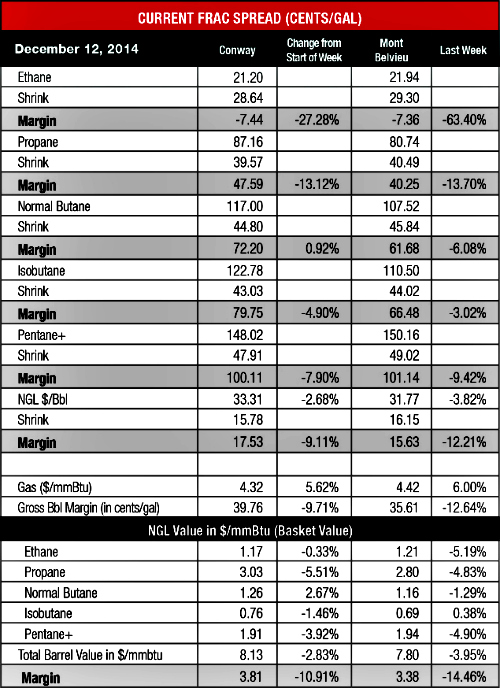

The theoretical NGL barrel (bbl) price fell 14% at Conway to $25.23/bbl with a 25% drop in margin to $12.74/bbl while the Mont Belvieu price was down 13% to $24.37/bbl with a 25% decrease in margin to $11.70/bbl.

Natural gas prices improved slightly by 2% at both hubs as the market rebalanced in advance of colder temperatures that will increase heating demand throughout the country. The Conway price was $3.42 per million Btu (/MMBtu) and the Mont Belvieu price was $3.47/MMBtu.

It was expected that the start of U.S. LNG exports early next year would support a gas price increase, but Asian LNG prices fell below $10/MMBtu on Dec. 9, their lowest level in four years, as the market began to add new suppliers. According to a report in The Wall Street Journal, Japan and South Korea are fully stocked for winter.

The most profitable NGL to make at both hubs was C5+ at 91 cents/gal at Conway and 92 cents/gal at Mont Belvieu. This was followed, in order, by isobutane at 61 cents/gal at Conway and 45 cents/gal at Mont Belvieu; butane at 53 cents/gal at Conway and 42 cents/gal at Mont Belvieu; propane at 25 cents/gal at Conway and 26 cents/gal at Mont Belvieu; and ethane at negative 7 cents/gal at both hubs.

Gas storage levels were down 51 billion cubic feet to 3.359 trillion cubic feet (Tcf) the week of Dec. 5 from 3.410 Tcf the week before, according to the Energy Information Administration. This was 5% below the 3.545 Tcf level reported last year at the same time and 10% below the five-year average of 3.710 Tcf. Heating demand will remain challenged as the National Weather Service’s forecast for the week of Dec. 16 anticipates warmer-than-normal late fall temperatures throughout the U.S.

Recommended Reading

Oceaneering Acquires Global Design Innovation

2024-10-30 - Oceaneering purchased Global Design Innovation, the only provider certified by the United Kingdom Accreditation Service (UKAS) to perform remote visual inspection using point cloud data and photographic images.

E&P Highlights: Nov. 18, 2024

2024-11-18 - Here’s a roundup of the latest E&P headlines, including new discoveries in the North Sea and governmental appointments.

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

E&P Highlights: Oct. 7, 2024

2024-10-07 - Here’s a roundup of the latest E&P headlines, including a major announcement from BP and large contracts in the Middle East.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.