If the past few years have been a period of NGL prices decoupling from crude and natural gas prices, the last few weeks have shown that these products are still linked. However, the recent price crashes in each market have had their own reasons for losing value that are separate from their connections.

The decrease in crude prices has been the biggest story in the commodities market recently. West Texas Intermediate (WTI) has dropped below $70 per barrel (/bbl) as production has exceeded demand for much of the second half of this year. The situation was made worse last week when OPEC announced that it will not halt production despite the already severe price drop. It is assumed that some OPEC members are attempting to undercut U.S. production to halt the development of unconventional domestic reserves, but the move could backfire.

“We believe the richer OPEC countries, led by the Saudis, are playing a dangerous game of chicken as the drop in crude prices has increased the probability of heightening geopolitical turmoil across the Middle East, which could boomerang against the richer OPEC countries (Saudi Arabia, UAE and Kuwait) before it significantly impacts U.S. shale production. Economic and political instabilities are growing in oil producing countries such as Libya, Nigeria, Venezuela, Angola, Algeria, not to mention the fragile geopolitics in Iraq and Iran and the deteriorating economy in Russia,” according to En*Vantage’s Weekly Energy Report for Dec. 4.

The report noted that as crude prices have decreased, gasoline demand has increased in the U.S. and that China is aggressively buying crude supplies, which supports a price turnaround.

“We realize that market sentiment remains very bearish and the deflationary environment can breed more downside as consumers delay purchases, but it seems very unreasonable that the market is placing no price risk premium to crude oil prices. The richer OPEC countries seem willing to place a big bet that their neighboring countries can withstand lower oil prices and still keep their political houses in order. This bet seems very risky to us,” the report said. It will take some time for crude prices to recover, but a turnaround could begin as soon as early 2015 when refinery turnarounds begin to take place and demand for gasoline increases.

The number of moving parts involved in crude markets makes it more difficult to predict where the market is headed, but that isn’t the cash in the natural gas market. Gas prices fell below $3.50 per million Btu (/MMBtu) at both Conway and Mont Belvieu because of mild temperatures that have limited heating demand. This is on top of the limited cooling demand that was experienced this past summer that resulted in storage levels to build back up close to their five-year average after they had drastically fallen after a very frigid winter.

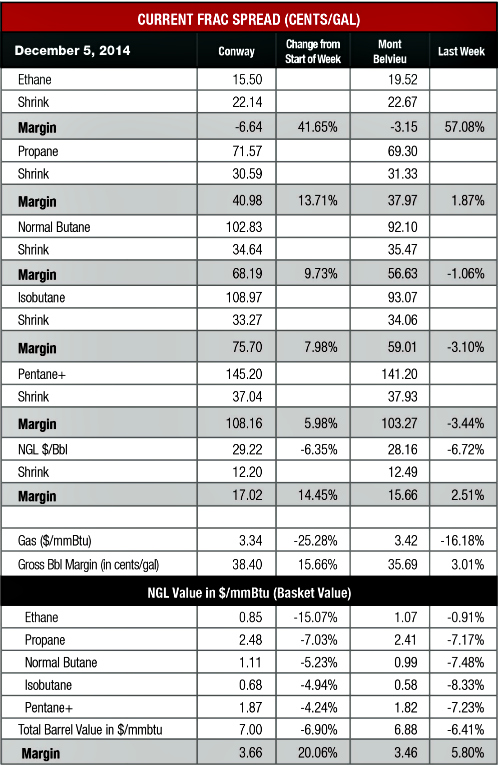

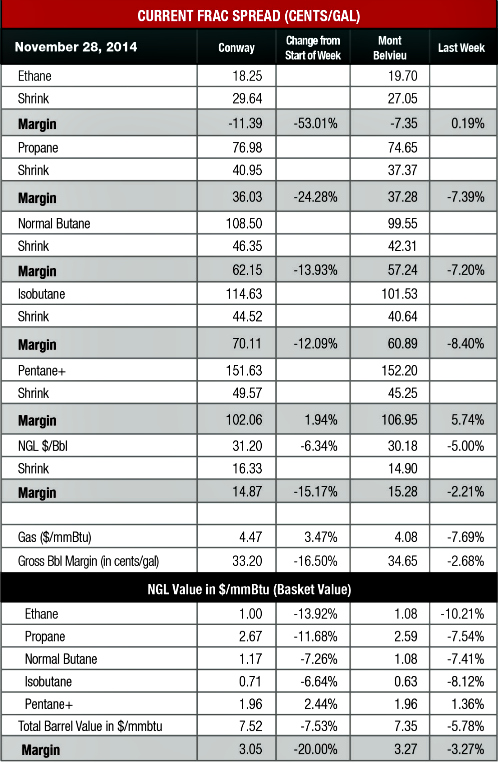

In fact, storage levels are so high that even with two solid withdrawals to start the winter heating season, prices fell heavily at both hubs. The Conway price was down 25% to $3.34/MMBtu and the Mont Belvieu price fell 16% to $3.42/MMBtu.

The downturn in NGL prices is related to both of these depressed markets, but also has its own reasons for falling, especially the light NGL markets.

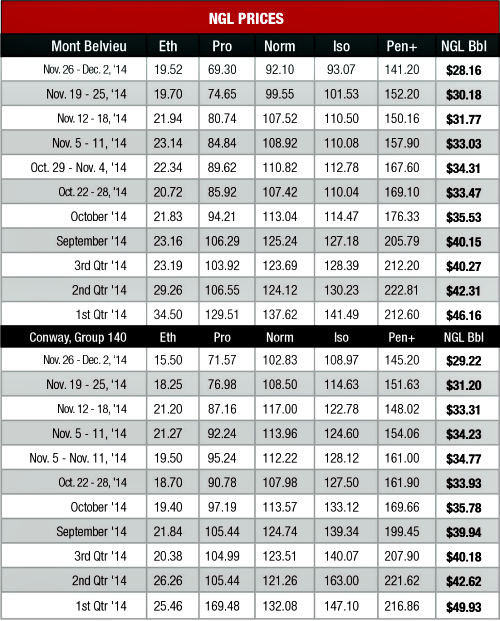

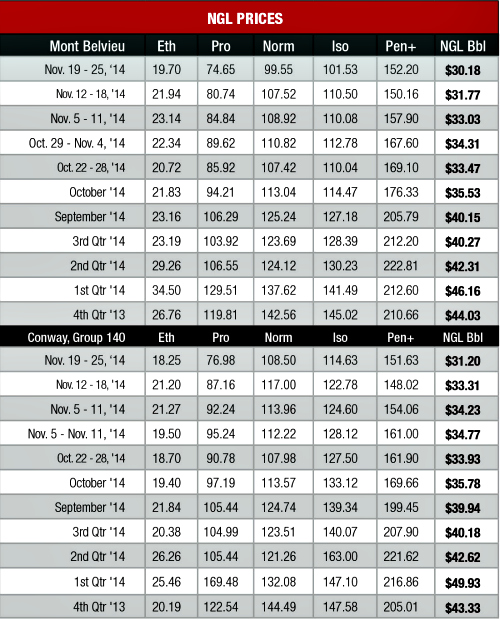

Ethane prices have deteriorated because of both planned and unplanned cracker turnarounds that have caused a tremendous storage overhang. The Conway price fell 15% to 16 cents per gallon (/gal) the week of Nov. 26 and the Mont Belvieu price dropped 1% to 20 cents/gal. The Mont Belvieu price was the lowest it has been since August 2005, while the Conway price was the lowest it has been since it was 13 cents/gal the week of Jan. 29, 2014.

The industry is approaching full capacity, but will take time to work off storage. A new headwind has emerged for ethane as lower propane and butane prices as propane is now the most preferred ethylene feedstock, though this shouldn’t result in a change in the petrochemical industry in the short-term, according to En*Vantage.

“It is doubtful that ethylene producers will significantly increase propane cracking with winter just beginning. But, the market fears that if the status quo does not change by spring then ethane cracking could be affected by increased propane cracking,” the company said.

Propane cracking is estimated between 300,000 bbl/d and 350,000 bbl/d and LPG exports remain firm, but the lack of heating demand caused prices to fall 7% at both hubs. The Mont Belvieu price was down to 69 cents/gal, its lowest price since it was 68 cents/gal the week of July 8, 2009. The Conway price of 72 cents/gal was the lowest it has been since it was also 68 cents/gal the week of Dec. 12, 2012.

The theoretical NGL bbl fell 6% to $29.22/bbl with a 15% increase in margin to $17.02/bbl at Conway while the Mont Belvieu price dropped 7% to $28.16/bbl with a 3% gain in margin to $15.66/bbl.

The margin increase at both hubs was based on improvements in ethane, but this is a statistical anomaly as ethane margins remain firmly negative and the increase is being rejected throughout the country aside from contractual and technical reasons.

The most profitable NGL to make at both hubs was C5+ at $1.08/gal at Conway and $1.03/gal at Mont Belvieu. This was followed, in order, by isobutane at 76 cents/gal at Conway and 59 cents/gal at Mont Belvieu; butane at 68 cents/gal at Conway and 57 cents/gal at Mont Belvieu; propane at 41 cents/gal at Conway and 38 cents/gal at Mont Belvieu; and ethane at negative 7 cents/gal at Conway and negative 3 cents/gal at Mont Belvieu.

Natural gas storage levels fell 22 billion cubic feet to 3.41 trillion cubic feet (Tcf) the week of Nov. 28 from 3.432 Tcf the previous week, according to the most recent information from the Energy Information Administration. This was 6% below the 3.637 Tcf posted last year at the same time and 10% below the five-year average of 3.782 Tcf.

Storage levels are expected to face challenges the second week of December as the National Weather Service’s forecast anticipates warmer-than-normal temperatures throughout the country, which should lower heating demand.

Recommended Reading

Texas Pacific Land Closes $290MM Permian Minerals, Royalties Deal

2024-10-03 - Texas Pacific Land Corp. acquired Permian Basin oil and gas minerals and royalties operated by Exxon Mobil, Diamondback Energy, Occidental Petroleum and ConocoPhillips.

WhiteHawk Energy Adds Marcellus Shale Mineral, Royalty Assets

2024-09-18 - WhiteHawk Energy LLC said it acquired Marcellus Shale natural gas mineral and royalty interests covering 435,000 gross unit acres operated by Antero Resources, EQT, Range Resources and CNX Resources.

Vital, NOG Close $1.1B Acquisition of Delaware Basin’s Point Energy

2024-09-23 - Point Energy Partners, backed by Vortus Investments Advisors, sold its Delaware Basin acreage at 40,000 boe/d of production to Vital Energy and Northern Oil and Gas for $1.1 billion.

Oxy CEO Sheds Light on Powder River Basin Sale to Anschutz

2024-11-14 - Occidental is selling non-core assets in the Lower 48 as it works to reduce debt from a $12 billion Permian Basin acquisition.

Dorchester Inks Deals for Midland, Delaware and D-J Basin Interests

2024-09-16 - Dorchester Minerals agreed to buy Permian Basin interests in the Midland and Delaware basins for roughly $215 million, based on its Sept. 16 unit price.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.