In this column over the summer, I outlined how conditions were favorable for dealmaking in midstream. Those conditions produced several deals since then, and while those conditions remain in place, there are fewer deals to do.

That’s because there are fewer companies left to buy each time a company gets bought, and there aren’t new companies being formed. ONEOK Inc. announced the latest major acquisition, the control stake in EnLink Midstream in a $3.3 billion cash transaction.

When the transaction with EnLink closes, ONEOK will have been responsible for the elimination of two of those companies in the last two years. After the Magellan Midstream Partners and EnLink acquisitions, ONEOK will have doubled its EBITDA through M&A in just a few years. The dynamics of less competition for big M&A than in the past, combined with industrial logic and big (but tangible) synergies allow for these larger deals to add value in a sector where big M&A has often been value destructive.

Sector impact

This latest ONEOK deal has several broader sector implications near-term, including:

Deal takes ONEOK out of the market for a time. ONEOK will be busy for a while closing this acquisition, integrating the assets and realizing synergies. That will keep the company too busy to be an acquirer of other companies that investors have speculated are targets, most notably Plains All American and Kinetik.

Market reaction could encourage more M&A. ONEOK traded up on the day the EnLink transaction was announced. The simple reaction to that might be that the market investors are OK with delaying buybacks and dividend acceleration that has been promised if a company would rather opt for M&A. But the positive reaction was due to the nuances of this particular transaction. If the M&A is strategic enough, i.e., has big synergies, is struck at a reasonable valuation and does not come with equity overhang (ONEOK paid cash for the GIP units), then the market reaction should be positive. That combination of factors is hard to replicate, but I still think other potential acquirers took notice that the market is not automatically opposed to big deals.

Scarcity of remaining players supports valuations. With fewer midstream companies left, investors will spread capital across the remaining names, supporting stock prices across the sector. Investors with dedicated midstream portfolios who may have owned ONEOK and EnLink will now probably look to upweight other midstream names with similar assets, maybe to the benefit of mid-cap names that are not already full positions such as Targa Resources, Kinetik, Western Midstream and DT Midstream, which are also among the names that are speculated takeout candidates. A corollary on the scarcity value impact is that this transaction will eventually remove another name from the Alerian MLP Index, which will jack up weights of the remaining constituents, leading to a technical index version of scarcity value to the benefit of other names not already capped in that index.

Universe update: smaller, more corp-y

Viewed through the wider lens of the last decade, this is just another data point on the trend line of rationalization and consolidation of midstream companies into a few dominant players. That consolidation has transformed the sector, and the numbers highlight how dramatic that transformation has been when you add up all the data points.

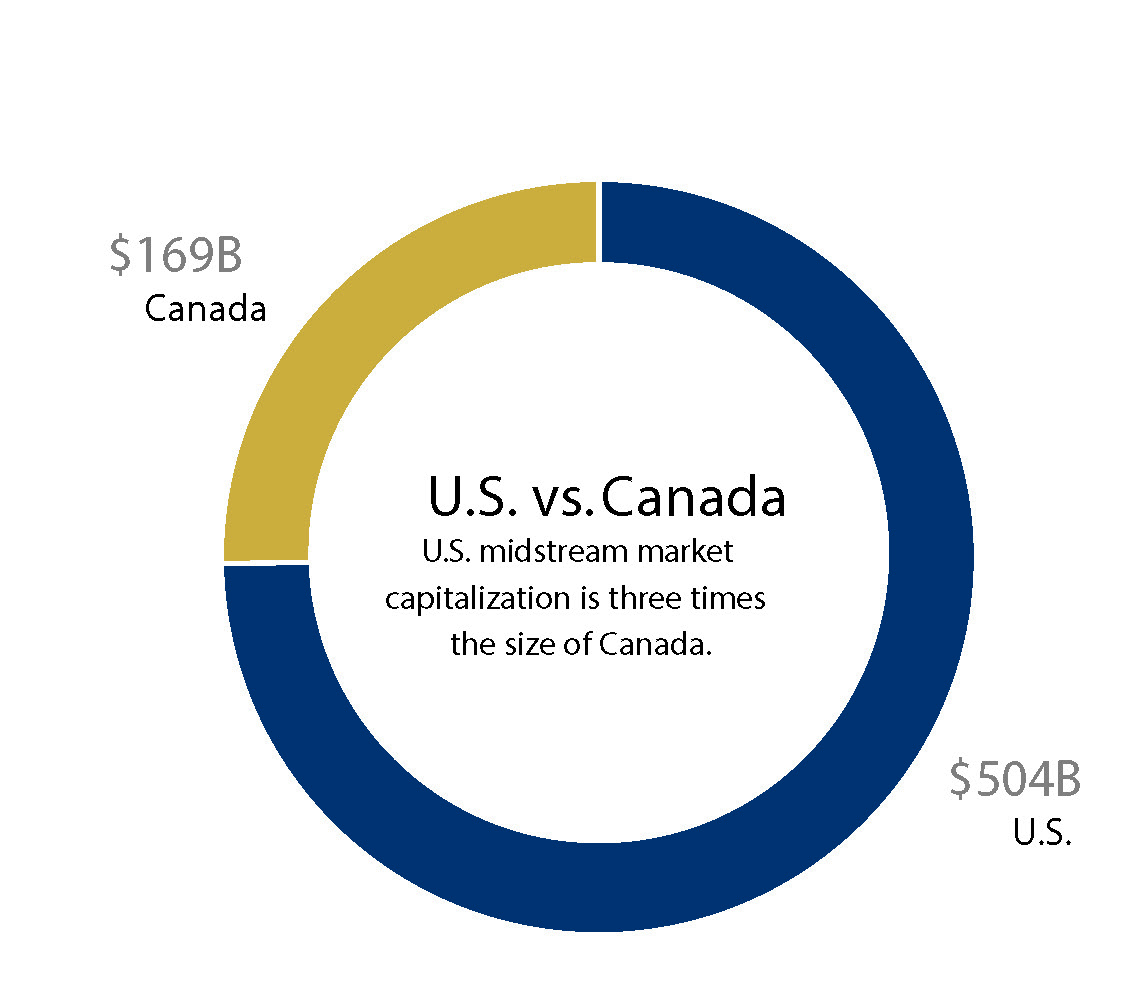

Assuming the eventual full takeout of EnLink, the overall universe of publicly traded midstream corporations in North America stands at 29, including 23 that are greater than $2 billion in market capitalization.

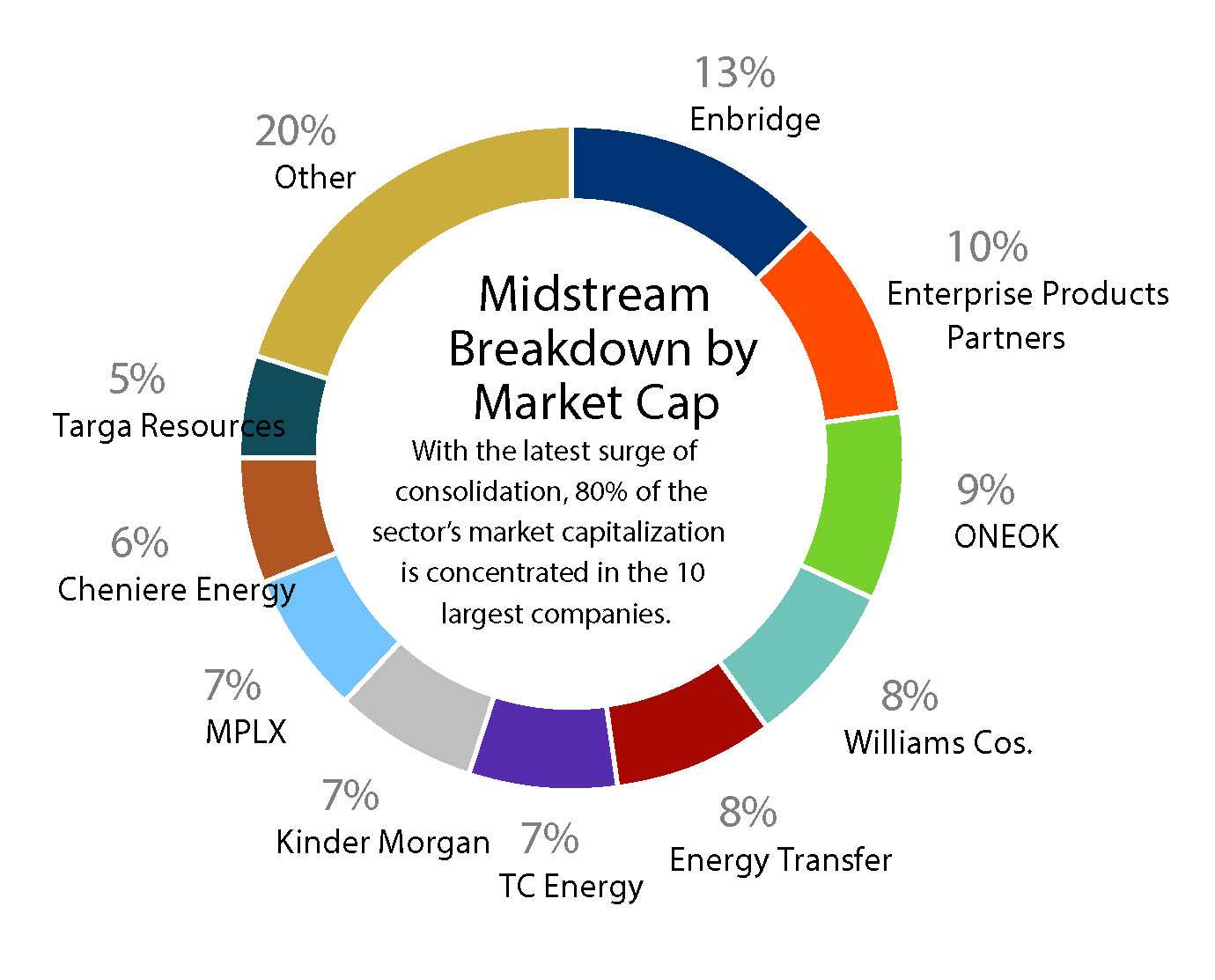

The five largest of those names make up almost 50% of the overall market capitalization of the universe, up from 28% in 2014. The consolidation continues, leading to fewer, larger companies with massive footprints.

A new company has formed with South Bow’s spin out of TC Energy, but it still feels like the total number of companies will continue to go down for another few years.

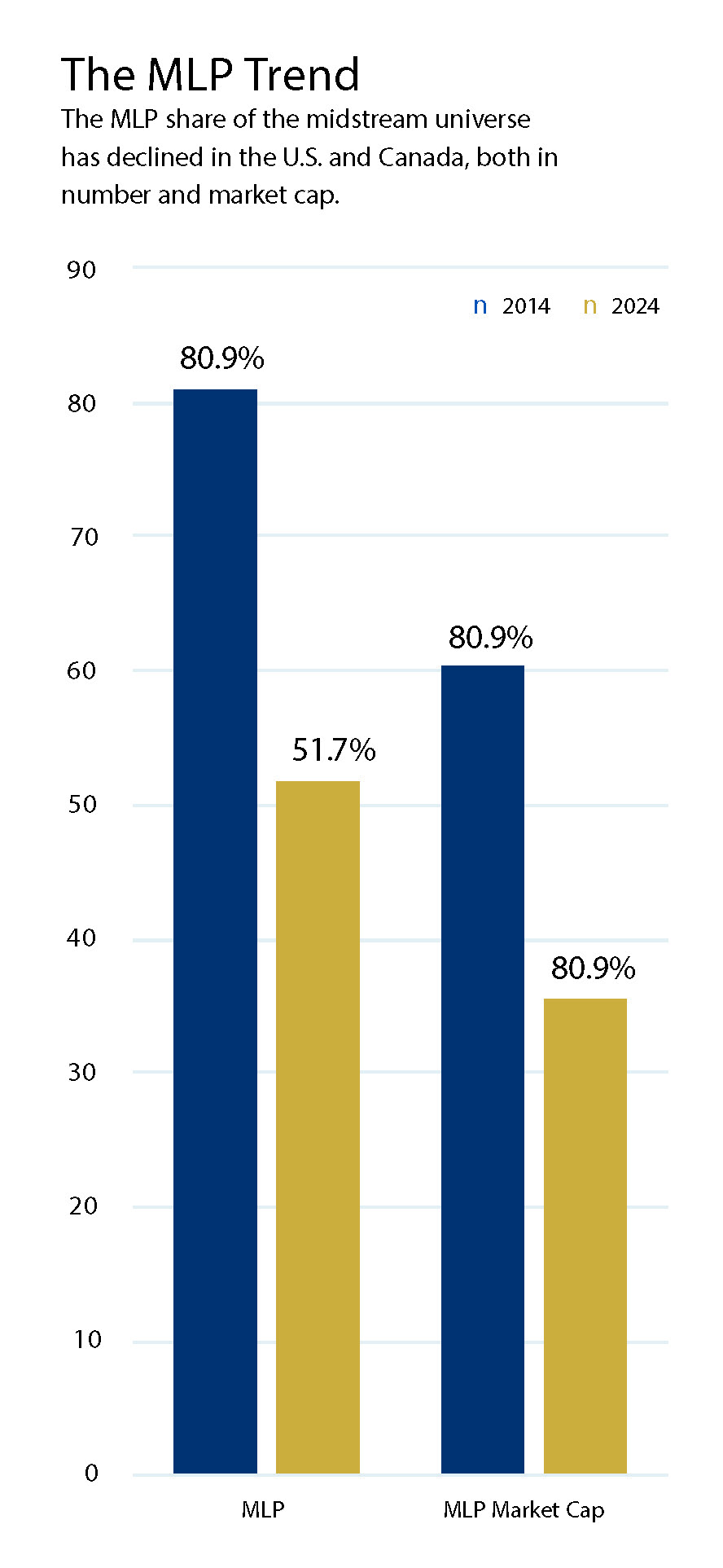

The 10-year rotation from MLPs has left the MLP structure with just 35.5% of the market capitalization universe. This latest deal did not remove an MLP from the universe, but in updating the universe, the big shift over the last decade stood out.

New king of Tulsa

One more thing to note: After this deal, ONEOK will be the third-largest midstream company across the U.S. and Canada by market capitalization. It will be $12 billion larger than Kinder Morgan, and it will trail only Enbridge and Enterprise Products Partners. ONEOK is now larger than its local peer Williams Cos. and is therefore the largest midstream company in Oklahoma.

ONEOK being the consolidator of choice has been a surprising turn in the last few years. And the market seems to be more willing to support deals by ONEOK after it has so far produced on the synergies promised in the Magellan deal. But with ONEOK sidelined for a spell, it will be interesting to see who steps up to the plate next.

Early in September, reports surfaced (and were later refuted) that Williams had approached Targa Resources about a possible merger. Clearly, Williams would like the chance to take back the Tulsa crown.

But other big energy players like Kinder Morgan, Enbridge, Phillips 66 and Energy Transfer could also emerge as the next buyer. Enterprise, Pembina Pipeline and MPLX seem less likely to pursue strategic M&A, but they are probably still looking at deals.

As to who is left, there are a few that get mentioned most often: Kinetik and Plains All American Pipeline. But others like Western Gas and DT Midstream could make sense, or even Gibson Energy and Keyera up in Canada. Anything is fair game at this point. However, names like Targa, Antero Midstream and Hess Midstream seem less likely, each for their own company-specific reasons.

There are still more cost synergies to wring out from this sector, which may mean fewer executive seats available in this industry. The bloat of the 2000s and early 2010s has taken a long time to cut away, but the surviving empires will be stronger than ever, with huge barriers to entry.

For customers of these major midstream companies, it may mean less negotiating power on rates for services in the future. For investors, it should mean greater returns over time.

Recommended Reading

Marketed: Stone Hill Exploration and Production Four Well Package in Ohio

2024-09-10 - Stone Hill Exploration has retained EnergyNet for the sale of a four well package including two proved developed producing wells in Harrison County, Ohio.

Marketed: Territory Resources 15-well Package in Oklahoma

2024-10-28 - Territory Resources LLC has retained EnergyNet for the sale of 15-well package in Kay, Noble and Pawnee counties, Oklahoma.

Marketed: Stapleton Group Gulf Coast Texas Opportunity

2024-10-21 - Stapleton Group has retained EnergyNet for the sale of 51,816 non-producing net mineral acres in Walker, Montgomery and San Jacinto counties, Texas.

Diamondback Swaps Delaware Assets, Pays $238MM For TRP’s Midland Assets

2024-11-04 - After closing a $26 billion acquisition of Endeavor Energy Resources, Diamondback Energy is getting deeper in the Midland Basin through an asset swap with TRP Energy.

Marketed: Wellbore Capital 10 Well Package Marcellus Opportunity

2024-09-12 - Wellbore Capital LLC has retained EnergyNet for the sale of a Marcellus Shale Opportunity 10 well package in Marion and Wetzel counties, West Virginia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.