NGL prices took a large downturn as they followed the downward trajectory of West Texas Intermediate (WTI) crude prices, which fell to their lowest levels in several years just above $80 per barrel (/bbl). Not only has this price decrease hampered heavy NGL, it also has the potential to weaken the North American petrochemical industry’s price advantage compared to the rest of the word if naphtha becomes economical compared to NGL as a feedstock for various petrochemicals.

While there is still some way to go before naphtha cracking would be on a level playing field with ethane, the steep crude price decrease the second week of October doesn’t put this scenario outside the realm of possibility.

There hasn’t been any one reason for the depressed crude market, but rather there has been a shared responsibility among fears over the spread of the Ebola virus that could limit travel and result in depressed global economies; increased production out of the Middle East; and decreased European and Asian demand.

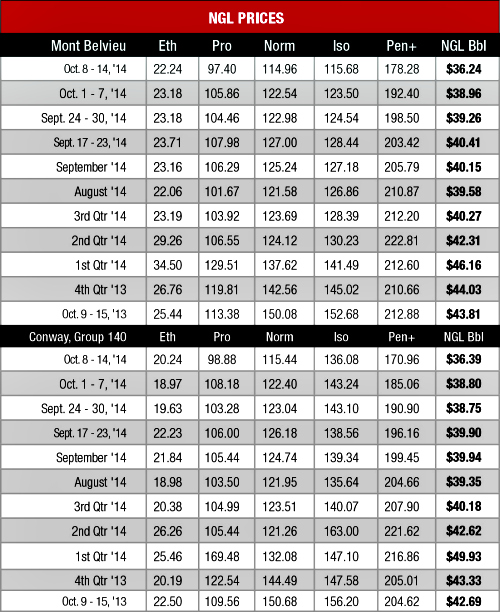

The impact this decreased demand for crude had on the NGL market was swift as prices fell to their lowest levels in more than a year across the board at both Conway and Mont Belvieu. The largest downturn was for propane, which fell below the $1 per gallon (/gal) threshold at both hubs.

The Mont Belvieu price fell 8% to 97 cents/gal, its lowest price since it was 96 cents/gal the week of July 31, 2013, and the Conway price tumbled 9% to 99 cents/gal, its lowest price since it had the same value the week of Aug. 7, 2013.

While LPG exports have helped to increase both demand and value for U.S. propane, they have also helped to improve the relationship between crude and propane due to increased exposure to global price trends. This relationship helped undermine U.S. propane prices as global LPG prices were down 10% for the week, according to PIRA Energy Group.

Warren Wilczewski, senior associate at ICF International, stated that there have been two major trends for propane prices since the shale revolution began in the U.S. The first was in the winter of 2011 to 2012 when demand fell below expectations and created a disconnect between propane and crude prices. “Propane prices just fell down and slid away while anything connected to crude just kept going up,” he said during a recent ICF webinar focusing on propane and butane demand and pricing. He noted that this price gap had been closing in the years since due to the U.S. market becoming more integrated with the global market through exports. It is likely that propane prices will continue to weaken along with crude in the weeks ahead until the crop drying and heating demand seasons begin.

Ethane prices showed a statistical improvement as they improved 7% at Conway and only fell 4% at Mont Belvieu, but they remained very weak in the 20 cents/gal range with widespread rejection throughout all U.S. markets.

Pentanes-plus (C5+) prices fell to their lowest level in more than two years, falling 8% at Conway to $1.71/gal, its lowest price since it was $1.67/gal the week of June 20, 2012, and experiencing a 7% drop to $1.78/gal at Mont Belvieu, which was its lowest price since the week of June 27, 2012, when it was $1.71/gal.

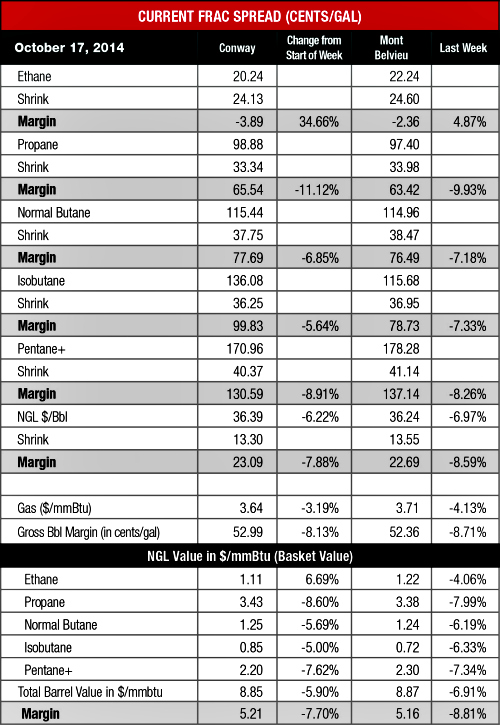

Another late starting heating season has resulted in stagnant gas prices, albeit ones that have fallen at a lesser rate than their liquid counterparts. Prices at both hubs were in the mid-$3 per million Btu range, but this could be further challenged as storage levels have been sufficiently reloaded this spring and summer after heavy demand in the winter.

The U.S. Energy Information Administration reported a 94 billion cubic feet increase in storage levels to 3.299 trillion cubic feet (Tcf) for the week of Oct. 10, up from 3.205 Tcf the previous week. This was 9% below the 3.643 Tcf figure posted last year at the same time and 10% below the five-year average of 3.661 Tcf.

Comparatively stronger gas prices helped reduce frac spread margins at both hubs. Despite experiencing nearly 10% decreases in margins C5+ remained the most profitable NGL to make at both hubs at $1.31/gal at Conway and $1.37/gal at Mont Belvieu. This was followed, in order, by isobutane at $1.00/gal at Conway and 79 cents/gal at Conway; butane at 78 cents/gal at Conway and 77 cents/gal at Mont Belvieu; propane at 66 cents/gal at Conway and 63 cents/gal at Mont Belvieu; and negative 4 cents/gal at Conway and negative 2 cents/gal at Mont Belvieu.

Recommended Reading

Glenfarne: Latest Customer Means Texas LNG is Ready for FID

2024-09-12 - Construction on Glenfarne’s Texas LNG is scheduled to begin this year, though the project is one of two LNG sites that had permits pulled after a court ruling in August.

Diamondback Subsidiary Viper Closes $900MM Midland Royalty Deal

2024-10-02 - Diamondback Energy’s Viper Energy closed the last of three acquisitions from Tumbleweed Royalty, owned by Double Eagle Energy’s founders, that together totaled about $1.1 billion.

SM Energy, NOG Close $2.6 Billion in Uinta Basin Acquisitions

2024-10-02 - SM Energy and Northern Oil and Gas have closed the acquisitions of XCL Resources and Altamont Energy, adding hundreds of locations and oil cuts of 86% to 87%.

Enterprise Closes $950MM Acquisition of Delaware’s Piñon Midstream

2024-10-28 - Enterprise Products Partners acquisition of Piñon Midstream expands Enterprise’s New Mexico Delaware Basin footprint with sour-gas processing.

DNOW Closes Cash Acquisition of Water Service Company Trojan Rentals

2024-11-26 - DNOW Inc.’s acquisition of Trojan Rentals LLC is its third purchase aimed at providing a holistic water management solution to the market, the company said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.