Exxon Shale Exec Details Plans for Pioneer’s Acreage, 4-mile Laterals

Exxon Mobil plans to drill longer, more capital efficient wells in the Midland Basin after a major boost from the $60 billion Pioneer Natural Resources acquisition. Data shows that Exxon is a leading operator drilling 4-mile laterals in the Permian’s Delaware Basin.

M&A Spotlight Shifts from Permian to Bakken, Marcellus

Potential deals-in-waiting include the Bakken’s Grayson Mill Energy, EQT's remaining non-operated Marcellus portfolio and some Shell and BP assets in the Haynesville, Rystad said.

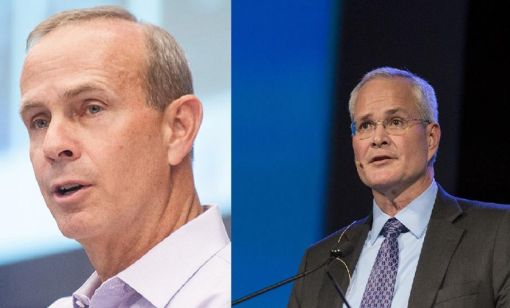

Chevron CEO: Permian, D-J Basin Production Fuels US Output Growth

Chevron continues to prioritize Permian Basin investment for new production and is seeing D-J Basin growth after closing its $6.3 billion acquisition of PDC Energy last year, CEO Mike Wirth said.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.

Chord, Enerplus’ $4B Deal Clears Antitrust Hurdle Amid FTC Scrutiny

Chord Energy and Enerplus Corp.’s $4 billion deal is moving forward as deals by Chesapeake, Exxon Mobil and Chevron experience delays from the Federal Trade Commission’s requests for more information.

Continental Resources Makes $1B in M&A Moves—But Where?

Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.

Silver Hill Energy Enters Bakken with Liberty Resources Acquisition

Silver Hill Energy Partners LP is getting into the Bakken in North Dakota through the acquisition of Liberty Resources II.