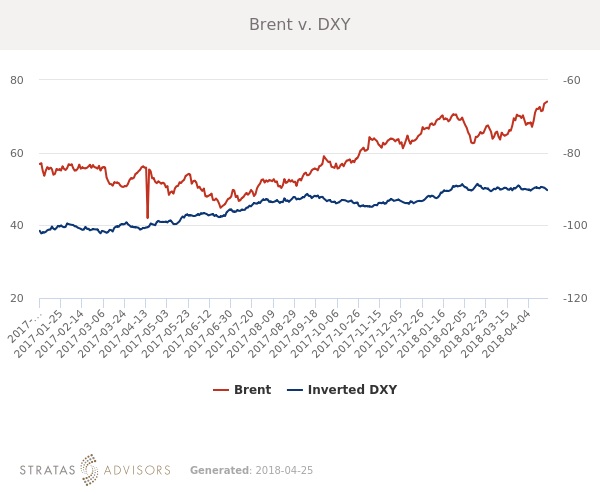

Brent prices averaged $72.86/bbl last week, up $1.59/bbl from the week before. WTI rose similarly, up $1.53/bbl to average $67.58/bbl. We expect prices could continue to ride this wave and Brent will average $74/bbl in the week ahead. However, given the lack of a fundamental basis and the rapid speed of the price rise, we think the risk of a sharp price correction is rising.

Geopolitical - Neutral

Geopolitical tensions appeared to lose one leg of support over the weekend with the announcement from North Korea that they would effectively stop their nuclear missile testing program. Additionally, the risk of an escalation in Syria due to recent airstrikes appears to have diminished. While geopolitics will be a neutral factor in the week ahead, the fact that prices have been so sharply impacted by a geopolitical event where relatively little crude volumes were actually at risk is evidence that global balances are generally considered to be tighter by market participants.

Dollar - Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar fell slightly last week while Brent and WTI both increased.

Trader Sentiment - Positive

Nymex WTI managed money net long positioning increased slightly last week while ICE Brent managed money net long positioning dipped. Overall positioning in both contracts remains supportive. Given the strong geopolitical drivers of recent weeks, ICE Brent is likely to see more support than Nymex WTI positioning in the week ahead.

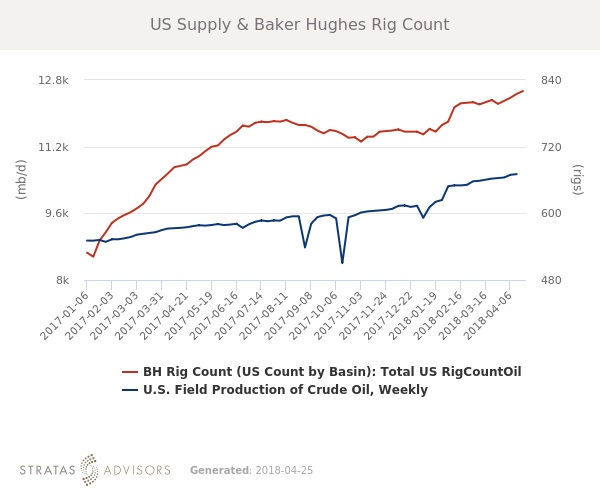

Supply – Neutral

According to Baker Hughes, the number of US oil rigs rose by 5 last week. US oil rigs now stand at 820, compared to 688 a year ago. Evidence of renewed global oversupply continues to pose the greatest threat to prices. Despite OPEC’s recent technical committee’s finding that current stocks are basically aligned with the current five-year average, the OPEC/non-OPEC supply deal remains secure as many members think current stocks are an inflated metric and that there is still work to be done to tighten markets.

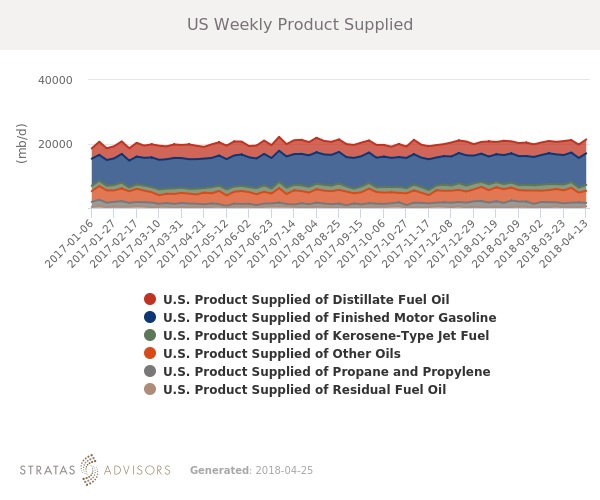

Demand – Positive

US consumption of petroleum products remains generally at or above seasonal averages in all products, including fuel oil. Economic indicators so far presage strong consumer spending through the summer demand season and refined product demand is likely to remain a supportive factor in the short-term.

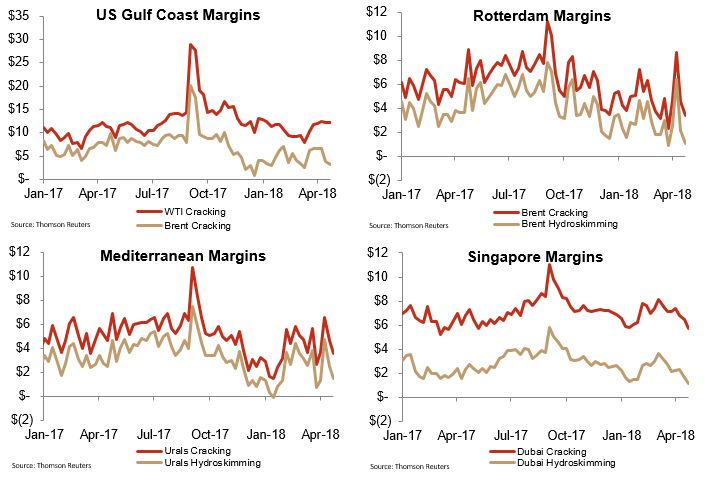

Refining – Neutral

Margins generally fell last week on ever-higher crude prices. With the exception of US Gulf Coast WTI cracking, all margins are below their prior-year levels. Heading into summer driving season, margins should be generally improving on strong demand, but high crude prices could add pressure.

How We Did