EIA Reports Big NatGas Withdrawal, as Expected

According to the EIA’s weekly storage report, natural gas levels are 238 Bcf below the five-year average and 561 Bcf below the level from the same time last year.

EIA Reports Larger-Than-Expected NatGas Withdrawal, Again

The storage drop failed to offset warmer forecasts, as natural gas prices dipped following a three-week rally.

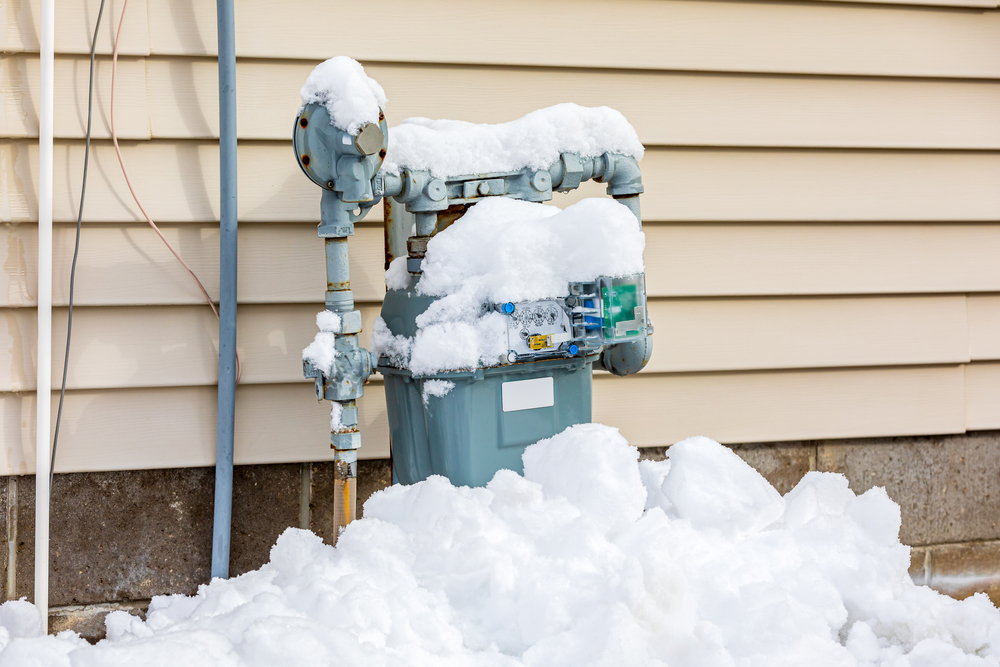

Natural Gas Prices Shoot Past $4

The market has responded to an oncoming cold snap, sending natural gas prices at the Henry Hub over $4/MMBtu.

What's Affecting Oil Prices This Week? (Dec. 30, 2024)

Looking forward, Stratas Advisors forecasts that Brent oil will average $76.90 in 1Q25.

The Latest

NextDecade Plans 3 More Trains at Rio Grande LNG

Houston-based NextDecade continues to build the Rio Grande LNG Center in Brownsville, Texas, as its permits filed with the Federal Energy Regulatory Commission continue to go through the legal process.

New Era Helium Signs NatGas Deal to Supply Permian Data Center Campus

The AI data center project will be developed on 200 acres of land the Texas Critical Data Centers joint venture will be acquiring. The project is expected to be online by the end of 2026.

Operators Look to the Haynesville on Forecasts for Another 30 Bcf/d in NatGas Demand

Futures are up, but extra Haynesville Bcfs are being kept in the ground for now, while operators wait to see the Henry Hub prices. A more than $3.50 strip is required, and as much as $5 is preferred.

US Drillers Add Oil, Gas Rigs for Fifth Week in a Row

The oil and gas rig count rose by one to 593 in the week to February 28, its highest since June.

Chord Drills First 4-Mile Bakken Well, Eyes Non-Op Marcellus Sale

Chord Energy drilled and completed its first 4-mile Bakken well and plans to drill more this year. Chord is also considering a sale of non-op Marcellus interests in northeast Pennsylvania.

Diversified Closes Summit Natural Resources Deal for $42MM

Diversified Energy Co. Plc closed its deal with Summit Natural Resources to buy operated natural gas assets and midstream infrastructure for approximately $42 million, the company said Feb. 27.

Vår Energi Makes Third Oil Discovery in Barents Sea

Vår Energi has discovered a third offshore oil reserve in the Goliat area of the Norwegian Continental Shelf as part of an exploratory collaboration with Equinor.

Eni, PETRONAS Form Gas Development JV in Indonesia, Malaysia

Eni and PETRONAS believe the joint venture will lead to synergies that create a leading LNG player in the region.

EIA Reports Big NatGas Withdrawal, as Expected

According to the EIA’s weekly storage report, natural gas levels are 238 Bcf below the five-year average and 561 Bcf below the level from the same time last year.

Range Secures Appalachian Takeaway to Capitalize on Higher NatGas Prices

Appalachian pure-play Range Resources expects strong demand in the second half of the decade and is taking the necessary steps to capitalize on higher natural gas prices.