Jim Wicklund, a managing director with energy investment-banking firm PPHB, wrote after a NAPE dinner hosted by Raymond James, “Natural gas was a hot topic.”

In particular, “where will the needed natural gas come from, if the drivers of demand require another 20 to 30 Bcf/d?”

The figure includes both incoming growth in U.S. Gulf Coast LNG exports and projected gas-fired power-generation demand by new AI data centers.

The Appalachian Basin has the gas, but Wicklund’s dinner mates said more takeaway capacity could take years to come online “even with a cooperative administration.”

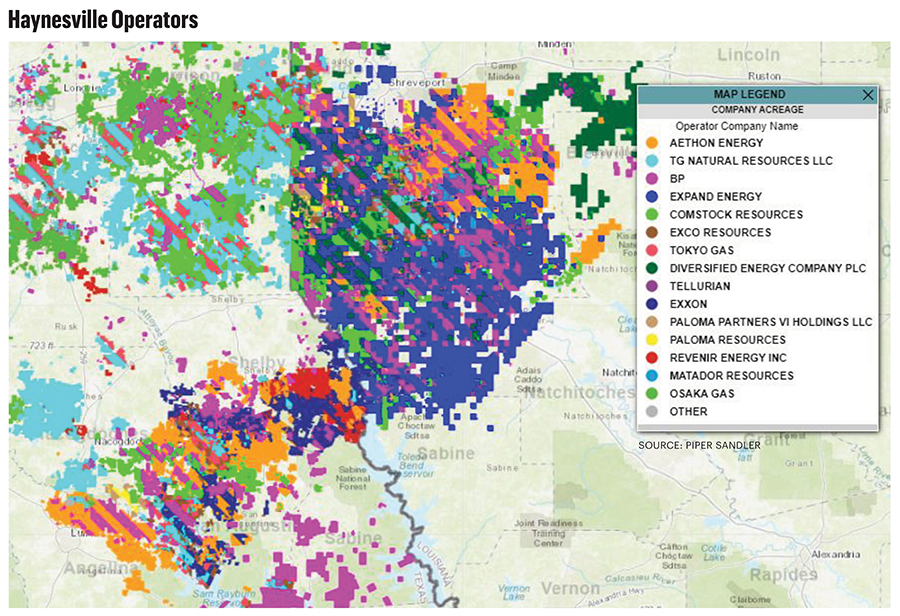

Thus, the Haynesville will be leaned on—and hard, Wicklund wrote in a note to investors.

But “it would have a difficult time supplying more than an additional 4 to 6 Bcf/d of production,” he added.

The Haynesville’s shown she has an extra 3 Bcf/d, at least, in her. All-time high Haynesville output was 14.7 Bcf/d in May 2023, according to the U.S. Energy Information Administration (EIA) data.

As operators choked back their capex when futures plummeted a few months later, production tumbled to 11.2 Bcf/d into last October and was 11.7 Bcf/d in January.

Nick Dell’Osso, Expand Energy’s president and CEO, agrees the Haynesville can’t answer the incoming call by itself, which is nearly 6 Bcf/d more in LNG exports alone by yearend 2026.

“The dynamics of demand internationally are pulling hard on the supply of the U.S.,” Dell’Osso said at a Goldman Sachs conference in early January.

Wicklund noted after the NAPE dinner in February that Permian gas could fill the gap. But “there is not a pipe that can deliver natural gas to the east side of Houston and all the [Gulf Coast] LNG facilities to the east.”

Kinder Morgan has shown up to answer some of that. To supply Golden Pass LNG at the Texas-Louisiana border, it announced the 216-mile, $1.7 billion Trident Intrastate Pipeline in January that will deliver 1.5 Bcf/d of Permian and South Texas gas beginning in early 2027. With expansion, it could grow to 2.8 Bcf/d.

John Abeln, senior gas analyst for research firm RBN Energy, wrote that past difficulty with getting West Texas gas east of Houston has been a “Herculean task” of overcoming urban opposition to rights of way.

Until Trident, that is. The pipe will travel to Katy, Texas, and then north, around Houston, instead.

Wicklund wrote, “This won’t solve the problem alone, but it is a good start.”

‘Starts with a $5’

As for Wicklund’s table mates’ thoughts on what gas price would be needed to answer the LNG call, he wrote, “around $5 an Mcf.”

Gordon Huddleston, president of 2.5 Bcf/d Haynesville producer Aethon Energy, concurs. “It probably starts with a $5 to bring significant development on,” he said at the Goldman Sachs conference.

Bernstein senior research analyst Bob Brackett thinks $5/Mcf gas could actually be on the horizon this year and in 2026, and that’s “conservative, in our view,” he wrote in a January forecast for “a coming U.S. gas super-cycle.”

Strip at the time—and into Feb. 11 as well—was $4.

Brackett cited new gas demand for power-hungry data centers as contributing to his forecast. U.S. utilities’ outlook was unchanged after China’s DeepSeek announced a low-power-intensity AI model later in January.

While the model remains unproven, investors’ consensus in early February was that lower-cost AI will result in more AI use, thus an unchanged forecast for 8 Bcf/d or more of additional U.S. gas demand.

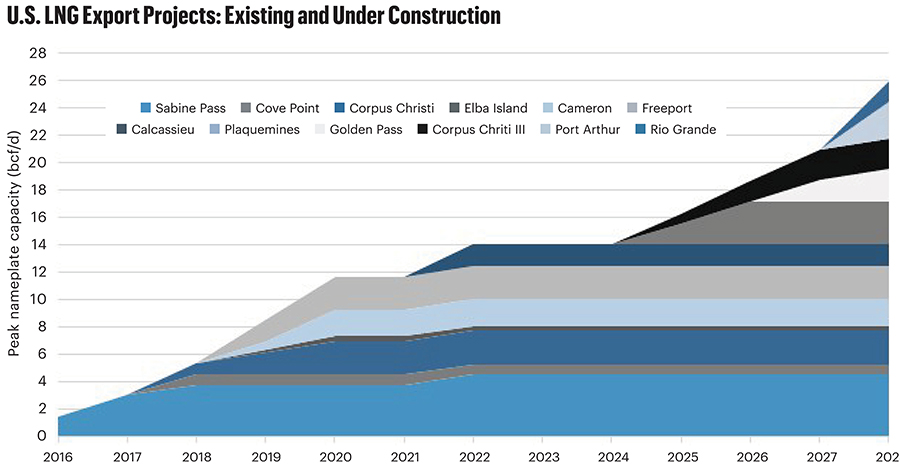

More certain is incoming growth in U.S. LNG exports, which are currently 14.5 Bcf/d.

That will grow another 10 Bcf/d alone by 2030 from projects already underway, Brackett reported.

Net of powering data centers, filling more LNG tankers and other factors in Brackett’s modeling, U.S. demand “would thus rise to approximately 150 Bcf/d in 2030,” he concluded.

He called the Haynesville “the poster child for a well located—i.e., near LNG and Henry Hub—and low-cost, earning good returns at $3.50/Mcf and amazing returns above $4.50/Mcf, shale-gas basin.”

‘Not surprised’

The money appears to agree as three pipelines are underway to get more Haynesville gas to the Louisiana Gulf Coast.

Williams Cos.’ Louisiana Energy Gateway (LEG) is among them. Capacity is 1.8 Bcf/d; in-service is expected in the second half of this year.

The other two are Momentum Midstream’s NG3 project that will take 1.7 Bcf/d from the Haynesville to the Louisiana Gulf Coast, expandable to 2.2 Bcf/d, and DT Midstream’s LEAP with 1.9 Bcf/d.

Alan Armstrong, Williams president and CEO, said of the three projects in a November earnings call, “I’m not too terribly surprised, if you look at the balance of where gas is going to have to come from and particularly gas that can meet the LNG specs and low nitrogen specs that are going to be required.”

With the demand growth Williams and others are seeing, “that’s going to have to come from somewhere,” Armstrong said.

“And it’s starting to mount up pretty big. I’m not too terribly surprised by that, frankly.”

Chad Zamarin, Williams executive vice president, corporate strategic development, added, “Even third-party models are showing over 10 Bcf/d of growth out of the Haynesville by the early 2030s to meet LNG demand.

“That’s a lot of gas that’s going to need to find its way to those LNG markets.”

‘Not a huge incentive’

But Haynesville producers aren’t showing up yet. Both Expand’s Dell’Osso and Aethon’s Huddleston said their Haynesville ramp-up would be cautious.

Like Aethon, Expand produces 2.5 Bcf/d from the Haynesville.

“You’re talking about a lot of potential demand coming on, and we know that’s going to necessitate higher pricing,” Huddleston said. “But until we see that materialize, it’s not something we want to get out in front of.”

Without significant returns, “there really isn’t a huge incentive for us to grow production.”

BP is also cautious about adding Haynesville supply, he added. The operator produces 1.4 Bcf/d from the play.

“They haven’t been active in developing” and, when it does step up, “that certainly could provide some additional swing production,” he said.

It would probably take nine to 12 months for the Haynesville to significantly ramp. “That means it’s going to take longer for the basin to react to pricing.”

Aethon would want to see triple-digit returns “because otherwise [capex is] going to be impacting free cash flow, and that’s not really our objective.”

Overall, “$3.50 works pretty well for most participants depending on where that inventory is and what their margins are.”

‘No, nothing’s changed’

Dell’Osso said, “We’ve had a lot of questions at this conference and leading up to it about, ‘Hey, it got cold, so are you going to go faster?’ Now the answer to that is ‘No, nothing’s changed.’”

Strong winter demand through January made the first significant dent in persistent U.S. oversupply, taking gas in storage to 8% less than at the end of January 2024 and 4.4% less than the five-year average, according to EIA data.

The $4 strip that materialized is what Expand anticipated it would be by this time. “Things are playing out as expected, so nothing’s changed for us,” Dell’Osso said.

By the end of 2026, the call on gas will be 5.6 Bcf/d more than at year-end 2024, including from Golden Pass LNG, Plaquemines LNG and Corpus Christi Liquefaction’s Line 3 (CCL3). The latter two came online in December and were ramping to full capacity when Oil and Gas Investor (OGI) went to press.

“And 5.6 Bcf/d is actually quite a bit for us to grow,” Dell’Osso said. It will take time “and it’s going to be expensive.

“You do need to see some volume growth and I think you are just [beginning to see] prices that might encourage some volume growth.”

The breakeven in the Haynesville is probably $3.50, he said.

And the Haynesville is the marginal supplier—that is, the swing supplier—so futures will have to be “materially higher than $3.50” for there to be a significant supply response from the play.

Of course, “there are plenty of wells in the Haynesville that make money at $2.50,” Dell’Osso said.

“But if you’re going to grow volumes, you’re going to need to capture the growth from areas that require a higher price.”

Russian deleted

A colder winter this year in Europe had countries there rushing in early February to keep up as well. France’s natural gas tank was 65% empty, Bloomberg reported.

EU-wide, the 4 Tcf of capacity averaged less than 50% full, according to Turkey’s Anadolu news agency. Of that 4 Tcf of capacity, 80% of it is in Germany, Italy, the Netherlands, France, Austria and Hungary.

The price for LNG delivered to the Netherlands’ TTF for March delivery was $17 on Feb. 10, up from $12 in mid-December and $14.79 in mid-January, according to CME Group.

Meanwhile, Gazprom’s contract to deliver gas to Ukraine expired at year-end.

And non-Russian gas demand in Europe is set to grow further after the Baltic States disconnected from Russia’s power grid on Feb. 8, drawing electrons from EU members instead and rendering Moscow’s Kalingrad Oblast a power-grid island.

“Demand around the world is growing for gas,” Bryce Erickson, managing director for business valuation firm Mercer Capital, wrote in January.

Delays in bringing on new LNG supply “kept supply tight, while extreme weather events added to market strains,” he added.

That stress is expected to continue until new U.S. and Qatari supply begin to come online after 2025 and into 2030.

LNG exports

Cheniere Energy counted 20 Bcf/d of global LNG export capacity under construction and potentially coming online this year through 2027, possibly shifting into 2028, the LNG exporter reported at a J.P. Morgan Securities conference in London in November.

Of that, the U.S. will add 10.7 Bcf/d; Qatar, 6.7 Bcf/d; and Canada, 2.7 Bcf/d.

J.P. Morgan energy analyst Arun Jayaram estimated in early February that U.S. LNG capacity may be 17.8 Bcf/d in 2026 and 18.5 Bcf/d by year-end 2026, up from 14.5 Bcf/d in January.

The January figure was boosted from 13.5 Bcf/d into December with Venture Global’s Plaquemines plant on the Mississippi River and Cheniere Energy’s CCL3 both coming online.

Exports may grow to 16.1 Bcf/d in this quarter as the Plaquemines plant reaches full capacity. It has FERC approval of 3.3 Bcf/d.

At CCL3, full capacity from the seven-train expansion will be 1.3 Bcf/d, bringing the plant’s total output to more than 3.3 Bcf/d.

Exxon Mobil’s long-awaited Golden Pass export plant on the Sabine River has FERC approval to 2.6 Bcf/d.

Mercer Capital’s Erickson wrote that, with Plaquemines and CCL3, nominal production capacity in the U.S. will be 15.4 Bcf/d, peaking at 18.7 Bcf/d.

That will grow to 21.2 Bcf/d and a 25.2 Bcf/d peak by 2028 with Golden Pass and two other projects that are underway—Rio Grande LNG at Brownsville, Texas, and Port Arthur LNG near Golden Pass on the Sabine River.

“As an undersupplied natural gas market drives prices above $5 starting this year and continuing to 2030, it provides a unique opportunity for long-term value creation,” Erickson concluded.

Aethon at $14 billion?

Haynesville gas producers’ stock prices have soared in the past 12 months, according to market data. Focused on both the Haynesville and Appalachia, Expand’s grew from $77.56 to $105.12 through Feb. 10.

Haynesville pureplay Comstock Resources’ stock grew from $7.71 to $18.49.

Aethon is rumored to be for sale or IPO with an estimated valuation of $10 billion.

The $10 billion figure, reported by Reuters in mid-November, was outdated in early February, though.

Based on pureplay Comstock’s $5.2 billion market cap on Feb. 12 and $3 billion of debt, enterprise value for its 1.45 Bcf/d was $5,655 per flowing Mcf/d.

Meanwhile, fellow pureplay Aethon produces 2.5 Bcf/d, suggesting its enterprise value would be $14 billion at $5,655 per flowing Mcf/d.

Aethon also holds 1,400 miles of gathering and takeaway, covering 85% of its Haynesville production, giving “us a margin uplift that allows us to be a little more comfortable in these lower-price situations,” Huddleston said at the Goldman Sachs conference.

He told OGI in late January that, as for a sale or IPO, “we have a lot of different options.”

He added, “For several years, we’ve been looking at what those options are going to be. We have been IPO-ready and continue to be.”

According to the Reuters report, Goldman Sachs and Citigroup are Aethon’s advisers. Huddleston wasn’t asked about whether it was for sale or planning to IPO while in the Q&A in January with Goldman Sachs commodities and securities analysts.

In addition to the Huddleston family, equity owners include RedBird Capital Partners and the Ontario Teachers’ Pension Plan.

He told OGI, “I think people are starting to realize that gas is going to be a very long-term fuel … for this country and for the world.”

Haynesville $/Mcf comps

Woodside Energy, which recently bought Tellurian and its Driftwood LNG project on the Louisiana coast, isn’t interested in buying gas production, too, it told the Wall Street Journal in January.

Before selling its LNG permit and property to Woodside in July, Tellurian sold its Haynesville E&P property to Aethon for $260 million.

The 31,000 net acres averaged 200 MMcf/d net in 2023 from 161 wells, according to Tellurian’s annual report, resulting in a deal value of $1,300 per flowing Mcf/d.

Henry Hub was $2.20/Mcf when the deal was signed on May 29, according to EIA archives.

Meanwhile, Haynesville pureplay TG Natural Resources’ (TGNR) deal for fellow pureplay Rockcliff Energy that was signed on Dec. 15, 2023, was for $2.7 billion plus $1.7 billion in debt assumption in a $4.4 billion total deal value, averaging roughly $3,650 per flowing Mcf/d net.

Rockcliff’s production was 1.3 Bcf/d gross and 1.2 Bcf/d net. Its net leasehold was more than 200,000 acres.

Henry Hub at the time was $2.44/Mcf, according to the EIA archive, having plunged from $3.34 just six weeks earlier.

And the Aethon buyer is?

TGNR’s owner, Japan’s Tokyo Gas, is looking for more energy investments in the U.S., but its next investments won’t necessarily be more E&P, the parent’s president told Bloomberg in January.

Bill Marko, a managing director for Jefferies, said at Hart Energy’s A&D Strategies and Opportunities conference in October, “If you’re an [LNG] off-taker, you’re thinking about, ‘How do I lower the cost of supply?’ One way to do that is to own the assets.”

In addition to Tokyo Gas, he said TotalEnergies has interest in owning more U.S. gas.

Huddleston said at the Goldman Sachs conference that he gets queries from parties with LNG contracts that are “trying to understand, ‘Hey, how am I going to supply gas for a 20-year contract? Where am I going to get this gas from for 20 years? And what price?’”

He told OGI that Aethon is among few gas producers on the Gulf Coast that is confident it could deliver gas for that long.

“And we’re also integrated. We have our own midstream across the bulk of our assets. So, our margins are the highest in North America,” he said.

“When you add that all up, there’s a lot of different, interesting options for us on ways we can partner and … continue to create additional value.”

Chevron’s Panola?

Jefferies was the marketer in 2024 of Chevron’s leasehold in Panola County, Texas, that remained unsold, according to Railroad Commission of Texas (RRC) files through November 2024.

Jefferies had opened the data room on Feb. 12, 2024. Chevron did not reply to a request for comment by press time.

According to Mercer Capital, a sale of the property was being discussed at Chevron as long ago as November 2023 as a portfolio revision post-merger with Hess Corp. toward raising $15 billion in divestments over five years. The Hess deal was not yet closed at press time.

The Chevron offer last spring was a sale or joint venture of the 71,000 net contiguous Panola County acres, which have been mostly untouched by Chevron for its Haynesville potential.

Jefferies described it in the flyer as “substantial virgin inventory with approximately 300 [potential] operated Haynesville locations.”

The acres are 85% operated and 100% HBP, primarily by vertical Cotton Valley wells. Production at the time was 48 MMcf/d net, 86% gas, according to the Jefferies ad. PDP was 120 Bcf net. EURs averaged 1.9 Bcf per 1,000 lateral feet for the handful of horizontal wells.

TGNR was considering buying the property, the Financial Times reported in October. TGNR didn’t respond to an OGI request for comment by press time.

Craig Jarchow, TGNR’s CEO, said at Hart Energy’s DUG Gas conference in Shreveport, Louisiana, last spring, though, that he was aware the Chevron property was on the market. But TGNR was busy with integrating its Rockcliff acquisition at the time. “We really have our hands full, but generally we look at everything just as a matter of discipline.”

By June, Jarchow told Reuters that he was looking for more deals. Tokyo Gas’ president similarly said in June that it was looking to buy more U.S. gas property.

Carthage-Haynesville

Carthage-Haynesville Field production in Panola County in November 2024 totaled 35 Bcf or 1.67 Bcf/d, according to RRC records.

Of this, TGNR produced 15.5 Bcf (517 MMcf/d); Sabine Oil & Gas, 7.2 Bcf (240 MMcf/d); R. Lacy Services, 5.4 Bcf (180 MMcf/d); and Comstock, 2.2 Bcf (73 MMcf/d).

TGNR’s Panola production includes what it picked up from Rockcliff in December 2023. In the prior month, Rockcliff had produced 21.6 Bcf or 720 MMcf/d from Carthage-Haynesville in Panola, while TGNR produced 2.3 Bcf (77 MMcf/d) that month.

Chevron produced 115 MMcf this past November from Carthage-Haynesville in Panola of its total 877 MMcf from the county, which was primarily 611 MMcf from hundreds of legacy, shallower, vertical Carthage-Cotton Valley wells.

It gained the position in 2000 in its merger with Texaco. Chevron had five Haynesville wells online on the property in November.

Aethon does not operate in Panola County. Instead, it produced 34 Bcf (1.1 Bcf/d) in November from Carthage-Haynesville in San Augustine, Nacogdoches, Angelina and Shelby counties, Texas, according to the RRC.

“That [Panola acreage] is a position that all Haynesville operators are interested in,” Mike Winsor, CEO of Paloma Natural Gas, which bought Haynesville operator Goodrich Petroleum in 2021, said at the Hart Energy conference in Shreveport.

“[And] mainly because it’s undeveloped: You don’t have parent-child [well] concerns.”

It’s a rare block of property. “It’s not very often you can come into an acreage position that is consolidated,” Winsor said.

“You can come in with a blank slate. And whatever your well-spacing, whatever your design, there’s a huge amount of running room there.”

Recommended Reading

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.