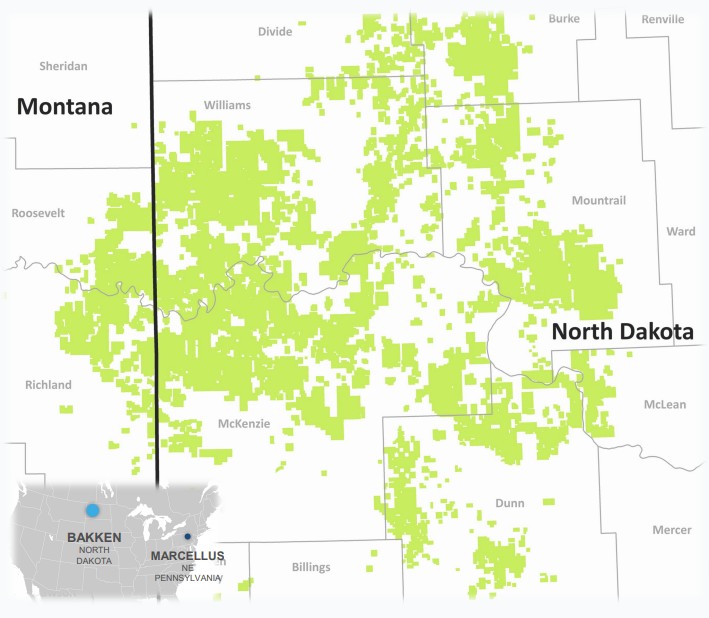

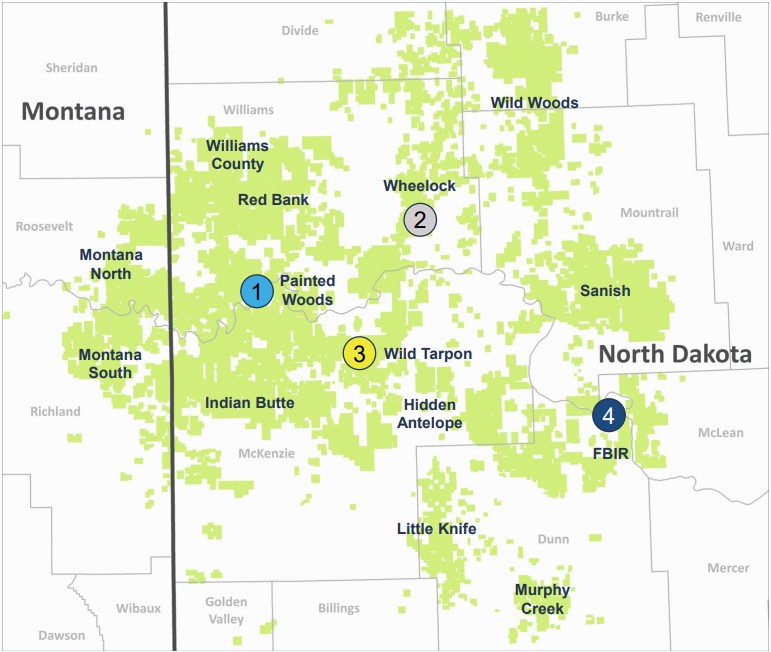

Chord Energy, a top producer in the Williston Basin (pictured), drilled its first 4-mile Bakken well in the first quarter. (Source: Chord Energy)

Chord Energy successfully drilled and completed its first 4-mile Williston Basin lateral—with more to come this year.

Darrin Henke, Chord executive vice president and COO, said the Bakken well exceeded a total depth (TD) of 30,400 ft.

“We are planning several more 4-mile laterals in 2025 and, with success, are likely to implement many more in 2026 and beyond,” Henke said during Chord’s Feb. 26 earnings call.

Chord takes two 2-mile DSUs and converts them into one 4-mile DSU, similar to the evolution of the company’s 3-mile well program.

Depending on project costs and returns, the company could look to convert some of its existing 3-mile inventory into 4-mile wells, Henke said.

Chord, formed in 2022 through the merger between Whiting Petroleum and Oasis Petroleum, has focused its efforts on building a Bakken beast. Chord ended 2024 with around 1.3 million net acres across the Williston Basin.

Fourth-quarter production averaged 273,500 boe/d (56.1% oil). Oil output averaged 153,300 bbl/d.

Chord got even deeper in the Williston Basin through a $4 billion acquisition of Enerplus Corp., which closed in mid-2024. The deal also included Enerplus’ non-operated Marcellus gas position in northeastern Pennsylvania.

With a massive contiguous land position as its sandbox, Chord is pushing Williston laterals further and further.

Over the past several years, Chord has drilled fewer 2-mile wells in the core Williston Basin and shifted to drilling more 3-mile wells on its western acreage, Henke said.

The economic benefits of 3-mile laterals are clear on Chord’s western acreage, where 3-mile wells have delivered 50% more oil EURs than 2-mile wells, for only a 20% increase in costs.

Longer 3-mile wells outside of the basin’s core “actually have similar or better returns” than 2-mile wells inside the core—since core wells generally have higher costs given the depth, pressure and other complexities, Henke said.

Chord’s three-year plan projects over 50% of its inventory to be 3-mile laterals. The company aims to have over 80% of its drilling inventory to be 3-mile wells.

“All else equal, a 3-mile well will deliver a slightly higher IP, stay flat longer and exhibit shallower declines than a 2-mile well,” Henke said.

RELATED

Chord Energy Goes Long: Bakken E&P Investigating Four-mile Laterals

Chord expects to see a similar uplift in production and performance moving from 3-mile laterals to 4-mile laterals.

But first, Chord needs to get its first 4-mile Bakken well into production to analyze results, President and CEO Danny Brown said.

RELATED

Williston Warriors: Enerplus’ Long Bakken Run Ends in $4B Chord Deal

Marcellus divestment?

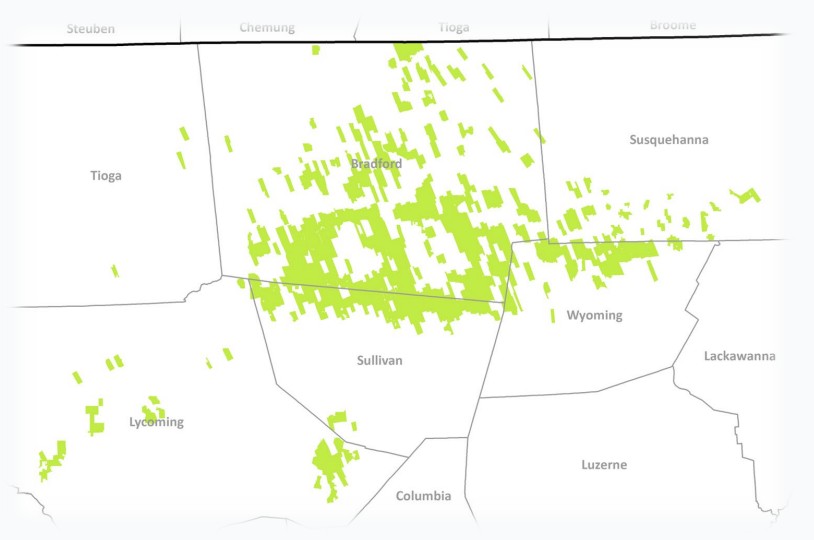

As part of the Enerplus acquisition, Chord picked up a non-operated Marcellus gas asset spanning across Susquehanna, Bradford, Wyoming, Sullivan and Lycoming counties, Pennsylvania.

Marcellus natural gas volumes averaged 113.7 MMcf/d during the fourth quarter at a realized price of $2.29/Mcf.

Chord anticipates between 130 MMcf/d and 140 MMcf/d of gas production coming through the non-op Marcellus position this year.

Chord likes its Marcellus gas asset, Brown told investors. It’s under a strong operator, and Chord has benefitted from realizing higher natural gas prices recently.

But the Marcellus non-op gas interests are not core to Chord’s portfolio—so the company is considering a sale.

“One option, obviously, that we’re thinking about is a potential monetization there,” Brown said.

Appalachia gas A&D activity is heating up as commodity prices increase and new LNG export projects come online.

Last fall, EQT Corp. agreed to sell its remaining non-op gas assets in northeast Pennsylvania to Equinor for $1.25 billion. The deal came after the two companies agreed to a large-scale acreage swap in Appalachia that spring.

CNX Resources paid $505 million to acquire upstream and midstream assets of Carnelian Energy Capital Management-backed Apex Energy II.

Barnett Shale gas producer BKV Corp. sold two Marcellus packages for around $131 million last year.

RELATED

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

Middle Bakken program

Chord estimates it has around 10 years of Williston drilling inventory economic at or below a $60/bbl WTI price.

The company plans to turn in line (TIL) between 130 and 150 gross operated wells (~80% NRI) in 2025; around 40% will be 3-mile laterals.

“It’s essentially a Middle Bakken-only program,” Brown said.

Brown said a very small, “single-digit percentage” of Chord’s total inventory is associated with the deeper Three Forks formation.

The Bakken Shale is the Williston’s most-targeted formation. Recent studies published by the North Dakota Department of Mineral Resources suggest the deeper Three Forks intervals still hold hundreds of millions of recoverable barrels.

Chord was one of the largest producers from the Three Forks during the first half of 2024, according to Enverus Intelligence Research data.

Chord says it’s conservative with inventory estimates due to wider spacing across its Bakken drilling program.

Wider spacing across the portfolio is consistently improving well productivity and predictability, the company said.

Upspacing across Chord’s drilling program—from 8 to 9 wells per DSU to around 5 to 6 wells per section—shows a consistent uplift in cumulative production.

Chord could look to tighten-up spacing in certain areas, depending on productivity and capital returns.

“But when you consider our 1.3 million-acre position up there, even a small tightening of spacing has a not immaterial impact on overall inventory,” Brown said.

RELATED

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

Recommended Reading

Kissler: Gas Producers Should Still Hedge on Price

2025-03-27 - Recent price jumps and rising demand don’t negate the need to protect against future drops.

Plains All American President Pefanis to Retire

2025-03-27 - Current CEO Willie Chiang will take over as the next president of Plains All American Pipeline following co-founder Harry Pefanis’ retirement.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

Shell Raises Shareholder Distributions and LNG Sales Target, Trims Spending

2025-03-25 - Shell trimmed its annual investment budget to a $20 billion to $22 billion range through 2028 after spending $21.1 billion last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.