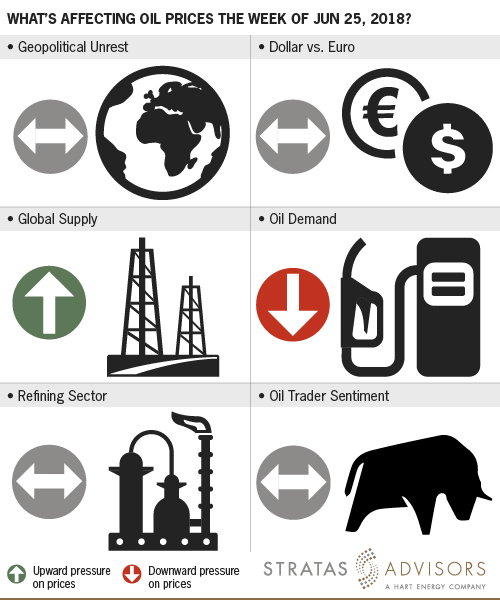

In the week since our last edition of What’s Affecting Oil Prices, Brent prices fell nearly a dollar to average $74.75/bbl after OPEC decided not to make any official changes to the current production agreement but instead to adhere to the deal and stop over-complying.

While this statement was initially interpreted as an agreement to increase production, helping prices ease back from recent levels, further interpretation shows it makes no actual promise to increase volumes. WTI held steady and averaged $66.25/bbl.

For the week ahead we expect markets will continue to digest the recent OPEC meeting and reposition accordingly, but this will have little impact on spot prices. Given that OPEC’s strategy is finalized, and U.S. production numbers are offering few surprises, there are little direct items to drive markets this week. Attention could re-focus on the potential impact of Chinese tariffs on U.S. crude, or rising consumer product prices and the risk they pose to demand. Brent prices will generally regain and maintain their recent strength given uncertainties around supply in the back-half of the year thus we expect prices to be range-bound to slightly up in the week ahead, averaging $75/bbl.