In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $65.62/bbl, losing strength throughout the week on reports of strong U.S. production. This week, prices will likely average $66.50 with the Brent-West Texas Intermediate (WTI) differential remaining about $3/bbl.

Stratas Advisors said we could see some whipsawing throughout the week on rumors coming out of the ongoing CERAWeek conference in Houston, otherwise news flow will likely be generally tepid, allowing prices to drift slightly higher.

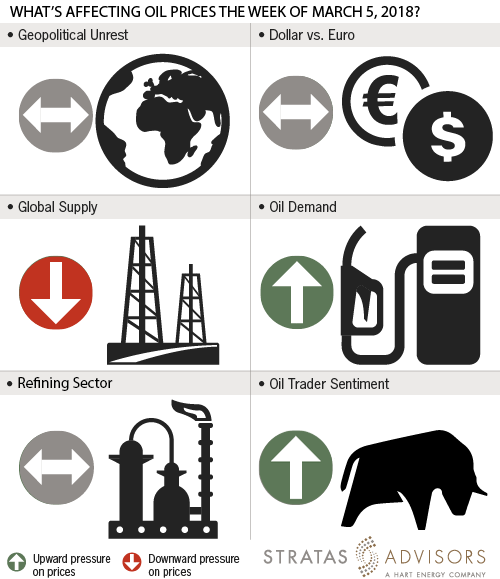

Geopolitical: Neutral

There is minimal news on the geopolitical front that is likely to influence prices this week. While perennial issues, such as the decline in Venezuela and unrest in Libya, remain analysts do not expect them to become more impactful in the short term.

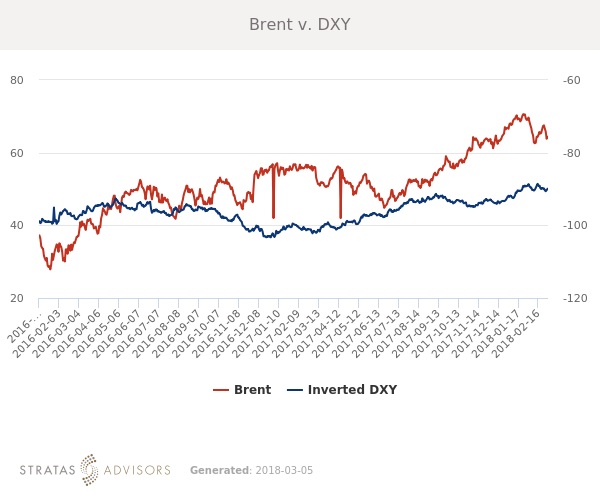

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar moved sideways last week as crude oil rose slightly. Crude oil will likely remain only marginally influenced by DXY in the week ahead.

Trader Sentiment: Positive

ICE Brent and Nymex WTI managed money net positioning both ticked up slightly last week. Despite reports that U.S. supply is growing strongly technical indicate there is still room for an upside run and overall sentiment remains positive. Rumors that OPEC could be considering an extension into 2019 will only serve to further support bullish sentiment.

Supply: Negative

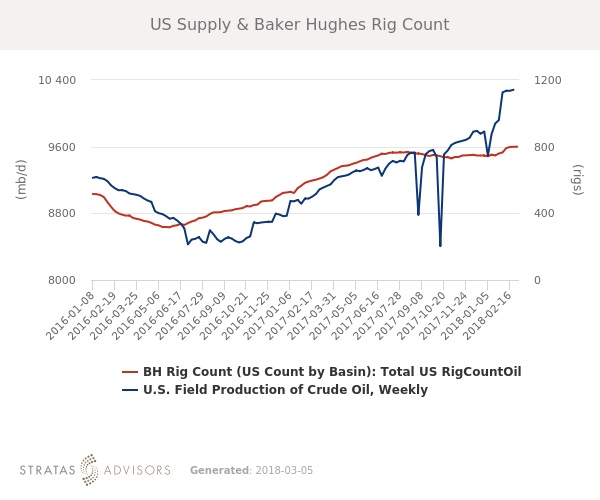

According to Baker Hughes (NYSE: BHGE), the U.S. rig count rose for the sixth consecutive week last week. Analysts expect that the impact on production of these rising rigs will likely start to be seen in May. The EIA’s Petroleum Supply Monthly report revealed that U.S. crude oil production fell slightly in December, likely due to weather-related slowdowns. However, weekly data indicates that production has generally trended upward, and fears of renewed oversupply continue to pose the greatest threat to prices.

Demand: Positive

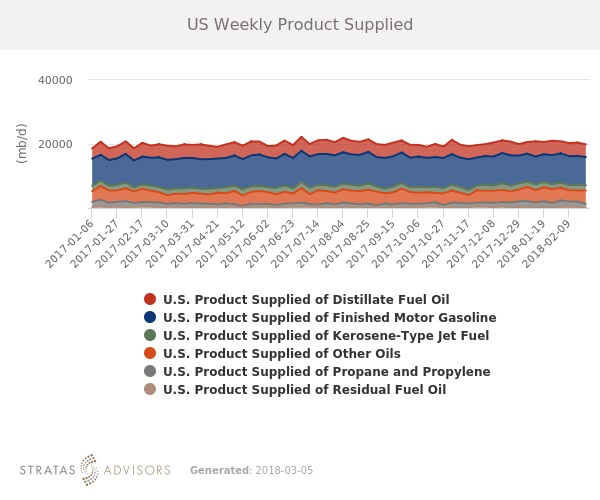

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products except fuel oil.

Refining: Neutral

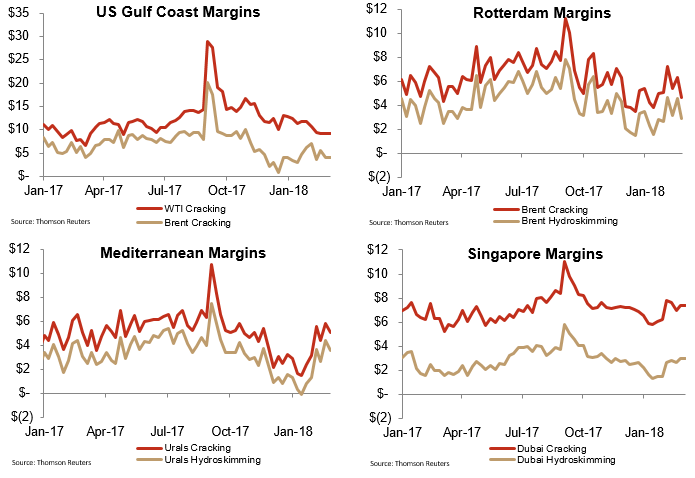

Global refining margins fell in Europe while rising in Asia. In the U.S., WTI cracking at the Gulf rose slightly while Brent fell. Mediterranean and Asian margins are generally at or above the five-year seasonal average while Brent and WTI indexed margins are sagging. Declines in margins appear to be slowing in all enclaves except Rotterdam, and Stratas Advisors said there could be some strengthening in margins in the weeks ahead as Asian refinery maintenance is underway. However, in the meantime, margins are not robust enough to incentivize additional runs of a level likely to support crude.

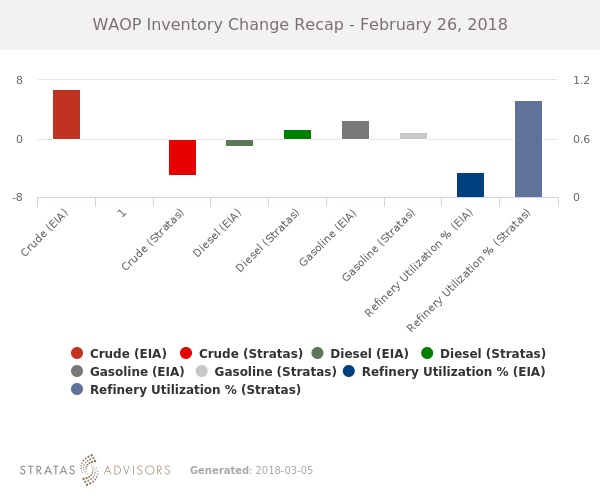

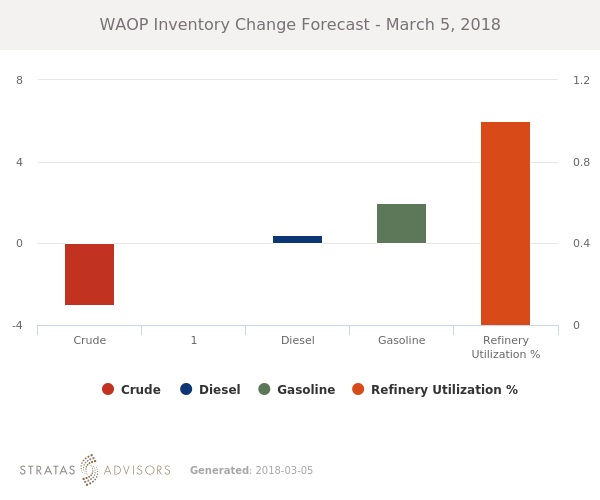

How We Did