In the week since our last What’s Affecting Oil Prices, Brent prices averaged $74.03/bbl last week, falling $0.36/bbl as WTI increased $0.24/bbl to average $68.38/bbl.

Geopolitical tensions will like rise throughout the week as the deadline for President Trump to recertify the JCPOA approaches, supporting Brent. If it continues to look as though President Trump might not recertify the deal, we would expect Brent to gain $1 to $2 throughout the week, likely averaging $75/bbl.

Geopolitical: Positive

Lacking any other distinct drivers, prices could track with geopolitical sentiment over the next week. Saturday May 12 is the deadline for U.S. President Trump to recertify the JCPOA and the Trump has previously asserted that he will not do so without significant changes to the deal. If the White House fails to recertify the deal, the U.S. would effectively be beginning withdrawal proceedings from the JCPOA, theoretically eventually leading to the loss of a significant number of Iranian barrels from the market.

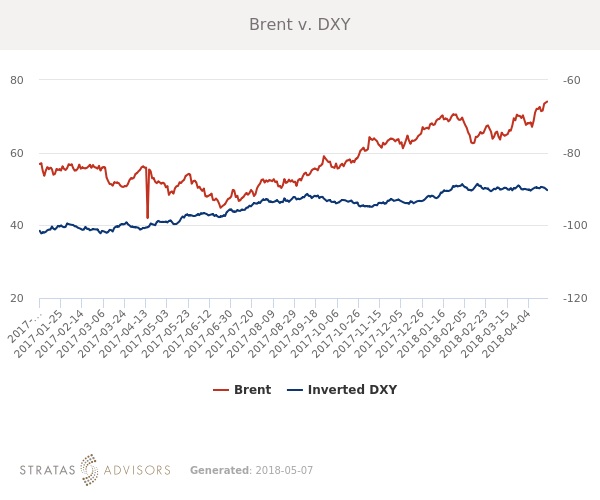

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar rose last week while Brent fell and WTI increased.

Trader Sentiment: Neutral

Brent and WTI managed money net longs all fell last week as price gains moderated. Technical indicators suggest that prices may have been overheated and those entering into speculative positions likely believe the same thing. While there is unlikely to be a full reversal in sentiment, optimism around further price increases is likely diminishing.

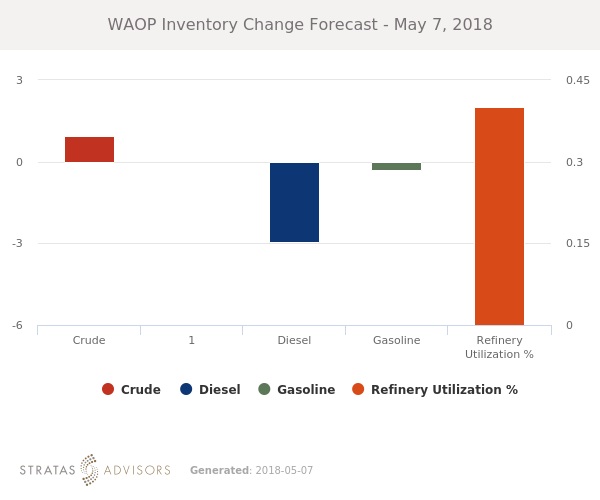

Supply: Negative

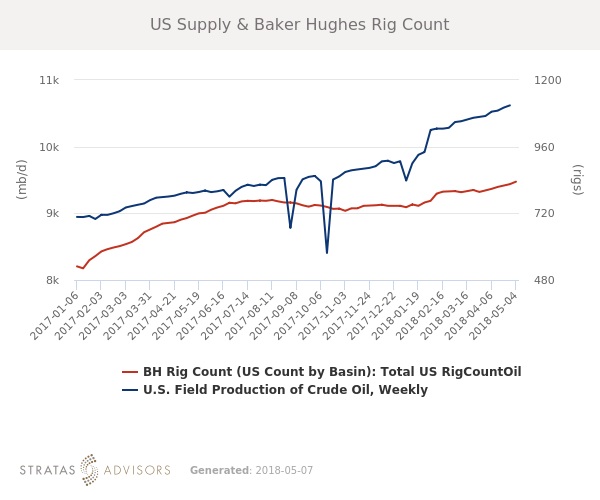

According to Baker Hughes, the number of U.S. oil rigs rose by nine last week. U.S. oil rigs now stand at 834, compared to 703 a year ago. The EIA’s recent Drilling Productivity Report confirmed that U.S. producers continue to get more efficient, with higher IP rates in many plays. This is partly a result of targeting the most prolific areas, but also improved operational practices. Evidence of renewed global oversupply continues to pose the greatest threat to short-term prices.

Demand: Positive

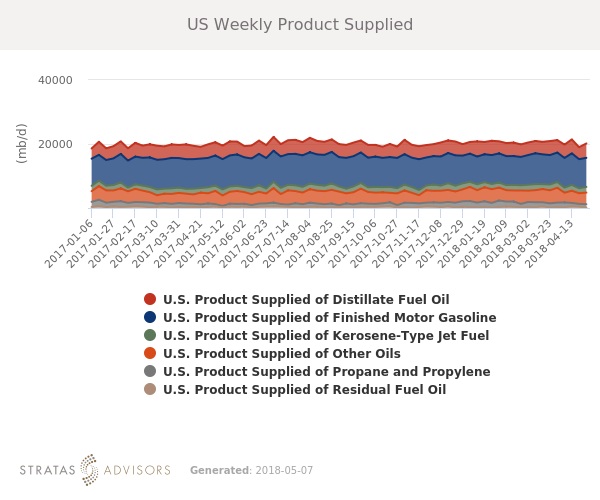

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products including fuel oil. Economic indicators so far presage strong consumer spending through the summer demand season and refined product demand is likely to remain a supportive factor in the short-term.

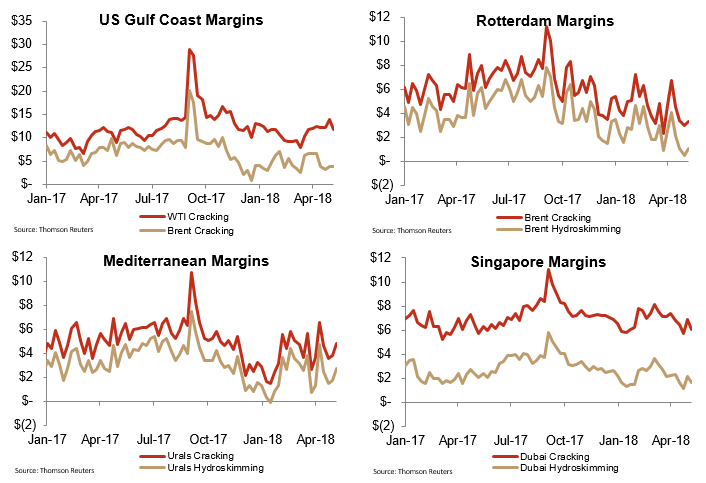

Refining: Neutral

Margins were healthier last week as price rises moderated. Heading into summer driving season, margins should be generally improving on strong demand but high crude prices could add pressure.