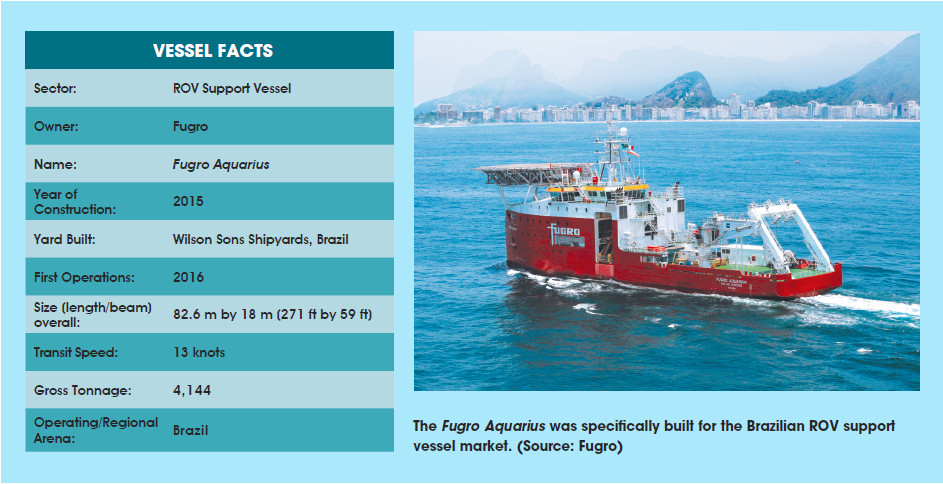

Everything about Fugro’s new DP2 ROV support vessel (RSV), the Fugro Aquarius, has a bit of Brazilian flair. The vessel was built in Brazil and is specifically targeted at the Brazilian market. The vessel was designed by Damen Shipyards Group and built by Wilson Sons shipyard in Guarujá near São Paulo, and its local content is more than 60%. Technology and equipment for the vessel also have been locally sourced.

Measuring 83 m (272 ft) long, the Aquarius has a deck area of 520 sq m (5,600 sq ft) and can accommodate 60 people.

The company considers the vessel, which was delivered in November 2015, as the most advanced vessel of her type built in Brazil. She is equipped with two Fugro-built 150-hp work-class ROVs and can operate in water depths up to 3,000 m (9,843 ft).

The vessel’s stern A-frame has an active heave-compensated winch system, which allows deployment of 10,000 tonnes. The helideck is suitable for medium-lift helicopters such as the Sikorsky S-92.

The Aquarius has two 1,500-kW electric azimuthing thrusters and two 750-kW electric bow thrusters for maneuvering. It can cruise at 11 knots and has a maximum speed of 13 knots. Deck equipment includes four cranes and an abandonment and recovery winch with an operational limit up to 4-m (13-ft) waves.

“Fugro Aquarius has been built specifically for the Brazilian market and is ideally suited for subsea inspection, repair and maintenance,” said Mathilde Scholtes, managing director of Fugro Brasil, in a press release. The vessel also can support subsea construction projects in Brazilian markets. It is expected to complement Fugro’s established presence and capabilities in Brazil and will help the company maintain the performance and production levels of Brazil’s oil and gas structure. It was expected to begin service in April 2016.

Recommended Reading

Wildcatting is Back: The New Lower 48 Oil Plays

2024-12-15 - Operators wanting to grow oil inventory organically are finding promising potential as modern drilling and completion costs have dropped while adding inventory via M&A is increasingly costly.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.