Overseas and offshore markets helped the oilfield services sector pull through in the second quarter. (Source: Shutterstock)

Oilfield service companies are bracing for a weakened North American market for the remainder of the year as drilling activity fell through the second quarter. But an uptick in international and offshore projects helped much of the sector post strong second quarter financials.

The second quarter showed positive momentum across “across the different verticals within the OFS market,” despite a slowdown in U.S. activity, according to an Aug. 10 Evercore ISI report.

“The four major oilfield service companies are well-positioned to benefit from the multi-year global upcycle in E&P spending and the increasing demand for energy services and technology,” Evercore analyst James West wrote. “Strong earnings growth and margin expansion are being driven by international and offshore markets.”

Jefferies equity research analysts agreed.

“Large cap oilfield service companies posted their second quarter earnings with momentum in international activity expected to continue, while North American activity is expected to trend lower in the second half of 2024, as investors look for cycle bottom,” analyst Lloyd Byrne wrote in a July 28 report.

Other analysts said that U.S. onshore rig operators may have seen the bottoming of activity in the quarter and many OFS firms are expecting a rebound in 2025.

‘Surfing the global upcycle’

In the second quarter, SLB benefitted from its strong international and offshore exposure, “with significant gains in digital technology adoption and a focus on leveraging its technology leadership,” West said in a report that referred to the sector as “Surfing the Global Upcycle.”

Jefferies added that SLB continued its margin expansion, “posting [a] second quarter earnings beat with the company reaffirming expectations of continued strong international outlook, while lowering growth expectations from North America.”

SLB EBITDA is projected to grow between 14% and 15% in 2024.

Baker Hughes landed $3.5 billion worth of non-LNG equipment contracts during the second quarter, but the company revised its global upstream spending outlook “slightly down” due to North American softness, President and CEO Lorenzo Simonelli said during the company’s July 26 earnings call.

Jefferies gave Baker Hughes a “buy” recommendation as “execution at Baker Hughes continues and the company’s stock reacted positively to strong second quarter results and positive revisions to 2024 guidance.” The company’s Industrial & Energy Technology segment continues to outperform with growth expected from LNG and non-LNG operations.

Halliburton Co. Chairman, President and CEO Jeff Miller said the company continues to see international markets boosting the company’s bottom line during the company’s July 19 earnings call.

“Despite lagging North American revenue and strong competition in the pressure pumping business, Miller said Halliburton will allocate capital to the markets and products that drive superior returns and margins.”

Jefferies analysts’ bottom line for the company was that “sluggish North American activity impacted Halliburton growth, lowering its price target to $47/share.”

“Halliburton’s second quarter revenue missed, but margins were above expectations,” Byrne said.

Halliburton’s guidance projects a 2024 decline in North American revenue of 6% to 8% year-over-year and slightly trimmed international revenue outlook.

“Our 2024 revenue/EBITDA is revised down by about 3.5% as we incorporate the updated guidance,” Byrne said. Jefferies still rated Halliburton a “buy” recommendation despite the slump.

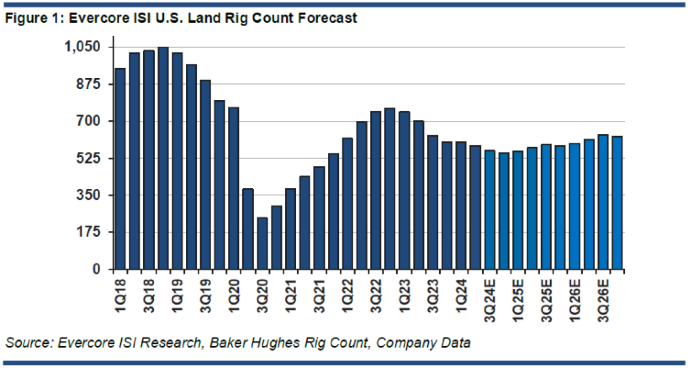

Evercore avoided commenting on the second quarter earnings miss saying, “Halliburton is preparing for a North American land recovery in 2025 and 2026, while its international revenue from Latin America and the Middle East/Asia, shows robust growth.”

Rounding out the Big Four OFS firms, Weatherford continued to benefit from international and offshore momentum despite the North American slowdown, according to company executives and analysts’ commentary.

Weatherford released its second-quarter financial results on July 24, reporting a 26% increase in adjusted EBITDA margins compared to the first quarter—the company’s highest margins in the past 15 years.

For a company threatened by a second bankruptcy in late 2020, President and CEO Girish Saligram called the company quarterly showing a “remarkable turnaround.” As a result, the company’s board authorized its first share buyback program and first quarterly dividend.

Evercore sees “favorable growth in the Middle East, Latin America and Asia with a new shareholder return program and improving margins and cash flow” for Weatherford.

Land rig market

“Commentary from U.S. land rig operators suggests that the end of the second quarter could mark the bottom in the rig count,” Johnson Rice & Co. said in an Aug. 12 commentary.

“Given the recent rebound in oil prices, we believe that we could see some oil rigs added in the coming months, but that is likely a fourth quarter event,” analyst Don Crist wrote.

Pricing remains stable with high-spec rigs in high demand. “Performance-based contracts have become more prevalent given the desire to have consistent drilling results, which we think will remain,” Crist said.

Evercore reported, “the onshore drilling sector is demonstrating resilience and strategic growth, despite mixed market conditions.”

Some of that expansion can be laid at the feet of H&P’s deal to acquire the U.K.’s KCA Deutag.

“Helmerich & Payne is expanding its global footprint through the acquisition of KCA Deutag, significantly boosting its presence in the Middle East, with expectations of strong growth and robust cash flow by 2025,” Evercore wrote.

RELATED

Helmerich & Payne to Acquire KCA Deutag for $2B

During a July 25 earnings call, H&P President and CEO John Lindsay put the company’s recent deal for KCA Deutag in perspective, saying “if you want to be big globally, you have to be in the Middle East.”

While Nabors showed second quarter resiliency in the Lower 48, which CEO Tony Petrello attributed “to a focus on rig automation and performance,” Nabors is also banking on increased international growth in the Middle East.

Nabors’ daily rig margins exceeded expectations, despite declines in the U.S. rig count, as the oilfield service company continued to focus on automation and performance with its high-spec rigs.

“Nabors Industries is capitalizing on international opportunities with substantial rig deployments in Algeria, Argentina and Saudi Arabia, while maintaining a solid free cash flow target of $100-200 million for 2024,” Evercore reported.

Offshore markets

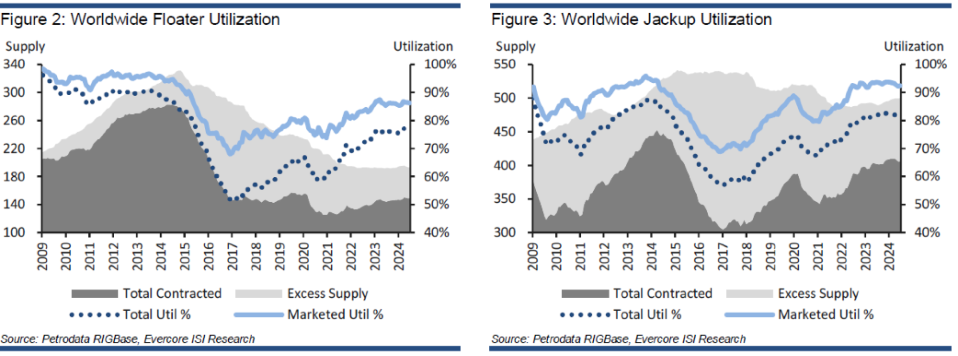

Demand for offshore rigs remains high with several recent contract announcements pushing day rates to a high $400,000 per day, with one contract at $520,000 per day, Johnson & Rice reported.

“The need for energy security worldwide continues to drive the offshore rig count higher, and we expect this to continue with the next wave of new contracts likely to be for the warm stacked rigs in the Canary Islands,” Crist said.

Evercore echoed that view, observing that “offshore drillers continue to benefit from increasing day rates and utilization globally, tail winded by a combination of increasing demand for high-spec rigs, slower than expected rig reactivations and the absence of any near-term newbuilds,” West said.

The offshore service vessel market remains tight, with any additional contracts for deepwater rigs and deliveries of FPSOs set to tighten the market even further.

“OSV provider Tidewater and helicopter transportation company Bristow are also experiencing strong upward momentum in rates and fleet utilization,” West said.

Other OFS companies are navigating a complex landscape marked by geopolitical uncertainties and market volatility, West wrote. “Smaller companies, including Core Laboratories and Dril-Quip, are reporting growth in specific segments despite facing headwinds.”

“The diverse strategies and market responses underscore a positive long-term outlook, with significant margin expansion and shareholder returns anticipated across the board,” West said.

Recommended Reading

Phillips 66’s Brouhaha with Activist Investor Elliott Gets Testy

2025-03-05 - Mark E. Lashier, Phillips 66 chairman and CEO, said Elliott Investment Management’s proposals have devolved into a “series of attacks” after the firm proposed seven candidates for the company’s board of directors.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.