Overall completions in Appalachia have been down due to the strategic growth of drilled but uncompleted inventories. Companies have stated that this maneuver was in response to the high volatility of gas prices throughout 2015 and infrastructure downtimes, which have resulted in bottlenecking throughout the region. However, these bottlenecking issues are beginning to be mitigated due to infrastructure coming back online and the market rebalancing.

Within both the Marcellus and Utica operators have been mirroring completion techniques where two key trends have appeared over the course of the downcycle: a continued increase in the average proppant mass per well and a falling completion count. The Marcellus has experienced an increase in average proppant mass of about 25% from January 2014 to January 2016 to average about 10 million pounds per well. During this time the number of completions in the Marcellus has decreased substantially to fewer than 100 wells on average being completed per month in 2016.

The average proppant mass being pumped per well in the Utica has jumped significantly by about 30%, from less than 6 million pounds per well in January 2014 to about 14 million pounds per well in May 2016, with monthly well completions dropping from more than 250 wells to under 20 wells within the same time frame. This trend shows how operators are spending less capital in cutting completions by such an astounding number while simultaneously ramping up proppant use to maximize well productivity.

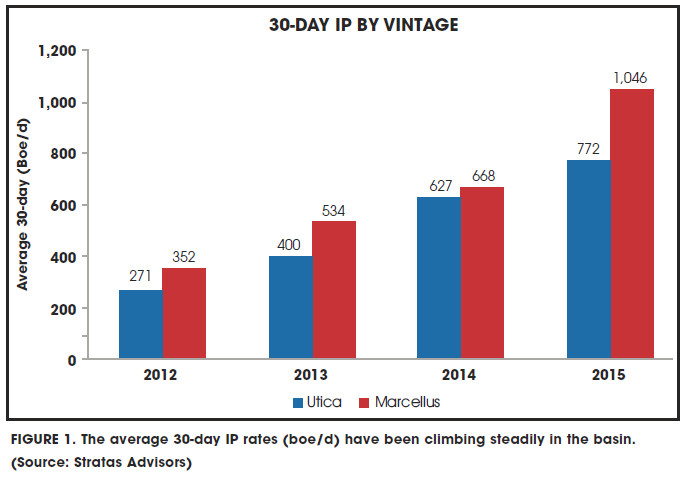

When analyzing about 7,000 wells and comparing the average 30-day IP rates (boe/d), it is found that Marcellus wells exhibit slightly higher IP rates when compared to the Utica (Figure 1). In 2012 IP rates in the Marcellus were about 350 boe/d, focused mainly within Lycoming, Bradford, McKean and Susquehanna counties. As the play shifted into the southern region, IP rates have increased by about 65%. Currently, Marcellus wells are achieving 30-day IP rates upward of 1,050 boe/d. Similarly, the Utica’s rates also trend upward, increasing by about 20% year-over-year. Within the Utica the largest IP rates are currently situated within Belmont and Monroe counties.

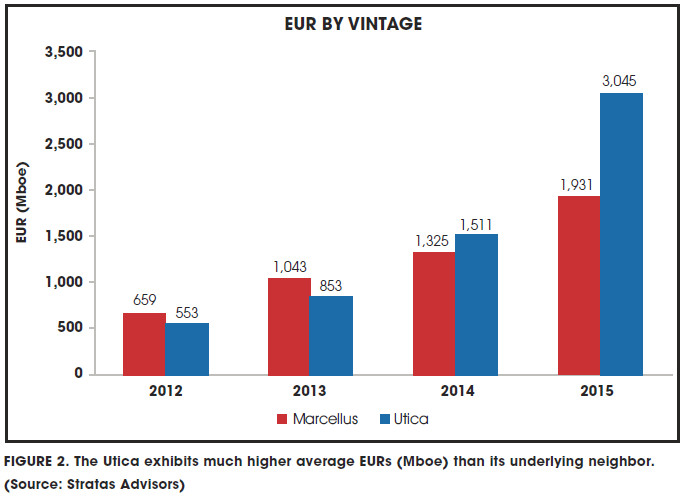

Similar to the IP trends, the average EURs also have been on the upward climb. The Utica has surpassed the Marcellus in terms of ultimate recovery potential in 2014 and has continued on that path. Despite this climb, well costs and ease of extraction are still a detriment to full-scale Utica production. Operators have been able to optimize the targeting of both the Utica and Marcellus by drilling Utica test wells on already constructed Marcellus well pads, thereby saving a portion of operational costs. In 2014 the Utica saw an average EUR of 1,510 Mboe, about 12% larger than the Marcellus EUR of only 1,325 Mboe. Moving into 2015, the Utica further increased its EURs by 50% to a playwide average of 3,045 Mboe (Figure 2). This rivals the Haynesville, another well-known gas play in the U.S., which shows an average EUR of 2,674 Mboe, falling between the Marcellus and Utica 2015 averages. When comparing both the IP and EUR trends of the Marcellus and Utica, it is evident that Marcellus wells, with the overabundance of primarily gas, yield larger IP rates with slightly larger declines, while Utica wells exhibit a more uniform life cycle.

When comparing expected production growth estimates in each play, both the Marcellus and the Utica are likely to continuing growing as they experience positive economics across the majority of core counties. The onslaught of production has created bottlenecking issues previously within the basin, but companies are coming along with planned infrastructure projects to increase takeaway capacities in the region. The anticipated projects planned will allow the Marcellus and Utica to reach full production potential within the next several years and will likely boost the local economy from jobs to tax breaks for companies. Historical and current operational trends suggest that companies currently active in both the Marcellus and Utica will continue to test and push operational limits.

Historical and current operational trends suggest that companies currently active in both the Marcellus and Utica will continue to test and push operational limits.

When looking at production in the short term, Stratas Advisors and the U.S. Energy Information Administration anticipate decreases in growth rates for each play compared to the 2015 exit rates. These decreases due to diminishing activity levels are expected to be mitigated to some extent given the increase in production experienced per well. Although rig counts have sharply declined in the region, by 67% since 2014, production on a per rig basis has increased, and the Appalachian Basin expects to be able to return to higher production volumes while utilizing fewer rigs in the future.

For more information, contact Jessica Pair at 713-260-4604 or jpair@hartenergy.com.

Recommended Reading

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Partnership to Deploy Clean Frac Fleets Across Permian Basin

2024-12-13 - Diamondback Energy, Halliburton Energy Services and VoltaGrid are working together to deploy four advanced electric simul-frac fleets across the Permian in an effort to enhance clean and efficient energy solutions in the region.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.