After the discovery of commercially viable reserves in the Vaca Muerta formation, the Argentinian shale play rapidly gained global attention as a robust, profitable and unconventional target. Billions of dollars worth of investments have been devoted to make Vaca Muerta unconventional oil and gas resources recovery a success. Well production performance is comparable with profitable shale plays in North America. However, operators are continuously looking to reduce well costs.

To maximize return on investment (ROI) per well, operators have shifted to apply horizontal drilling technologies and techniques mainly seen in U.S. shale basins to accelerate learning curves in drilling, production and logistics. With significantly higher potential profits on horizontal wells in relation to vertical wells, drilling projections have changed from vertical wells to horizontal extended-reach wells to increase field recovery percentages and, consequently, to increase the ROI.

A crucial step in completing the wells in Vaca Muerta prior to production is rigless operations performed by coiled tubing (CT) units. As most wells are hydraulically fractured in Vaca Muerta through plugging and perforation, CT has become an integral component to reduce cost and time relative to the use of full-scale workover rigs. Its utilization has gradually evolved, with the cooperation between operators, service companies and manufacturers to increase suitability, reliability and predictability.

Vaca Muerta operators and service companies have embraced smarter CT technologies to pursue engineered, fit-for-purpose CT string designs that can satisfy the extended capabilities required by the new well designs and drilling projections.

Limited by CT design boundaries

Vaca Muerta unconventional wells pose numerous challenges for CT operations. The high reservoir pressure leads to high operating pressures during post-fracturing plug millouts and cleanout jobs, which increase operational risks and diminish CT service life. Additionally, most wells have tortuous laterals with high degrees of inclination that exacerbate CT dragging and early lockup.

To address challenges faced in developing horizontal completions, many elements of the CT operation for both surface and downhole equipment and operational practices have progressed throughout the years to accommodate increased fl uid volumes, higher circulating pressures, greater axial loads and improved lateral accessibility.

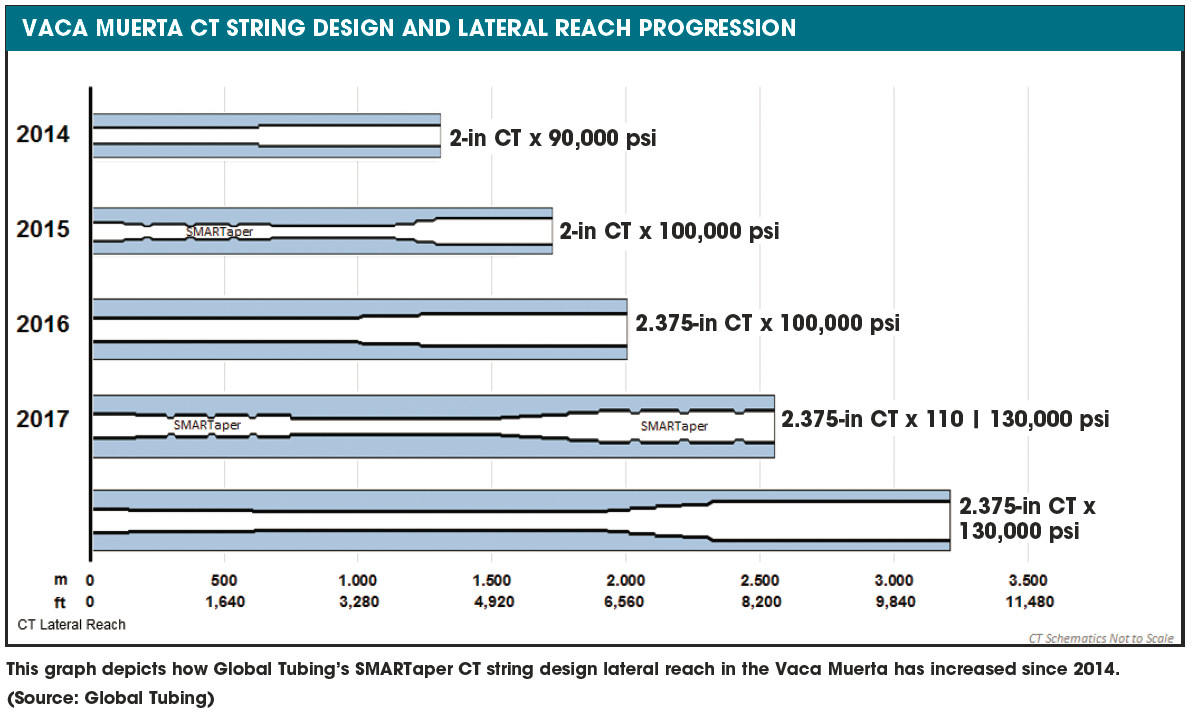

However, the importance of CT string design was overlooked, hindering the progress of drilling projections for increased lateral lengths. Up to late 2014 2-in. CT with conventional steptaper configurations and 90,000-psi grade materials were used to complete horizontal wells, which had up to 1,300-m (4,300-ft) laterals. However, as the projected well laterals increased, the CT encountered setbacks during operations such as being unable to reach targeted depths, provide sufficient weighton- bit (WOB) to millout all plugs in the well and produce proper annular velocities for well cleaning. These simple CT designs also were unable to cope with the high working pressures seen during operations, which caused early retirement of the string because of excessive ballooning and rapid fatigue accumulation.

CT engineered solution

To overcome Vaca Muerta unconventional shale challenges faced by inadequate CT designs, technology advancements in the CT manufacturing industry enabled design improvements in the CT string to maximize the utilization of CT equipment available in the area. The tubing string makeup was engineered and optimized for the present well conditions while maintaining CT equipment design constraints.

By using proprietary technology such as SMARTaper, the CT design engineers can strategically place specific wall thicknesses to add strength to the CT where it is needed most. This technology allows rapid transitions between wall sections to minimize tubing weight in the horizontal section and increase stiffness in the vertical to avoid the onset of CT buckling inside the wells.

The evolution of the CT string design employed to complete Vaca Muerta unconventional wells has progressed considerably during the last three years:

- Taper configuration: The strings’ makeup has progressed from conventional Step Taper skelps to multitaper Continuous Taper and SMARTaper configurations, with rapid wall transitions that feature hourglass profiles;

- Outer diameter: The CT size increased from 2 in. to 2.375 in. to improve cleaning efficiencies, WOB and lateral reach;

- Wall thicknesses: The maximum wall thickness employed in the CT strings designs increased from 0.19 in. to up to .25 in. wall sections to optimize stiffness of the CT in the well;

- Steel grade: The CT grade had increased from 90,000 psi to up to 130,000 psi to expand the utilization of the CT string to high-pressure environments and bestow it with greater resistance to deformation and low-cycle fatigue; and

- Lengths: As the well laterals increased, the CT string lengths have been extended from 5,200 m (17,000 ft) to 6,400 m (21,000 ft). With the utilization of customengineered CT string designs, operators were able to increase well laterals lengths by up to 150% during the last three years.

The latest technological advancement in the CT manufacturing industry is quench-and-tempered CT such as DURACOIL, which is used in Vaca Muerta. This technology uses inline induction heating and precision slot-quench HALO Induction Technology to produce consistent microstructure through the string length, adding life, abrasion and corrosion resistance compared to conventional coiled tubing grades.

Currently, 2.375-in. quench-and-tempered CT strings in 110 and 130 grades are being used to complete wells of up 3,200-m (10,500-ft) laterals, tackling the ambitious objectives set by the operators.

With operators continually seeking to improve and extend the boundaries of well completion technology, CT manufacturers like Global Tubing will continue to provide engineering and technologies that will expand the horizons for Vaca Muerta development.

Recommended Reading

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

DOE Approves Venture Global’s CP2 LNG to Export to Non-FTA Countries

2025-03-20 - The U.S. Department of Energy approved Venture Global’s Calcasieu Pass 2 LNG project in Cameron Parish, Louisiana, to export LNG to non-FTA countries.

LNG, Data Centers, Winter Freeze Offer Promise for NatGas in ‘25

2025-02-06 - New LNG export capacity and new gas-fired power demand have prices for 2025 gas and beyond much higher than the early 2024 outlook expected. And kicking the year off: a 21-day freeze across the U.S.

US LNG Exports May See EU Demand Drop-Off, Asian Surge

2025-03-27 - Ukrainian peace talks could end with Russian gas back on the market, Poten & Partners analysts said.

Charif Souki Plans Third US NatGas Venture, Including E&P Team

2025-03-25 - Charif Souki, co-founder of the Lower 48’s first and largest LNG exporter, has his sights set on a third natural gas venture after his exit from Tellurian Inc.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.