Data show falling breakevens and greater definition of the Bakken core.

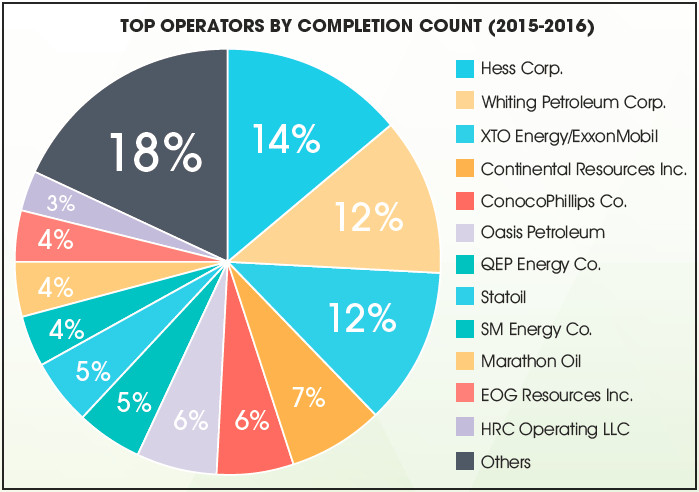

The top three Bakken operators by completions held a combined share of 38% of the market in 2015-2016. Recently, EOG Resources, which represented 4% of the market in 2015-2016, increased its monthly market share, averaging a 13% share in August through October 2016. (Source: RS Energy Group)

Analyzing operator market shares by production alters the order of the top Bakken operators. Whiting Petroleum Corp. holds the largest share, followed by Hess with 3% less of the production market. The most notable change is XTO Energy/ExxonMobil. The company held 12% of the completion market during 2015-2016 and now holds only 6% of the overall production market. (Source: RS Energy Group)

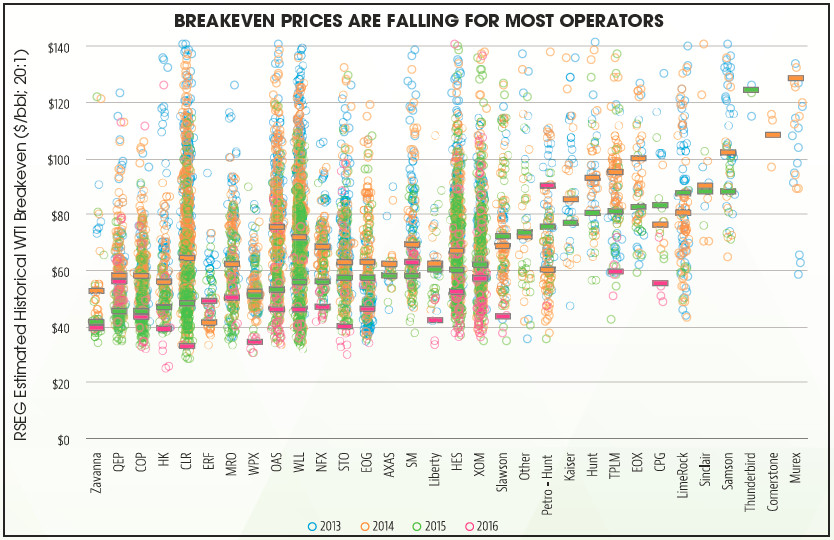

In 2014 RS Energy Group estimated that the average horizontal well in the Williston Basin required $66/bbl to generate a 10% pretax rate of return. That fi gure dropped to $48/bbl in 2016. The current breakeven estimate is at about $45/bbl. The drop in 2016 breakevens can be associated with high-grading, service cost defl ation and effi ciency gains as well as productivity improvements from enhanced completions. It is probably no coincidence that several operators who have embraced more intense completions also experienced the biggest drops in year-over-year supply cost. (Source: RS Energy Group)

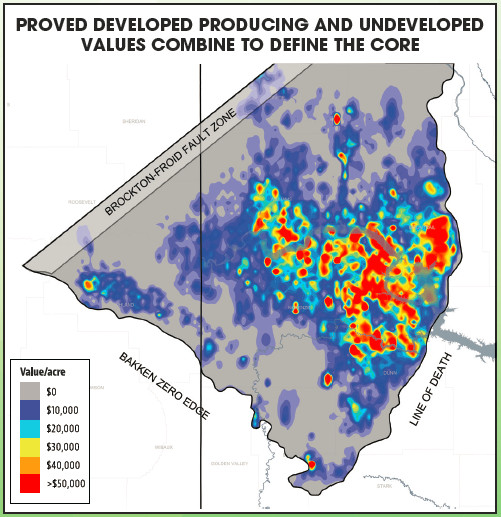

By combining the value of production with the value of the undeveloped acreage to derive a map of total value per acre, the core area with the Williston Basin is clearly highlighted. These regions within the Williston are valued in excess of $50,000/acre, taking into account the existing production as well as undeveloped acreage. These are impressive metrics but remain below the lofty values set by recent core Permian and SCOOP/STACK transactions. (Source: RS Energy Group)

Recommended Reading

ONEOK, MPLX Enter $1.75B JV for Texas LPG Export Terminal, Pipeline

2025-02-04 - ONEOK Inc. and MPLX have entered into agreements to invest $1.4 billion to build a 400,000 bbl/d LPG export terminal in Texas and a $350 million pipeline project.

Elliott Demands Phillips 66 Sell or Spin Off Midstream Biz for $40B+

2025-02-12 - Activist investor Elliott Capital Management disclosed Feb. 11 it has built a $2.5 billion position in Phillips 66 and issued a series of initiatives, including the sale or spinning off of the company’s midstream assets.

DT Midstream Closes $1.2B Midwest Pipeline Acquisition with ONEOK

2024-12-31 - DT Midstream acquired three pipelines with more than 3.7 Bcf/d of capacity that span approximately 1,300 miles across seven states.

ONEOK Completes EnLink Midstream Takeover for $4.3B

2025-02-02 - ONEOK had agreed to acquire the remaining stake in EnLink in November 2024 for $4.3 billion after having acquired the controlling interest a month prior.

Delek Closes $285MM Buyout of Permian’s Gravity Water Midstream

2025-01-03 - Delek Logistics continues to focus on bolstering its Permian Basin infrastructure holdings with the acquisition of Gravity Water Midstream.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.