The Permian Basin’s rapid adoption of in-basin sand is changing the road map of proppant logistics. According to investment banking firm Tudor, Pickering, Holt & Co., 75% of sand used in domestic oil and natural gas production in 2015 was shipped by truck or rail from mines located in the upper Midwest. Now, new in-basin mines are expected to generate more than 7 MMtons of sand per quarter. The opening of these mines will result in the removal of nearly 800,000 tons of sand requiring long-haul rail logistics in the fourth quarter of this year compared to the first quarter of the year. Northern White Sand’s hold on market share across the U.S. is expected to decrease to 38% by 2019 as more oilfield service firms and operators turn to sourcing their sand in-basin.

A simplified supply chain

The driving force behind the adoption of in-basin sand is a much-simplified supply chain, which results in significant costs savings. With the use of Northern White Sand, mining and processing costs range from $10 per ton to $30 per ton. An additional $30 per ton to $60 per ton is added for load-out and long-haul rail. Those additional costs include freight and rail car leases, fuel surcharges and administrative fees. Once the sand arrives at its respective basin, transload fees of $7 to $20 are added before final last-mile trucking costs of $15 per ton to $50 per ton are tacked on. All told, the long and complex supply chain involved with delivering Northern White Sand totals upward of 50% to 75% of total delivered costs.

In-basin sand eliminates entire links in this supply chain, cutting delivery distances from 1,931 km (1,200 miles) to about 402 km (250 miles) or fewer. This compression in logistics reduces sand costs upward of 50%, which equates to about $500,000 in savings per well.

Predictable delivery

Predictable delivery

In-basin sand also delivers better delivery predictability–– a key component of logistics planning. Driven by strong economic activity, the U.S. rail system is experiencing high demand even as Northern-based sand mines attempt to ship more sand to increasingly active basins. This has led to less predictability and the potential for significant delays. Permian-based transload hubs delivering Northern White Sand are at the mercy of rail. Once sand inventory is depleted, it can be seven to 10 days before the next shipment is received. In-basin sand eliminates this uncertainty. Sand is produced continually on property and is fed directly from the dryers into the silos for immediate deployment to the well site.

Last-mile loop

With the rail link removed and in-basin sand always at the ready, the logistics equation becomes a matter of managing inventory and time in a continuous five-segment last-mile loop. The first segment is the time required for load-out to replenish the starting wellsite inventory. The second and third segments are the times required for transit back to the transload facility and the load-in time, mine-gate to mine-gate. The fourth and final segments are the transit time back to the well site and offloading of new inventory to support the next fracturing stage.

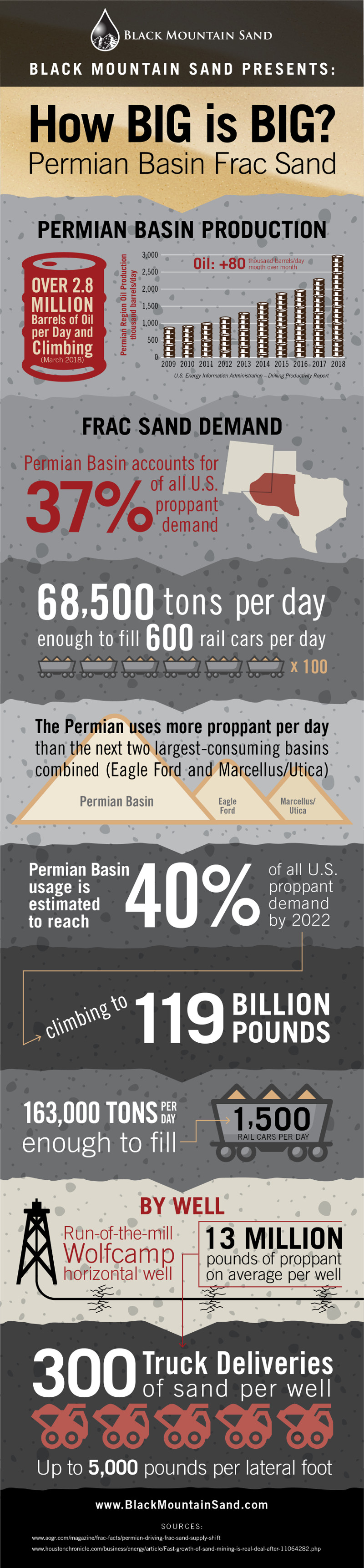

From addressing onsite storage to managing trucking cycles, the last-mile loop requires precision and efficiency. This is especially significant when factoring in the sheer volume of sand required per well completion. The average Wolfcamp horizontal well requires 13 MMlb of sand, which totals 300 truck deliveries averaging 23 tons of sand each.

Using this single-well example, a 36-stage Wolfcamp fracture treatment would start with two to three stages worth of sand on hand. Because sand storage capacity at the well site is finite, the race to replenish sand begins the moment the pressure pumpers begin their work. Each fracturing stage, which requires about eight truckloads of sand, takes about 1.5 hours to complete. Keeping the pressure pumper up and running becomes a balancing act between inventory levels, mine-gate to mine-gate load times and offloads, all with an eye to gaining predictable timing efficiencies wherever possible.

Seeking timing predictability

To keep the sand coming, logistics teams add up the five time segments in the last-mile loop and order sand and schedule deliveries accordingly. Although transit times to and from the transload facility remain relatively static components of the equation, certain mine processes and load-out solutions can deliver predictability and efficiencies.

The Black Mountain Sand transload check-in process at the mine-gate utilizes radio frequency identification (RFID) technology. Upon the first visit to either of the company’s two facilities, a truck’s identification number, company information and weight specifications are recorded. An RFID badge is then issued to help expedite future entry. Drivers scan their card, type in the unique order number and proceed directly to one of eight load-out lanes. Specially designed software assigns each truck a route and silo position based on existing traffic patterns, load-in progress and sand inventory per silo. The average truck load-in time at the Black Mountain Sand facilities, mine-gate to mine-gate, is 10 minutes or fewer. With this 10-minute time frame considered into the equation, logistics teams can more precisely gauge when to place orders for sand as well as delivery timing.

For load-out on site, further efficiencies (and critically needed time) can be gained through adopting last-mile equipment innovation. Although pneumatic deliveries are still widespread, bottom dump capabilities are gaining momentum by offering an accelerated offload process. Fed by gravity, sand flows down an accordion-like chute into a fully enclosed conveyor that loads the sand into mobile vertical silo systems. Whereas pneumatic systems take upward of 45 minutes to offload, a bottom dump can be accomplished in about 10 minutes, which cycles the truck back into service that much faster. Using the Wolfcamp example previously cited, 300 trucks offloading in 10-minute cycles versus 45-minute cycles compress total offload time on location from 225 hours to 50 hours. On a truck-by-truck basis, this eliminates up to 35 minutes in downtime per truckload––time that can be better spent on the road.

Basinwide, in-basin sand is estimated to deliver cost savings upward of $3.5 billion per year. The promise and delivery of a simplified supply chain has paved the way to widespread adoption. Driven by a new logistics equation from mine-gate to the well site, in-basin sand delivers more dependable, cost-effective and timely access to a product critical to U.S. energy production.

Recommended Reading

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

EON Deal Adds Permian Interests, Restructures Balance Sheet

2025-02-11 - EON Resources Inc. will acquire Permian overriding royalty interests in a cash-and-equity deal with Pogo Royalty LLC, which has agreed to reduce certain liabilities and obligations owed to it by EON.

Berry Closes Debt Refinancing to Uphold Growth Commitments

2024-12-26 - Berry Corp. closed a debt refinancing agreement to continue its corporate strategy of promoting scale and diversification.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.