Freehold Royalties is getting deeper in the Permian with a CA$216 million (US$152 million) Midland Basin acquisition. (Source: Shutterstock.com, Freehold Royalties)

Freehold Royalties has agreed to acquire Midland Basin mineral and royalty interests for CA$216 million (US$152 million), the latest transaction among firms scouring the lucrative Permian Basin for deals.

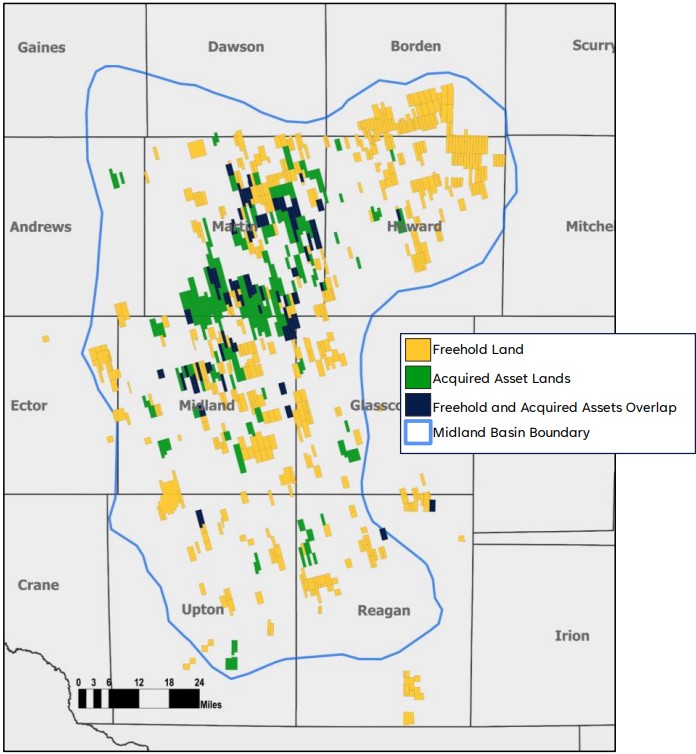

The acquisition from a private seller includes around 1,300 boe/d of net production, 244,000 gross drilling acres and around $31 million in annual net royalty revenue, Calgary-based Freehold said Dec. 9.

Around 95% of the production is operated by Exxon Mobil Corp. and Diamondback Energy, and 16 rigs are currently active on the acquired assets.

Freehold’s transaction will boost its Midland Basin portfolio by 35% and positions the company to capture one in every three rigs active in the Midland Basin. Most of the acreage is in Martin and Midland counties, Texas.

The deal comes as mineral and royalty companies focused on acquiring Permian acreage in 2024. Texas Pacific Land Corp. is among several firms active in the Permian, striking a pair of deals—one in August and another in October—to buy interests in the Midland and Delaware basins for a combined $455 million. Also in October, Diamondback Energy subsidiary Viper Energy closed on Midland mineral and royalty interests in a deal valued at $915 million.

In January, Freehold itself closed a pair of transactions in the Midland and Delaware basins in Texas and New Mexico for CA$116.2 million (US$82 million).

“This acquisition is a successful reflection of our disciplined approach to strategic M&A, in an area we know well and further builds on the two core Midland Basin acquisitions we closed earlier this year,” said David Spyker, president and CEO at Freehold.

After closing, 50% of Freehold’s Midland Basin production will be operated by Exxon Mobil; Diamondback will operate around 11%.

Freehold plans to finance the transaction with CA$125.1 million (US$88.25 million) in equity financing and its existing credit facilities.

The transaction includes significant “white space” across drilling spacing units (DSUs), with about 25% of the acquired acreage characterized as undeveloped with no previous horizontal drilling, Freehold said.

Freehold said it has significant running room across the basin’s most targeted benches, the Lower Spraberry, Wolfcamp A and Wolfcamp B zones.

The deal also gives Freehold greater exposure to so-called “second generation” benches, including the Middle Spraberry, Jo Mill, Dean, Wolfcamp C and Wolfcamp D intervals.

And the company also sees opportunity in emerging Midland benches like the Clear Fork, Upper Spraberry and deeper Barnett shale.

As Freehold has evolved over the past five years into a North American royalty player, the Midland Basin has emerged as a key part of the portfolio. After closing, the Midland Basin will make up around 50% of Freehold’s total U.S. production and around 20% of companywide output.

The company’s top three plays are the Midland Basin (3,250 boe/d pro forma), the Eagle Ford Shale (2,400 boe/d) and Canadian heavy oil assets (1,300 boe/d).

RELATED

Recommended Reading

BP Forecasts Dip in First-Quarter Upstream Production

2025-04-11 - BP anticipates a quarter-over-quarter decline in upstream production when it reports earnings later this month.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Phillips 66 Urges Shareholders to Vote Against Elliott at Annual Meeting

2025-04-08 - Phillips 66’s board of directors is again pushing against one of its largest investors—Elliott Investment Management—with a letter to shareholders detailing how to vote against the investment company at its upcoming annual meeting.

NRG’s President of Consumer Rasesh Patel to Retire

2025-04-07 - NRG Energy anticipates naming a successor during the second quarter. Patel will remain in an advisory role during the transition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.