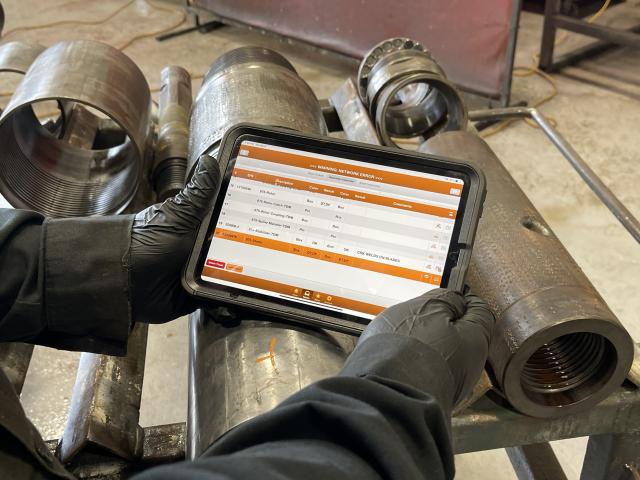

D90 software being used in real time in the field to capture the BHA data. (Source: Turnco)

Some Permian Basin operates are cutting the chances of catastrophic bottomhole assembly (BHA) failures by more than half through the strategic use of data, according to software provider Turnco.

A digital inspection portal that tracks BHA equipment before and after it’s deployed is also helping companies reject items that may result in downhole failure. Along with decreasing critical failures, the software is helping to improve the supply chain for components, according to Turnco.

Lonnie Smith, co-founder of Turnco, said the inspection portal started as a way to digitize data on the last 90 ft of the drillstring, which they used to name the software: D90 (Digital 90). Historically, data provided to operators about equipment at the end of the drillstring was inconsistent, he said.

“Sometimes it was literally carbon copy paperwork,” he said. “There just was a huge gap there in having digital records, databases of the information.”

The company realized that complete and digitized information about the drillstring equipment would improve BHA reliability.

D90 is a “quality platform that uses technology to solve BHA reliability challenges by uniting the data into one platform that then the operator has control over, even though it might be data that's being generated by 10 different service companies,” Smith said.

The inspection portal began as a bespoke, customizable software product that debuted in 2017 to capture and validate information about drilling equipment. Now, the software has evolved into an analytical tool that makes it possible to optimize BHA performance.

In the Permian lab

Beginning in 2017, a global operator with a large presence in the Permian Basin implemented D90 in their operations. From then until 2019, D90 “eliminated the amount of catastrophic BHA failures from 25% down to 9%,” Smith said.

According to Smith, it’s not possible to truly eliminate tool failures “because there’s a million different ways” failures can happen. But helping avoid catastrophic failures can save money.

“A lot of times you're having to fish for the tool, you're having to sidetrack, you're having to pay the company that you rented the tool from,” he said. “Being able to avoid that and get those numbers down is extremely valuable.”

D90 has built up its database by gathering information on BHA components before they arrive at the rig site and then continuing analysis after drilling operations are complete. Post-drill analysis has helped detect that certain components “marked by the supplier as good to go to the rig” actually cause downhole failure, Smith said.

“We identified that there was some reason why those components needed to be rejected,” he said. “These were actual components that would've absolutely gone to the rig and potentially could have caused failure.”

D90 identified those components and rejected them before they had a chance to make it to the rig site, he added.

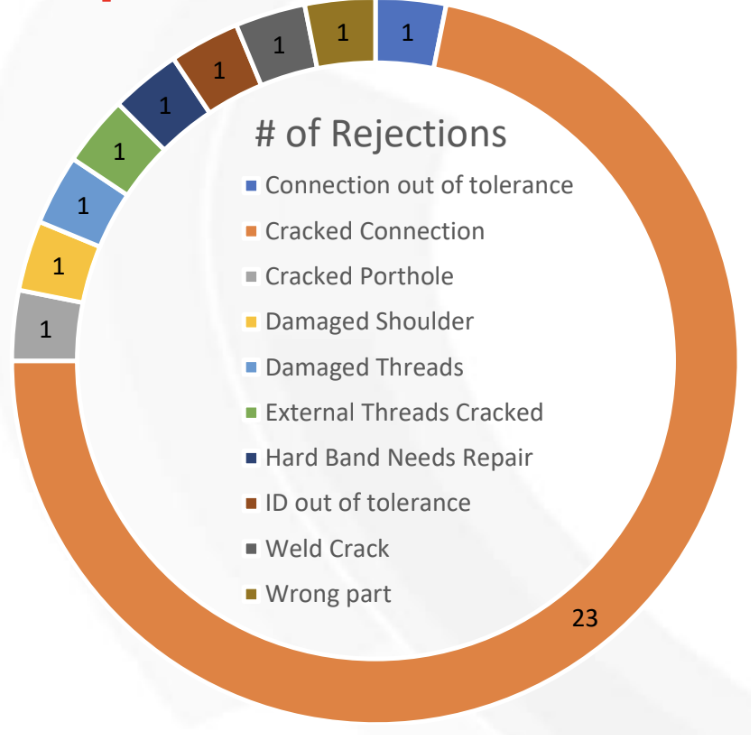

And when D90 rejects the pieces, such as components with cracked connections, Turnco uses the analytics to guide the supplier on how to better choose components and supply more reliable parts, he said. That’s resulted in supply chain improvements.

“It actually improves it because once you start to bring awareness to these service suppliers on what the expectations are, they can plan and adjust their business plans around that,” Smith said.

And as D90 evolves, it is collecting even more data, such as “drilling data, mud data, the other areas and pockets of information that can be tied together and stitched into one big picture of what's happening during the drilling process,” he said.

That data can be used to help the operator better understand drilling from one well to the next in the same formation, he said, and how the changes may affect the BHA equipment.

Trendsetting software

The data collected by D90 also helps identify trends. As the product moves into the future, Smith said it will use artificial intelligence and machine learning to predict failures or maintenance requirements.

“The only way we can really learn that information is by gathering it in the front end and the back end,” he said. “We're trying to reverse that and make it much more proactive, identifying those things before they break.”

By the end of 2023, he said Turnco aims to release a motor failure prediction algorithm.

That data, combined with machine learning, could also help operators make better decisions about drilling and the equipment they are using, he said.

“Eventually, I think that's going to evolve into automated decision making at the rig site where the rig is practically drilling itself,” he said, adding, “That's way down the line.”

Smith has an even bigger vision for preventing downhole equipment failure.

He wants to see the industry be as proactive about equipment as it is about overall safety. Safety reporting includes near misses, including when an accident almost happens or incidents in which someone didn’t get hurt, but could have been.

“When it comes to BHA tools, the only time that the operator ever gets that information…is when it breaks,” Smith said. “We want to switch that to a mentality of a near miss. How many near misses of this part breaking did we have, and what caused that before there's actually a failure down hole?”

Recommended Reading

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

NatGas Shouldering Powergen Burden, but Midstream Lags, Execs Warn

2025-02-10 - Expand Energy COO Josh Viets said society wants the reliability of natural gas, but Liberty Energy CEO Ron Gusek said midstream projects need to catch up to meet demand during a discussion at NAPE.

PrairieSky Buys Canadian Mineral Interests in Deals Totaling $57MM

2025-02-10 - PrairieSky Royalty Ltd. acquired royalty interests in December and January deals in Alberta and Saskatchewan, Canada.

Element3 Produces Lithium Carbonate from Permian Oil, Gas Wastewater

2025-02-10 - Element3 says it produced the battery-grade lithium carbonate using a Double Eagle Energy Holding subsidiary’s wastewater in the Midland Basin.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.