It is possible to establish a robust methodology for evaluating the true economic potential of shale assets integrating various sources of data, namely geological, completions and production data. The central theme of recent work is that completion design with regard to hydraulic fracturing is dynamically evolving. Even good frackable rocks with sufficient total organic carbon may underperform with poor completion design. Shale assets that proved to be sub-economic in the past could potentially benefit from recent advances in completions and be more profitable in the future.

It is very difficult to identify the factors that affect well performance when studying several horizontal shale wells, with each well having enormous amounts of data associated with it. When there are hundreds of wells around the area of interest, the dataset soon becomes too huge to manage.

The solution to this problem lies in Big Data analytics. Data mining followed by creative and intelligent data analytics can assist in identifying the key parameters that affect well performance. Once these factors have been identified, wells with optimum completion design can be selected for type curve determination.

Using the above-mentioned methodology, 20 different assets in the range of 5,000 acres to 30,000 acres across the Permian Basin were analyzed for their economic potential. Comprehensive data analytics considering several but not all of the parameters that could potentially affect production were implemented. It was observed that each area had different sets of parameters that correlated to production. The robust data-driven methodology enabled the quick identification of the key parameters in each area and cut down the asset evaluation time by 90%. Assets that were thought to be sub-economic and were previously overlooked were shown to have benefitted from optimized completion design, with the newer type curves yielding a rate of return of more than 30% even at depressed commodity prices.

Case study

The case presented had almost 1,000 wells on a similar dip with no known faults in the area. About 75% of the wells were landed in the same bench and at similar depths. In total, there were three to four Wolfcamp benches in the area of interest.

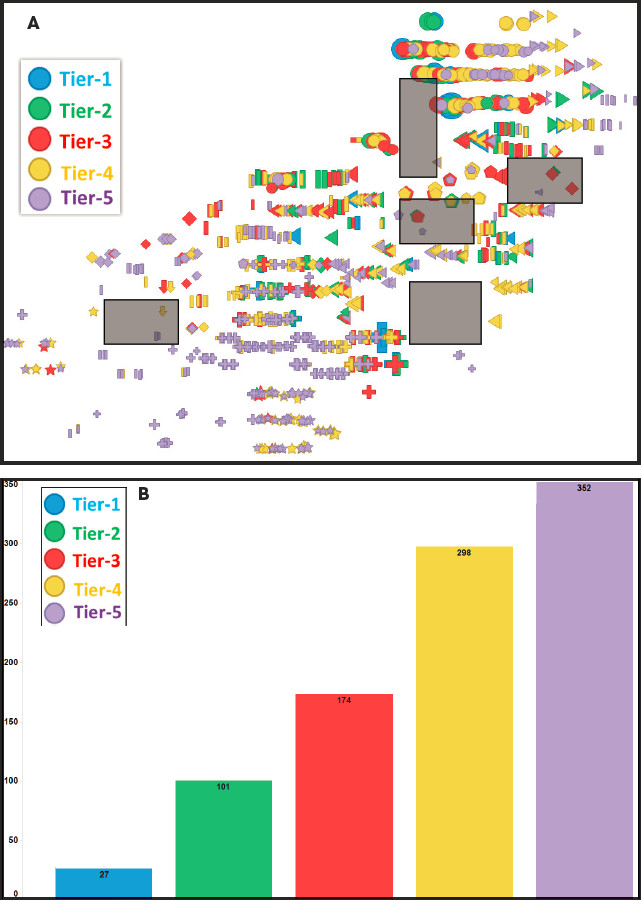

In Figure 1A each well is represented by a dot, and the area of interest is shown as semitransparent black rectangles. The color of the dot represents the production performance category of the well, blue being the best producers and purple being the worst. Dots are shaped according to the operators and are sized according to six months’ cumulative production (normalized to 3.2 km [2 miles] lateral length). The wells used for economic evaluation of the asset were within a 16-km (10-mile) radius.

Figure 1B shows the distribution plot for the number of wells in different performance tiers. The total number of wells in the bottom two tiers is 650. The total number of wells in the top two tiers is 128. However, it is important to identify key differences in completion parameters for different performance tiers.

FIGURE 1. The area of interest lies in the 1,981-m to 2,164-m (6,499-ft to 7,100-ft) true vertical depth range. The color of the dots in Figure 1A represents which peak production performance category the well fell in. Dots are shaped according to their operators and sized according to their initial performance tiers. The histogram plot in Figure 1B shows the number of wells that fall in each tier. (Source: Texas Standard Oil LLC)

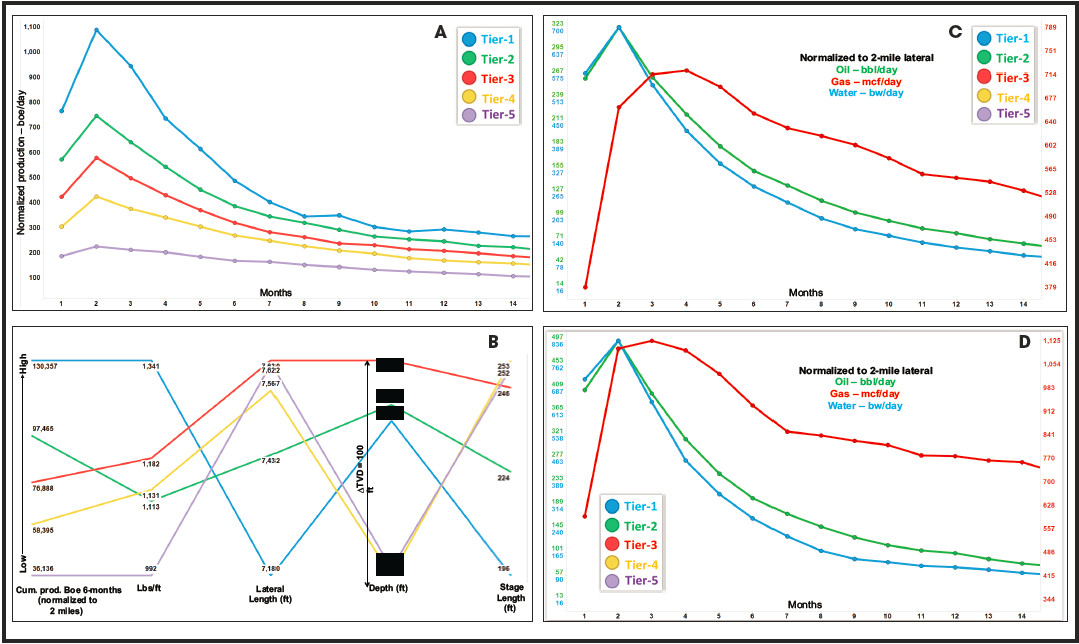

Figure 2A shows the production type curve for each tier. Tier 1 wells on average peaked at 1,100 boe/d, while Tier 5 wells peaked at 200 boe/d.

Figure 2B is a multivariate plot. The X axis has five parameters: production, proppant, perforated interval, depth (shaded for confidentiality) and stage length. The Y axis from low to high (bottom to top) is a normalized scale for each variable. The figure clearly shows that Tier 1 wells had more aggressive proppant loading (greater than 1,300 lb/ft) and shorter stage lengths (less than 61 m [200 ft]). In other words, the wells exhibited more stages per lateral, with six-month normalized cumulative production of greater than 130 Mboe. Tier 5 wells used less proppant (less than 1,000 lb/ft) and fewer stages per lateral (stage length more than 76 m [250 ft]) and had six-month cumulative production of less than 40 Mboe. Perforation intervals averaged about 2,256 m (7,400 ft) for all wells. The landing depths of wells were not drastically different for the different tiers.

Using this plot, the team inferred that for this asset it is best to select only those wells with greater than 1,100 lb/ft of proppant and stage lengths of less than 230 ft (70 m) for type curve determination. It is important to point out that this was only the first step of the evaluation process. There might have been other completion parameters, like type of fracturing fluid, perforation design and pumping rate, that bore relationship with well performance. Due to the lack of data on pumping rates and perforation design, it is not clear if they were significant in enhancing production. Most of the wells were fractured with slick water, though some of the older wells were fractured with more viscous fluids.

Figure 2C shows the type curve before Big Data analytics was used to evaluate the asset. Before analysis the type curve for a 3.2-km lateral had an EUR of 600 Mboe. The drilling and completion costs for a 3.2-km lateral were $5 million. This asset appeared to be sub-economic with this type curve. Big Data analytics allowed integrating completions, production and geological parameters on a multivariate plot. It was identified that proppant amount and number of stages correlated to better production. Therefore, only wells with optimum completion design were selected for asset evaluation because those parameters will be controllable by the operator on future well completions.

Figure 2D shows the type curve after data analytics. It was shown that with an optimized type curve the asset was economic, with wells yielding an internal rate of return of 30% even at the depressed price strip in February 2016. The wells in this area with optimized completions and current price strip yield much higher rate of returns.

FIGURE 2. A type curve for each tier is shown in Figure 2A. Figure 2B shows a multivariate plot indicating that Tier 1 and Tier 2 wells had more aggressive proppant loading (more than 1,300 lb/ft) and shorter stage lengths (less than 73 m [240 ft]), meaning more stages per lateral. Tier 1 wells had a six-month cumulative production of about 138 Mboe, while the bottom tier had a six month cumulative production of only about 31 Mboe. Tier 4 and Tier 5 wells used less proppant (less than 1,200 lb/ft) and had fewer stages per lateral. Type curves for the asset before and after the analysis are shown in Figure 2C and 2D. Big Data analytics helped filter out the wells with less proppant and fewer stages. (Source: Texas Standard Oil LLC)

Have a story idea for Shale Solutions? This feature highlights technologies and techniques that are helping shale players overcome their operating challenges. Submit your story ideas to Group Managing Editor Jo Ann Davy at jdavy@hartenergy.com.

Recommended Reading

Halliburton Secures Drilling Contract from Petrobras Offshore Brazil

2025-01-30 - Halliburton Co. said the contract expands its drilling services footprint in the presalt and post-salt areas for both development and exploration wells.

SLB Launches Electric Well Control Tech to Replace Hydraulics

2025-03-04 - SLB says the new systems reduce costs and provide real-time data for operators.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Inside Prairie’s 11-Well Program in the D-J

2025-04-08 - Prairie Operating Co.’s 11-well program in the Denver-Julesburg Basin is drilling horizontal 2-milers with a Precision Drilling rig.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.