A hurricane in the Gulf of Mexico. (Source: Shutterstock)

The Atlantic hurricane season was more active than usual in 2024, disrupting oil and gas infrastructure in the Gulf of Mexico and markets connected to the region, the U.S. Energy Information Administration (EIA) announced Dec. 17.

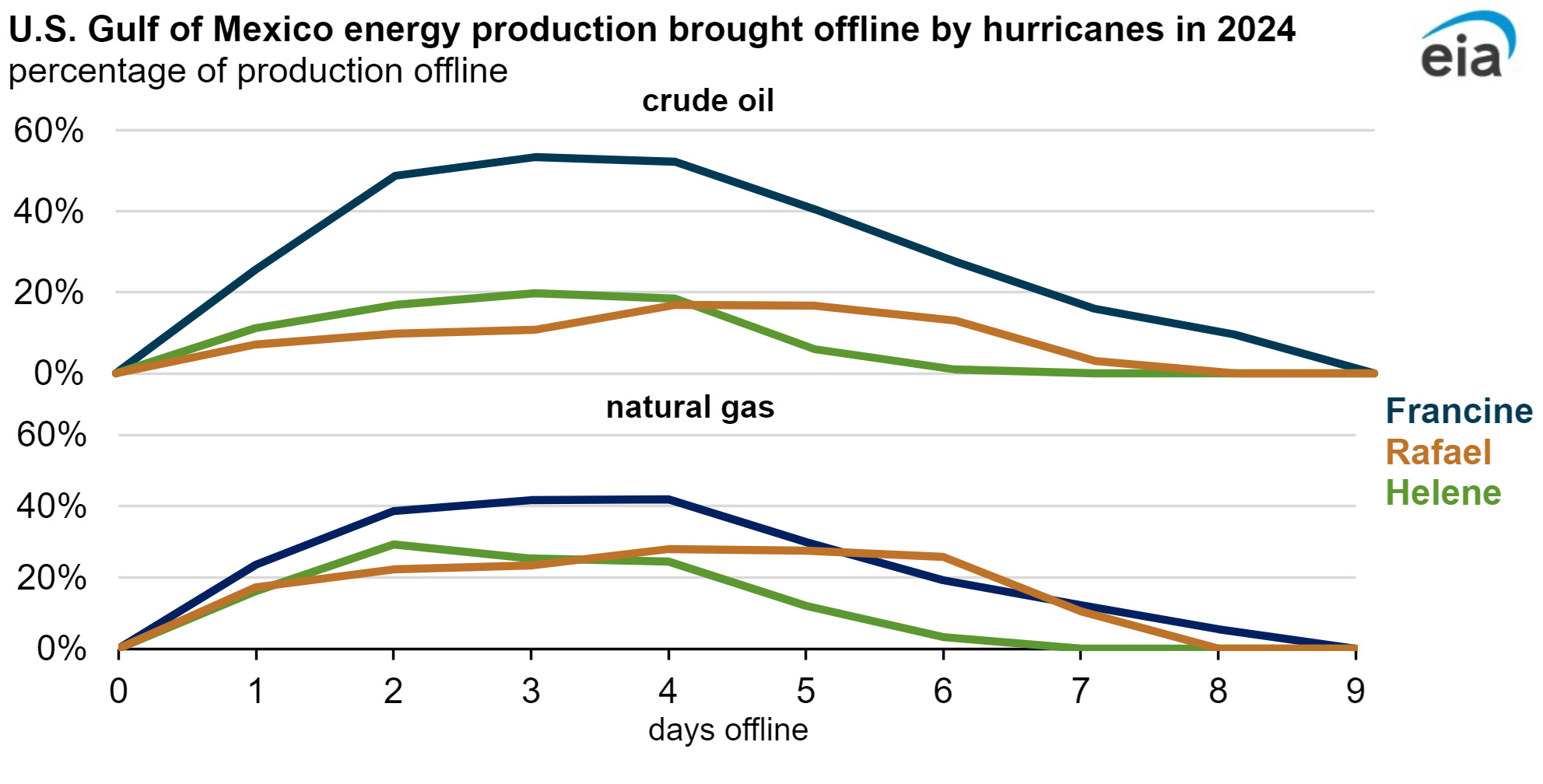

“Energy impacts from hurricanes this season were most notable in electricity markets, although Hurricanes Francine, Helene and Rafael forced some oil and natural gas production from fields in the Gulf of Mexico to be shut in,” the EIA wrote in a report on its website.

The Atlantic hurricane season runs from June 1 to Nov. 30. In 2024, the region saw 18 named storms, with five classified as major hurricanes with windspeeds greater than 110 mph. An average hurricane season has 14 named storms and three major hurricanes, according to the National Oceanic and Atmospheric Association.

While some storms caused severe damage within the continental U.S., most of the outages to the oil and gas infrastructure were short-lived, resulting primarily in platform evacuations and shut-in production from the Gulf.

The EIA estimated unplanned outages of crude production in the Gulf of Mexico averaged 295,000 bbl/d in September and 110,000 bbl/d in November, accounting for 16% and 5% respectively of total crude oil production from U.S. Gulf of Mexico waters in those months.

Natural gas production outages in the Gulf averaged 200 MMcf/d in September and 70 MMcf/d in November, accounting for 11% and 3% respectively of total natural gas production in the U.S.’ Gulf areas, the EIA found.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.