Advances in drilling and completion technologies mean fewer rigs are needed. (Source: Shutterstock)

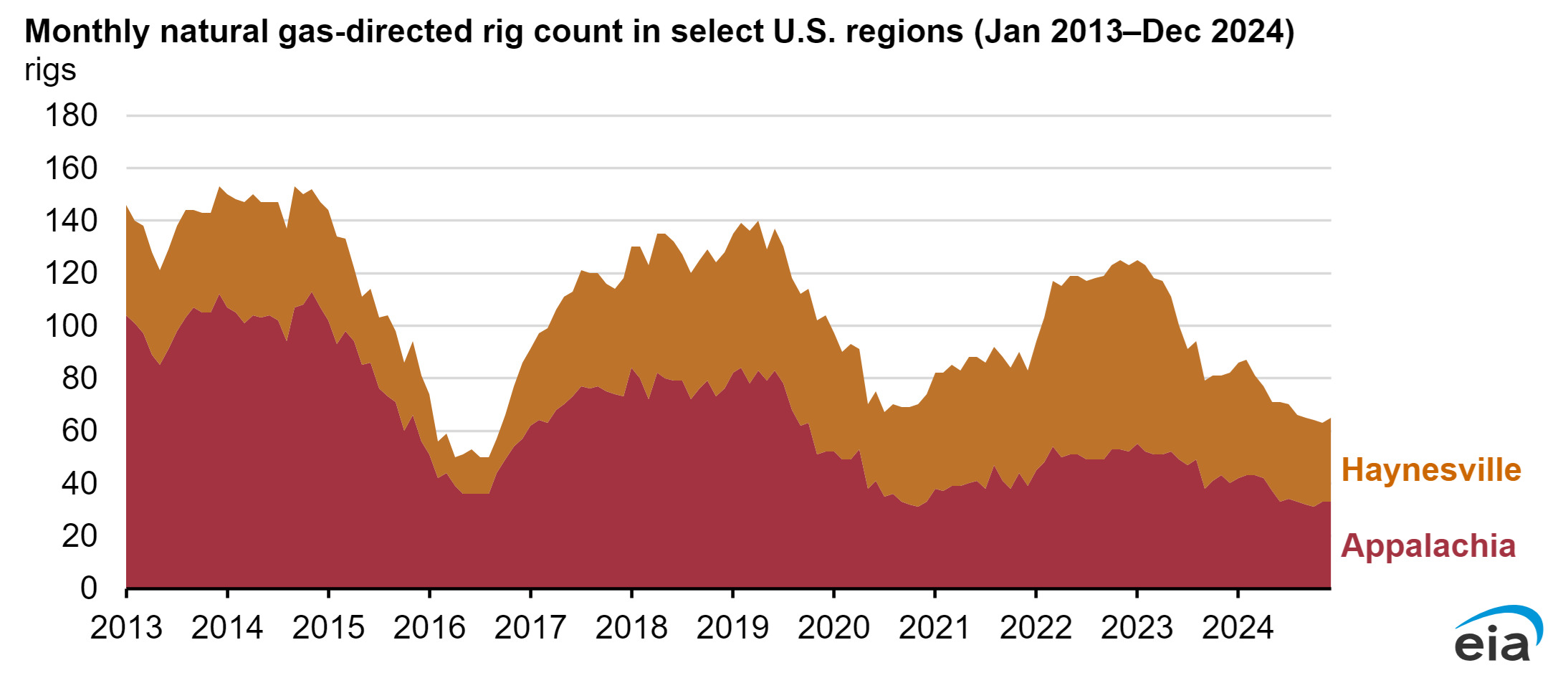

The U.S. Energy Information Administration reported the number of deployed natural gas rigs in the Lower 48 fell by 32% over 2023 to 2024, primarily in the gas-focused Appalachian and Haynesville shales.

The percentage accounted for about 50 rigs going offline after 2022. The numbers confirm the anecdotal evidence from many gas producers who reported cutting their exploration activities.

Oversupplied gas markets caused natural gas prices to hit record lows in 2024, and advances in drilling and completion technologies meant fewer rigs were needed for the same activity, the EIA reported.

In Appalachia, the rig numbers declined by 34% (43 rigs) in 2023 and 24% (21 rigs) in 2024. In the Haynesville, a basin particularly sensitive to prices, the number of rigs decreased by 55% over the two-year period, where gas production also fell by 7% in the same period, the EIA reported.

U.S. gas prices have rallied over the last five months, staying at or above $3.50/MMBtu at the Henry Hub for most of 2025.

Recommended Reading

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Phillips 66 Urges Shareholders to Vote Against Elliott at Annual Meeting

2025-04-08 - Phillips 66’s board of directors is again pushing against one of its largest investors—Elliott Investment Management—with a letter to shareholders detailing how to vote against the investment company at its upcoming annual meeting.

NRG’s President of Consumer Rasesh Patel to Retire

2025-04-07 - NRG Energy anticipates naming a successor during the second quarter. Patel will remain in an advisory role during the transition.

PE Firm Andros Capital Partners Closes $1 Billion Energy Fund

2025-04-07 - Andros Capital Partners maintains a flexible investment mandate, allowing the firm to invest opportunistically across the capital structure in both public and private equity or debt securities.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.