Equinor has implemented a widespread approach to digital adoption throughout its operations. (Source: Equinor)

Evolutionary changes are often imperceptible during the time in which they are occurring and only fully realized after the passage of time. Revolutionary changes, however, are more immediately recognizable and bring about change more rapidly. The era of digitalization in the oil and gas industry lies somewhere in between, with some companies fully embracing the latest technologies while others are either resistant or slow to adopt.

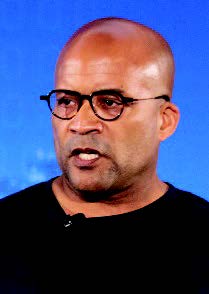

Those at the forefront of the industry’s digital age are pushing for its full-scale adoption, hailing the changes as revolutionary and disruptive. Executives from Google, Equinor and Accenture, among a host of others, lauded the benefits of digitalization at the Baker Hughes, a GE company (BHGE), Unify event in June in Houston. The Unify conference offered discussions and working models of digital transformation tools and trends as panelists and session speakers touted an industry future that is more efficient, safer and more environmentally friendly.

“The story of our industry is one of innovation and technology,” said Torbjørn Folgerø, head of Equinor’s Digital Centre of Excellence, at the Unify event. “We have used technology to extract resources from some of the harshest environments in the world. However, what is new in our industry is that we are experiencing the most fast-paced development in our history driven by significantly increasing connected devices and exponential growth in data algorithms.”

Value of adoption

Speaking at the event, Darryl Willis, vice president of oil, gas and energy at Google Cloud, estimated that the industry only uses about 5% of the data at its disposal. Kausar Qazilbash, managing director and global head of digital business for oil and gas, utilities, mining and chemicals industries at Accenture, also a speaker at Unify, added that although the oil and gas industry has the highest digital potential, it has the least digital maturity of other industries.

“The oil and gas industry is a data-rich industry,” Qazilbash said. “But the exploitation of those data is very poor. On the maturity index, it’s pretty clear that the oil and gas industry is one of the least mature when it comes to digital.”

Qazilbash said full-scale adoption of digital technologies, such as machine learning, data analytics and artificial intelligence (AI), could unlock about $1.6 trillion of value for the industry, its customers and society in general.

“There is a paradigm shift in the operating model in oil and gas, and that demands agility; it demands a lot more reliability in the operations and in the equipment and in the processes,” he said.

In a January 2017 report for the World Economic Forum, Accenture reported that the environmental benefits of adopting digitalization include reducing CO2-equivalent emissions by approximately 1.3 billion tonnes, saving about 800 MMgal of water and avoiding spills equivalent to about 230,000 bbl of oil.

The report stated the top areas of focus in the industry as it continues its digital transformation over the next three to five years will be Big Data analytics, the Internet of Things and mobile devices. The fastest areas of growth over the same period, the report stated, will be robotics/drones, AI, wearable technologies, collaboration and social tools.

Implementing change

Folgerø paraphrased The Economist when he said the world’s most valued resource is no longer oil but rather data. Equinor has been one of the companies at the forefront of widespread digitalization adoption.

Folgerø touched on the company’s recent opening of its Digital Centre of Excellence in Norway, which coordinates and manages the company’s digitalization efforts across the country. The facility collaborates with external specialist communities and features dedicated units for data analytics, machine learning and AI.

“Our ambition is first and foremost to use data and digital tools to significantly improve our performance and to reduce the carbon footprint of our operations,” Folgerø said.

Equinor’s goal through its digitalization journey is to increase revenue by $2 billion from its producing assets and reduce offshore drilling costs by 50%, he said.

One of the primary assets in which Equinor is leveraging its full-scale digitalization program is its Johan Sverdrop Field, which the company states will account for 20% to 25% of Equinor’s total offshore production in its plateau period. The project will make use of interdisciplinary teams exploring digitalization opportunities throughout the life of a project, one of which is the creation of a digital twin of the Johan Sverdrop project.

Folgerø said Equinor delineates its digitalization strategy into six programs: digital safety, security and sustainability; “field of the future” smart designs and concepts; data-driven operations; process digitalization and insight; subsurface analytics; and next-generation well delivery.

In an effort to broaden its digitalization capabilities and that of the industry as a whole, Equinor announced in June that it has partnered with Microsoft, a venture in which Equinor will provide industry knowledge and business needs to support Microsoft in developing new solutions. Microsoft will provide expertise to accelerate Equinor’s technology development and establish new data centers in Oslo and Stavanger.

Folgerø said a critical component of full-scale adoption of digitalization, whether at Equinor or elsewhere, was hiring a diverse workforce able and willing to fully implement digital innovations.

“If a company needs one thing in a digital transformation, it is a diverse workforce,” he said. “Companies need [to hire] a new type of skillset such as data scientists, but in practice you need all types of competences. You should not think of diversity in terms of gender or race, but also in regard to skills, background, introverts and extroverts, leaders and followers. That is the workforce of the future.”

Willis said he joined Google Cloud after running an oil and gas company in Angola “to help increase the velocity of change that is underway” in the energy industry

Willis said he joined Google Cloud after running an oil and gas company in Angola “to help increase the velocity of change that is underway” in the energy industry

with the goal “to build a permanent bridge between the digital world and the industrial world.”

He said widespread digital transformation in the industry could help play a role in bringing energy to the global population.

“We all have a role to play in creating heat, light and mobility for the world,” Willis said. “Energy does not end poverty, but you cannot end poverty without energy.”

He said Google Cloud has worked with companies such as Repsol, Total and BHGE on projects such as leveraging AI and machine learning.

Adoption recommendations

In its World Economic Forum report, Accenture offered several recommendations for the industry to keep up with digital transformation. Accenture recommended that companies make digital adoption a priority for senior executives and that they develop a digital strategy road map. Those leaders, Accenture suggested, should drive a culture of innovation and technology adoption. Companies also should invest in human capital by promoting new, digital thinking and invest in a collaborative ecosystem to use partnerships and platforms that work in the sharing economy.

“Every company, whether they realize it or not, is a data company,” Willis said. “Other industries—health care, retail, financial services, gaming—have all embraced this reality at a much faster rate than oil and gas. Companies will either be a catalyst or a casualty.”

Recommended Reading

Valeura Boosts Production, Finds New Targets in Gulf of Thailand

2025-03-03 - Valeura Energy Inc. has boosted production after drilling three development wells and two appraisal wells in the Gulf of Thailand.

Judgment Call: Ranking the Haynesville Shale’s Top E&P Producers

2025-03-03 - Companies such as Comstock Resources and Expand Energy topped rankings, based on the greatest productivity per lateral foot and other metrics— and depending on who did the scoring.

Baker Hughes, Frontier Form CCS, Powergen Partnership

2025-03-03 - Baker Hughes will provide technology solutions to support the Sweetwater Carbon Storage Hub being developed by Frontier Infrastructure in Wyoming.

US Drillers Add Oil, Gas Rigs for Fifth Week in a Row

2025-02-28 - The oil and gas rig count rose by one to 593 in the week to February 28, its highest since June.

BKV Positions Itself to Meet Growing Power, CCS Demand

2025-02-26 - Electricity needs across the U.S. are expected to soar as industrial and manufacturing facilities, data centers and other consumers crave more power. BKV is exploring ways to bridge the gap between demand and energy supply.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.