Oil and gas deals are poised to get considerably smaller in 2025, according to Enverus Intelligence Research. (Source: Shutterstock)

Following $300 billion of M&A in the past two years, deals are poised to get considerably smaller, according to a 2025 outlook released by Enverus Intelligence Research (EIR) on Jan. 21.

More than half of that figure—$188 billion—has been the rush by public companies to consolidate, with 11 public deals of more than $2 billion and fewer targets to pursue.

EIR expects average deal size to fall and breakeven economics of acquired inventory to rise in 2025.

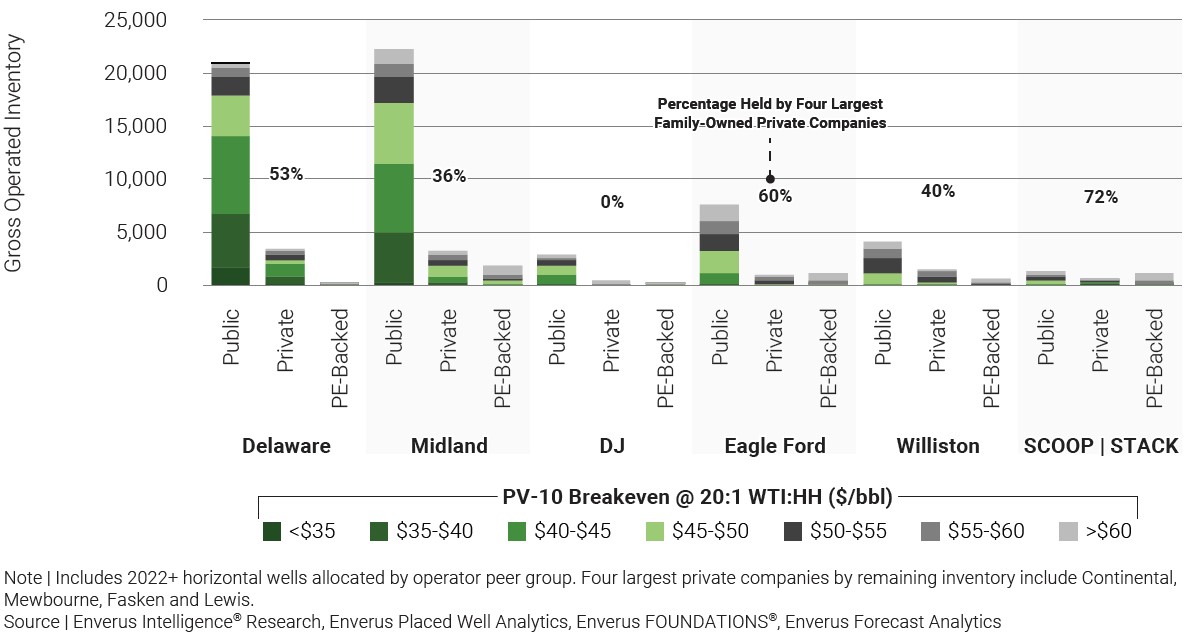

“The quality of acquired inventory has already declined, averaging a $50/bbl breakeven in 2024 versus $45/bbl in 2022-23,” EIR said. “The pool of available remaining private equity assets is largely smaller, higher on the cost curve or both.”

However, the report also forecasts Brent oil to average $80/bbl pricing, based on OPEC+ slowly unwinding production cuts and the assumption that Chinese liquids demand will be flat year-over-year.

Despite quality concerns, a need for scale and duration will motivate small- and mid-cap E&Ps to pursue these opportunities, EIR said.

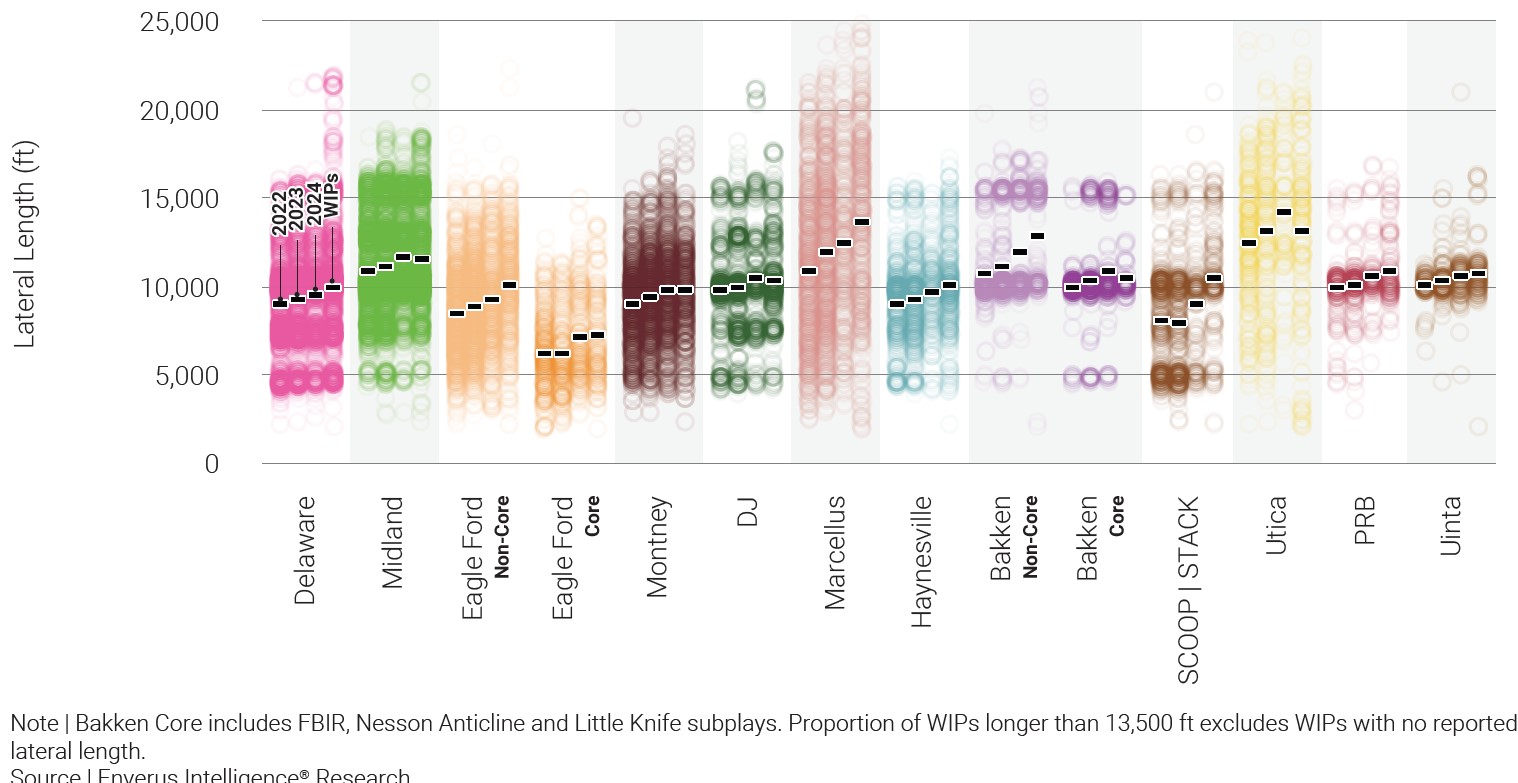

“Operational synergies like long laterals will be critical to improving economics on the available marginal acreage, with an estimated ~$5/bbl breakeven benefit to an incremental mile,” the report said.

The report also said that long laterals, which have helped drive down well costs, will continue to be a major catalyst for improving economics in 2024.

“We expect the trend will accelerate in 2025 with broader utilization of 3-mile laterals and a pivot to 4-mile wells by select operators,” the report said.

Public companies’ mergers are also expected to slow this year from the recent average of five per year, EIR said.

“While public companies hold nearly 90% of the remaining operated sub-$50/bbl breakeven inventory in oil-weighted major U.S. basins, ~85% of this inventory is held by operators with enterprise values exceeding $20 billion,” EIR said. “These companies are not near-term motivated sellers for either corporate or asset deals. SMID-cap corporate deals offer suppressed valuations relative to private opportunities, but the lack of a strategic fit and agreement on go-forward management teams present headwinds.”

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

TG Natural Resources Boasts 20 Years of Haynesville Inventory

2025-04-09 - TG Natural Resources President and CEO Craig Jarchow said the company’s valuable Haynesville inventory provides a line of sight for investors 20 years down the line.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.