EOG's headquarters in Houston, Texas. (Source: Shutterstock)

EOG Resources has dropped a new five-well pad in its Ohio Utica oil play, showing 700-ft spacing will make IPs as strong as 1,000-ft-spaced pads.

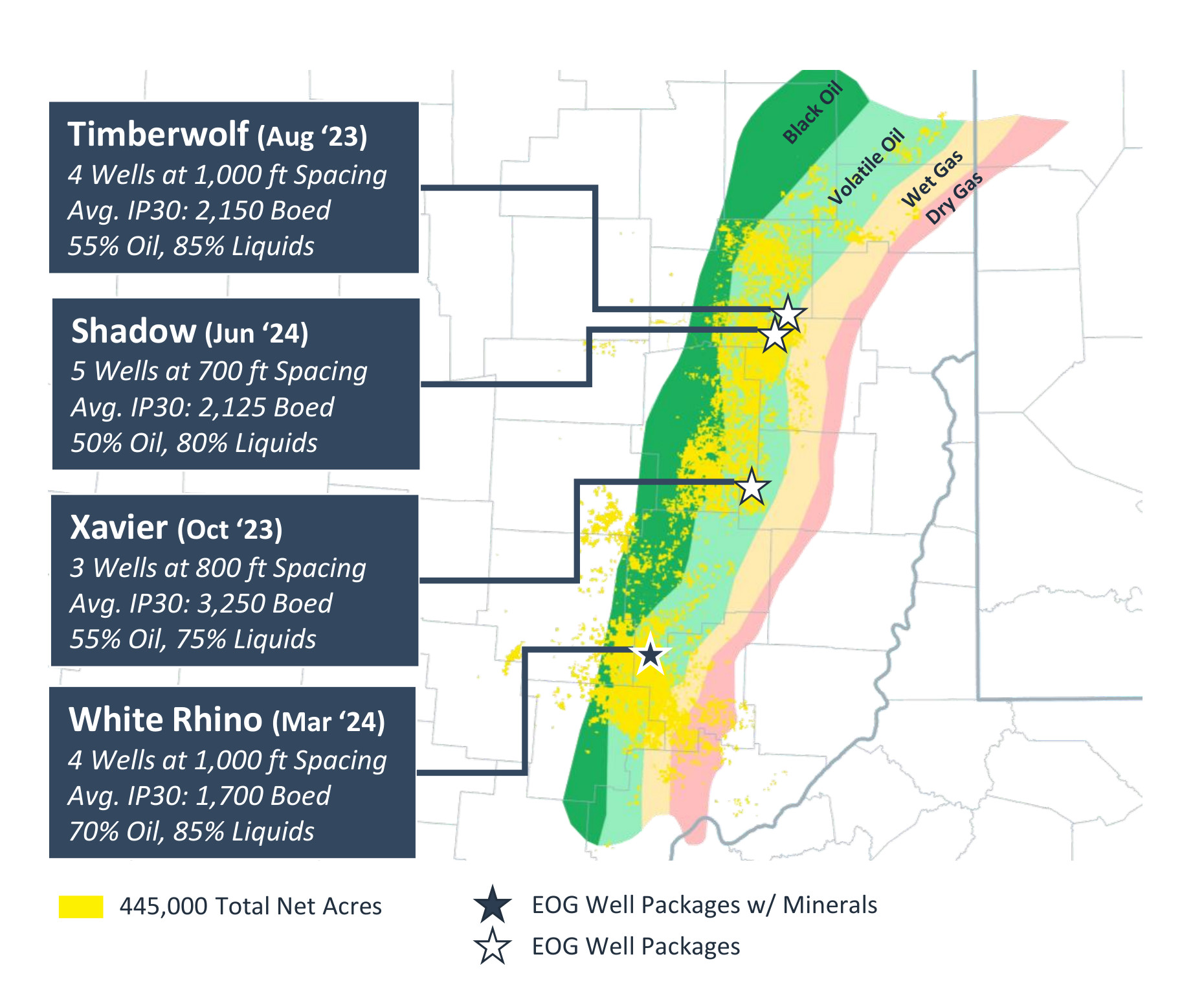

Its new pad, called Shadow, is in Carroll County at the northern end of its 140-mile-long north-south leasehold, which it grew by 10,000 net acres this spring to total 445,000 acres, the company told investors on Aug. 2.

Shadow’s 30-day IP averaged 2,125 boe/d per well, 50% oil and 80% liquids.

It is near EOG’s four-well Timberwolf pad, which was D&C’ed last summer at 1,000-ft spacing. It IP’ed a 30-day average of 2,150 boe/d per well, 55% oil and 85% liquids.

Through first-quarter-end, it made 780,068 bbl, averaging 886 bbl/d per well in the first 220 days, according to Ohio Department of Natural Resources (DNR) data. First-37-day production averaged 1,214 bbl/d per well.

Longer-term data

At how many months into Shadow’s production will the spacing test’s success be clear?

A securities analyst asked Keith Trasko, EOG senior vice president of E&P, in the company’s earnings call Aug. 2.

Trasko said, “We just want to see more production data [in the next], at least, six [to] nine months or so and compare that to the dataset that we have on some of our older packages.”

In addition to the Timberwolf pad, EOG made the three-well Xavier last fall in the middle of its north-south leasehold with 1,000-ft spacing and the four-well White Rhino this spring at the southern end with 800-ft spacing.

In Harrison County, Xavier’s three wells produced 667,366 bbl in its first 179 days online, averaging 1,243 bbl/d each, according to Ohio DNR data. First-88-day production was 1,536 bbl/d each. It had IP’ed a 30-day average of 3,250 boe/d per well, 55% oil and 75% liquids.

In Noble County, White Rhino made 30,800 bbl in its first eight days, averaging 963 bbl/d per well. It had a 30-day IP of 1,700 boe/d per well, 70% oil and 85% liquids.

The Xavier wells were placed at 800-ft spacing; Timberwolf and White Rhino, 1,000-ft. All of the wells' results are normalized to 3-mile laterals.

The Utica reservoir is thinner at the southern end, thus smaller IPs, EOG reported. But it has 100% mineral rights there, it noted, thus 100% net revenue interest.

‘Haters gonna hate’

Tim Rezvan, analyst with KeyBanc Capital Markets, wrote Aug. 1 after EOG released an earnings report, “Haters gonna hate, but [EOG’s] Utica results continue to look good.”

He explained, “Nothing fills our email inboxes with hate mail like positive comments we make on EOG's activity in the Utica Shale.”

The spacing-test results at the Shadow pad “suggest spacing tighter than 1,000 feet is feasible.”

Jeff Leitzell, COO, said in the Aug. 2 earnings call that the Utica oil findings “have delivered strong initial results and continue to demonstrate the premium quality of this play.”

EOG reported this spring that Utica results can compete with the best acres in the Permian Basin.

‘Glacial event’

Virtually all of EOG’s acreage in the Utica is HBP. So when will it ramp up the play from delineation mode to development mode?

Doug Leggate, analyst with Wolfe Research, asked this in the Aug. 2 call, adding that “delineation is kind of a glacial event for a lot of companies.”

“When would you anticipate a more meaningful development plan as you move forward? … [Are you just still] figuring this thing out?”

Ezra Jacob, EOG chairman and CEO, said, “Everything you're saying is correct. It's how we feel about it too. Geologically, we're doing a great job figuring it out.”

In the north, “I would say we're feeling very confident there,” while still “not a 100% satisfied with a spacing number” and whether it could go lower.

“But in any North American shale play, … it's going to be between 600-foot and 1,000-foot spacing probably on average, depending on the play.”

At the southern end where White Rhino is, “we’re a little bit further behind on delineation … even though that package did come online within our expectations,” Jacob said.

Otherwise, “it is too early to talk about 2025.”

Leggate replied, “To be honest, I think some of us were a little skeptical [about the Ohio oil play] to begin with, and you’re proving us wrong, so congratulations on that.”

Black oil fairway

EOG’s 445,000 net acres in the play include 220,000 acres in the Utica’s black oil window along the western side of the volatile-oil fairway. Leitzell said the operator’s focus will remain on the volatile-oil window for now “where we have a more comprehensive geologic dataset.”

EOG reported earlier this year that it is acquiring seismic and other data on the window before testing it.

It expects to complete 20 net wells in the volatile-oil play this year and has one rig drilling it full time, while it is using a frac spread half-time.

Recommended Reading

Entergy, KMI Agree to Supply Golden Pass LNG with NatGas

2025-02-12 - Gas utility company Entergy will tie into Kinder Morgan’s Trident pipeline project to supply LNG terminal Golden Pass LNG.

Howard Energy Clinches Deal for EPIC's Ethylene Pipeline

2025-01-09 - Howard Energy Partners’ purchase of EPIC Midstream Holdings ethylene pipeline comes days after EPIC agreed to sell midstream NGL assets to Phillips 66 for $2.2 billion.

ArcLight Completes $865MM Deal for Phillips 66’s Stake in NatGas Line

2025-02-03 - Kinder Morgan will continue to operate the Gulf Coast Express as a project to increase the line’s capacity moves ahead.

Kinder Morgan Acquires Bakken NatGas G&P in $640MM Deal

2025-01-13 - The $640 million deal increases Kinder Morgan subsidiary Hiland Partners Holdings’ market access to North Dakota supply.

Kinder Morgan Completes Bakken G&P Acquisition from Outrigger Energy II

2025-02-18 - Kinder Morgan closed on a $640 million deal for a Bakken natural gas gathering and processing network in the Williston Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.