From a discovery offshore Brazil to new contracts, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Petrobras Finds Oil in Potiguar Basin

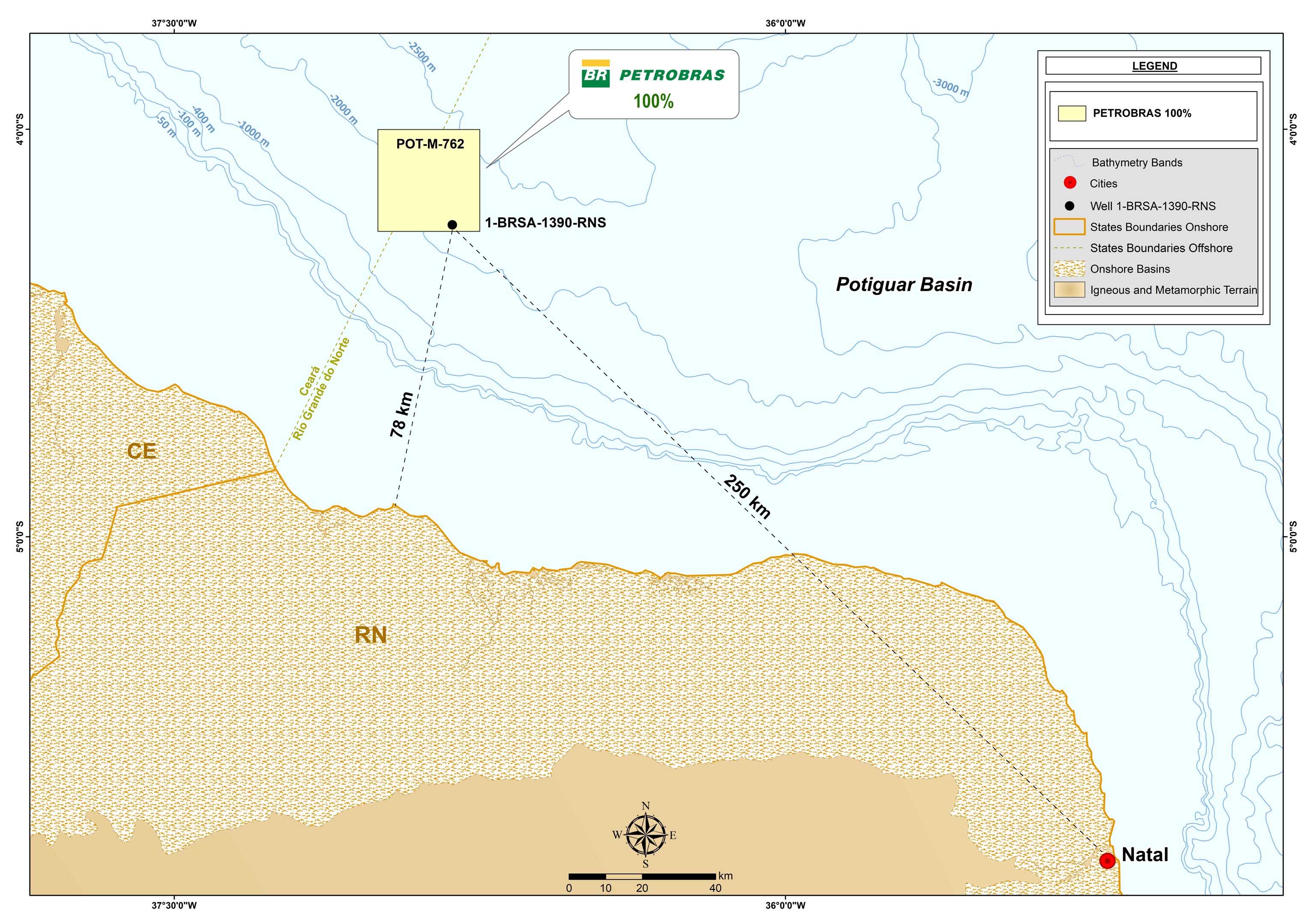

Petrobras found oil in the Anhangá exploratory well in the ultra-deepwater Potiguar Basin offshore Brazil, Petrobras announced April 9.

The find is the second discovery in the basin this year, following the Pitu Oeste well about 24 km away from Anhangá.

Petrobras, which operates the concessions holding both discoveries with 100% interest, said further assessment of the discoveries is necessary. Further exploratory activities are planned.

Anhangá, in Concession POT-M-762, is in 2,196 m water depth in the Brazilian Equatorial Margin.

Contracts and company news

Petrobras Taps SLB for Buzios Work

Petrobras awarded SLB three contracts for completion hardware and services for up to 35 subsea wells for the presalt Buzios Field offshore Brazil, SLB announced April 15.

The scope of the contract includes SLB’s full bore electric interval control valves and electric subsurface safety valves. The award is a catalyst toward full production system electrification for Petrobras, improving production availability via more reliable completions, SLB said.

By converting to electric completions, Petrobras will gain the ability to reliably control a more sophisticated system in the subsurface. Full electrification of completions enables maximum production control across multiple reservoir drains, potentially requiring fewer wells and limiting heavy workovers during the productive life of the Buzios wells.

“This contract award represents a critical milestone on Petrobras’ journey to digitally integrated offshore electric production systems,” said Steve Gassen, president of production systems at SLB, in a press release.

Much of the technology to be deployed in Buzios and available for other operators of Brazilian presalt fields was developed at SLB’s Taubaté Engineering Center in Brazil for Brazilian presalt, in collaboration with Centro de Pesquisas Leopoldo Américo Miguez de Mello (Cenpes), Petrobras’ research center, and TotalEnergies.

Saipem Signs on for Whiptail Work

Saipem announced April 13 it won a contract for the detailed engineering, procurement, construction and installation of the subsea production facility for the recently sanctioned Exxon Mobil-operated Whiptail development offshore Guyana.

Whiptail is targeting 850 MMbbl of estimated oil resource base, according to block partner Hess.

Saipem vessels FDS2, Castorone and Constellation will be used for the offshore installation.

This contract for work in the Stabroek Block is valued at between $750 million and $1.5 billion. Previously, Saipem carried out work on the Liza Phase 1, Liza Phase 2, Payara, Yellowtail and Uaru projects.

Energean Buys into Chariot’s Morocco Acreage

Energean announced April 10 that it completed the farm-in to Chariot Ltd.'s acreage offshore Morocco, following approvals from the Moroccan authorities, and a signed rig contract with Stena Drilling Ltd.

The Stena Forth drillship is under contract for an appraisal well in the Anchois Field in the Lixus licenses for the third quarter of 2024, with an option for an additional well.

Following closing, Energean operates the Lixus license with 45% interest on behalf of partners Chariot with 30% and ONHYM with 25%. Energean operates the Rissana license with 37.5% interest on behalf of Chariot with 37.5% and ONHYM with 25%.

Energean paid $10 million cash consideration upon farm-in closing.

KCA Snags Middle East, LatAm Drilling Contracts

KCA Deutag announced on April 10 it won $204 million of land drilling contracts in Oman, Saudi Arabia, Peru and Bolivia.

In Oman, the company secured contracts for five rigs with one customer worth a combined value of $181 million and amounting to 18 years of additional work. The company also secured three short-term extensions in Saudi Arabia with a total value of $16 million.

KCA Deutag secured a six-month extension of a rig in Bolivia worth around $6 million and finalized two short-term workover contracts in Peru.

Sercel Sells 528 System to TPIC

CGG announced April 10 the first major sale by Sercel of its next-generation 528 cable-based land acquisition system to the Turkish Petroleum International Corp.

The client will deploy the system, representing a total of 8,000 channels, on a 3D seismic survey in Turkey, across semi-arid terrain. Delivery started at the end of March, with the survey expected to start in the third quarter of 2024.

BP Extends Petrofac Services in North Sea

Petrofac said on April 15 that BP extended its North Sea maintenance and engineering services contract by three years.

Pipeline Testing Facilities Open

PipeSense opened the doors of new testing facilities in Houston and Clearbrook, Minnesota, the monitoring company announced April 9.

The facilities will provide PipeSense’s engineering team the ability to test pipeline monitoring and leak detection solutions in real-world conditions.

The Houston facility features a 4-inch continuous test loop with options for diverse demonstrations, including the ability for clients to choose and actuate leak points. The Clearbrook test facility features a custom-built, 24-inch pipeline test rig to assess and demonstrate PipeSense's real-time pig-tracking technologies.

Repsol Chooses Kent for North Sea Services

Kent won a three-year framework contract from Repsol Norge for a range of services in the Norwegian North Sea, Kent announced April 10.

The contract encompasses studies; specialist engineering support; engineering, procurement, construction and installation packages; and structural integrity and analysis services.

Recommended Reading

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.