From the largest natural gas discovery in Bolivia since 2005 to Energy Transfer and Sunoco teaming up in the Permian, below is a compilation of the latest headlines in the E&P space.

Activity headlines

LLOG Exploration Acquires 41 Deepwater Gulf of Mexico Blocks

Privately owned LLOG Exploration Co. acquired 41 blocks of acreage encompassing in the East Breaks and Alaminos Canyon areas of the deepwater Gulf of Mexico, the company said on July 17. Financial details of the deal weren't disclosed.

The blocks, which span approximately 236,000 acres, sits north of LLOG's Blacktip and Blacktip North deepwater discoveries in Alaminos Canyon blocks 335, 336, 337, 380, 381 and 424. With the acquisition, LLOG owns a 100% working interest in and is the operator of all 41 blocks.

In third-quarter 2023, LLOG drilled a successful sidetrack on the Blacktip discovery and is planning an appraisal well at Blacktip North in the third quarter of this year.

Bolivia Makes Largest NatGas Discovery Since 2005

The Bolivian government announced the discovery of a significant natural gas reserve, located north of the country's administrative capital, La Paz, according to Reuters.

“A 1.7 Tcf reserve is confirmed, being the most important discovery for Bolivia since 2005. It will likely make for the third-best producing field in the whole country,” Bolivian president Luis Arce said during a speech announcing the discovery.

The field, called Mayaya Centro-X1 IE, will be included in Bolivian state-owned oil and gas company YPFB's Upstream Reactivation Plan. The Mayaya Centro-X1 IE Field will increase Bolivia's current natural gas reserves, which were reported at 8.95 Tcf as of December 2018.

Contracts and company news

Saipem Awarded Two Contracts for Offshore Saudi Arabia

Saipem was awarded two offshore projects in Saudi Arabia, the company announced July 15. Saipem, which has a long-term agreement with Saudi Aramco, said the value of the two projects is approximately $500 million.

Saipem’s scope of work for the first project involves the engineering, procurement, construction and installation (EPCI) of a 31-mile crude trunkline for the Abu Safa Field. The second project involves the production maintenance programs of the Berri and Manifa fields.

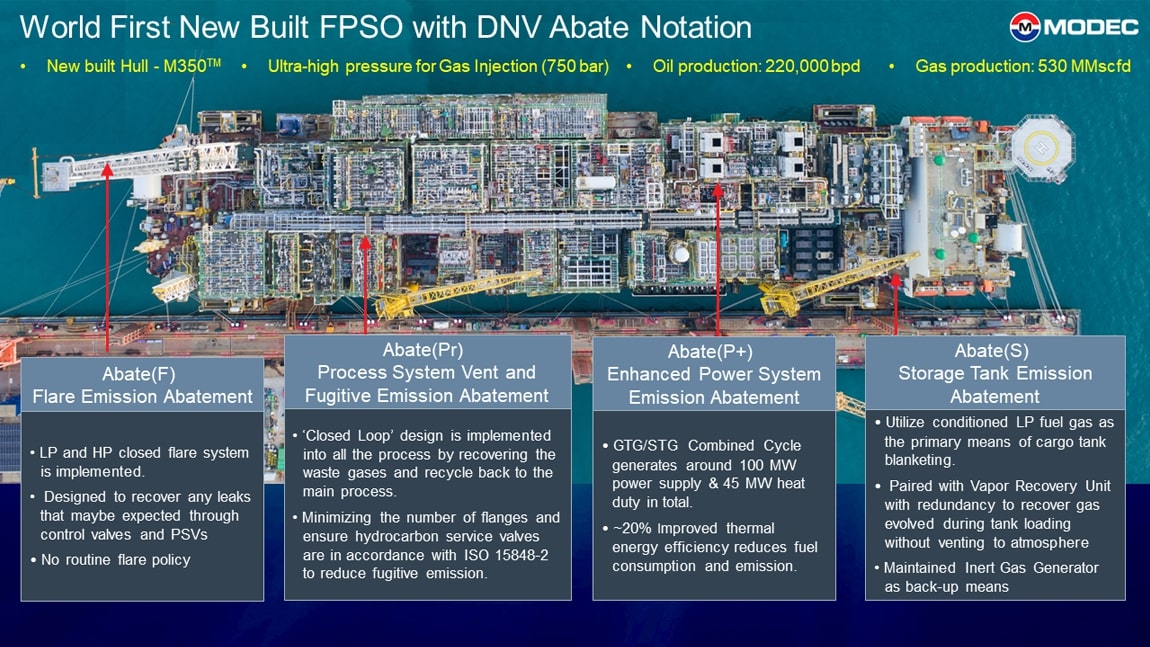

FPSO Bacalhau receives DNV Abate Notation

FPSO Bacalhau has received the approval in principle (AiP) for abate notation from classification society DNV, MODEC said on July 18. Bacalhau is reportedly the first newbuild FPSO in the world to achieve the recognition.

As part of the AiP, the FPSO conducted a comprehensive assessment of greenhouse-gas emissions abatement on Bacalhau according to DNV guidelines. The abate notation requires stringent management of emission systems and the implementation of substantial abatement measures to prevent non-emergency flaring and optimize the efficiency of power/heat generation.

MODEC credited Bacalhau operator Equinor with initiating many of the technical requirements that ultimately led to the vessel’s recognition by DNV.

Receiving AiP from DNV represents a significant step towards MODEC’s decarbonization targets.

Detechtion Acquires Software Solutions Company EZ Ops

Detechtion Technologies, a North America-based asset-performance management solution provider, has acquired EZ Ops, a field operations and logistics management software solutions company. Financial terms of the transaction weren’t disclosed.

The acquisition enhances Detechtion's presence in field service management and complements its Fieldlink product, which serves producers and service companies in inspection, maintenance and chemical management, the company said in a July 17 press release.

EZ Ops' field service management solution leverages AI-driven intelligence to prioritize field activities, maximize production and ensure compliance.

By combining Detechtion's oil and gas asset monitoring and optimization expertise with EZ Ops' technology, the acquisition creates a product suite designed to maximize production and extend asset life, while reducing operating costs and improving field safety,

Following the acquisition, Brandon Ambrose, CEO and founder of EZ Ops, will serve as strategic adviser for the combined company. Detechtion CEO Chris Smith will serve as the combined company’s CEO.

Halliburton's Unveils Sensori Fracturing Monitoring Service

Halliburton unveiled its new Sensori fracture monitoring service on July 16, which the service company billed as a cost-effective fracture monitoring solution for automated, continuous measurement and visualization of the subsurface.

The Sensori fracture monitoring service provides real-time data acquisition and processing of near-well and far-field subsurface measurements. Using automation, cloud processing and data analytics, the Sensori service provides continuous subsurface feedback for multiple well pads across an entire asset. With the integration of non-intrusive downhole diagnostics, the service allows more frequent, cost-effective acquisition of quality subsurface measurements, Halliburton said.

Shell Signs Multi-Year Deal for TGS Imaging AnyWare Software

Shell Information Technology International BV signed a global multi-year agreement to license TGS’ Imaging AnyWare software suite, TGS said in a July 17 press release.

Through the agreement, Shell will transition from its current in-house software to Imaging AnyWare, a fully integrated enterprise-class imaging system.

“Joint collaboration opportunities have already been identified between Shell and TGS to continuously improve Imaging AnyWare software performance while at the same time reducing project turnaround time and cost,” Liz Sturman, vice president of petroleum engineering at Shell, said in the press release.

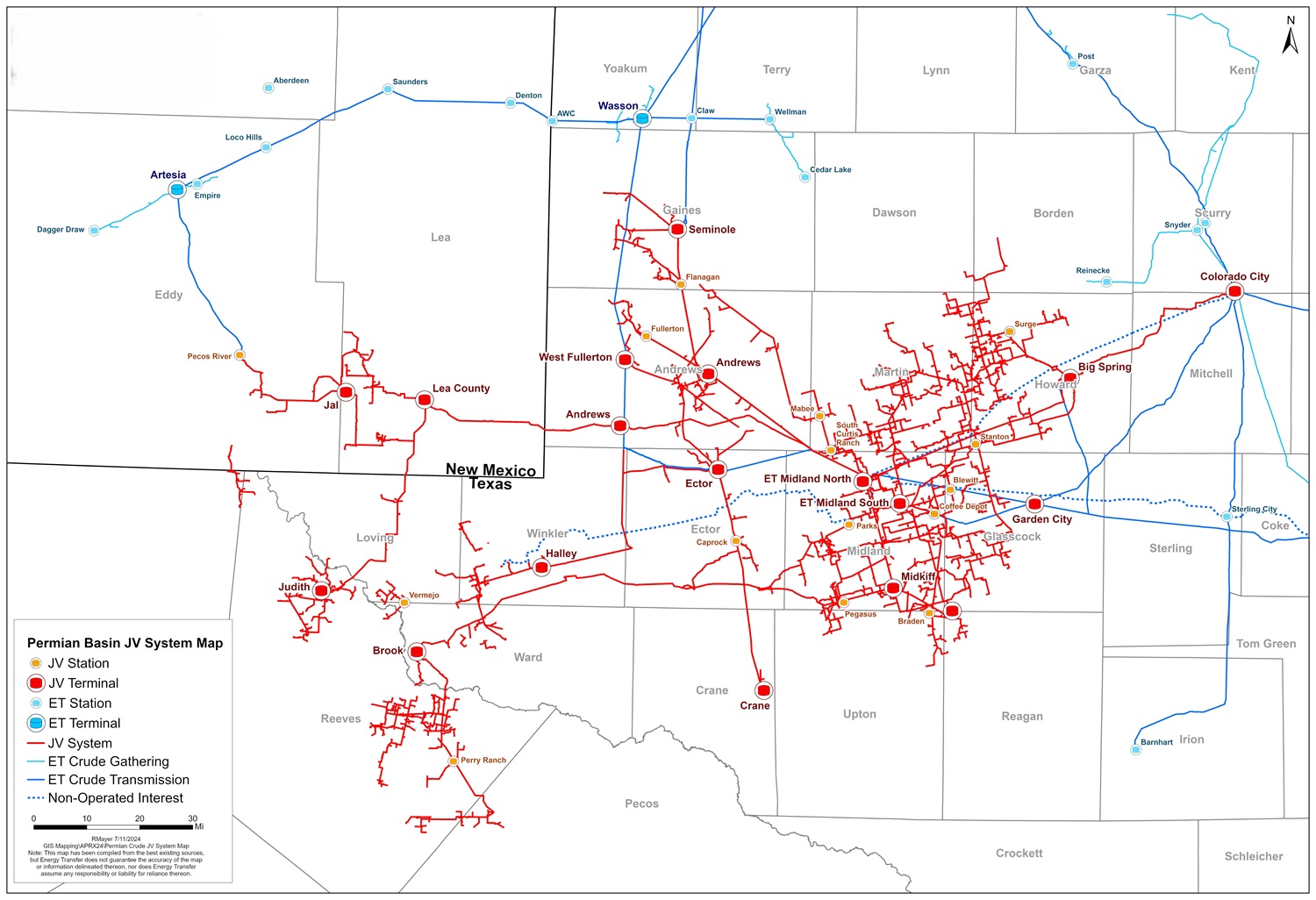

Energy Transfer, Sunoco Announce Team Up in Permian Basin JV

Energy Transfer and Sunoco LP have entered a joint venture (JV) agreement that combines some of their crude oil and produced water gathering assets in the Permian Basin, the companies said July 16.

The JV will operate more than 5,000 miles of crude oil and water gathering pipelines with crude oil storage capacity in excess of 11 MMbbl. The JV’s reach will extend from Colorado City, Texas, in Mitchell County, through the Midland Basin and into the heart of the Delaware Basin, Lea County, New Mexico.

Energy Transfer will serve as the operator of the JV and contribute its Permian crude oil and produced water gathering assets and operations to the partnership. Energy Transfer’s long-haul crude pipeline network provides transportation of crude oil out of the Permian Basin to Nederland, Houston and Cushing is excluded from the JV.

Sunoco, coming off its May deal to buy NuStar Energy for $7.3 billion, will contribute all of its Permian crude oil gathering assets and operations to the JV.

Energy Transfer will hold a 67.5% interest in the joint venture with Sunoco holding a 32.5% interest.

The formation of the partnership has an effective date of July 1 and is expected to be immediately accretive to distributable cash flow per LP unit for both Energy Transfer and Sunoco.

Intrepid Partners LLC served as financial adviser to Energy Transfer’s conflicts committee, and Potter Anderson & Corroon LLP acted as Delaware counsel.

Guggenheim Securities LLC served as financial adviser to Sunoco’s special committee. Richards, Layton & Finger, P.A. acted as Delaware counsel for Sunoco’s special committee.

Vinson & Elkins LLP and Akin Gump Strauss Hauer & Feld LLP also acted as legal counsel to the partnerships on the transaction.

Hart Energy Staff contributed to this report.

Recommended Reading

BP Cuts Renewable Investment, Boosts Oil and Gas in Strategy Shift

2025-02-26 - BP aims to grow oil and gas production to between 2.3 MMboe/d and 2.5 MMboe/d in 2030.

Shell Raises Shareholder Distributions and LNG Sales Target, Trims Spending

2025-03-25 - Shell trimmed its annual investment budget to a $20 billion to $22 billion range through 2028 after spending $21.1 billion last year.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Confirmed: Liberty Energy’s Chris Wright is 17th US Energy Secretary

2025-02-03 - Liberty Energy Founder Chris Wright, who was confirmed with bipartisan support on Feb. 3, aims to accelerate all forms of energy sources out of regulatory gridlock.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.