From new discoveries to company name changes, below is a compilation of the latest headlines in the E&P space.

Activity headlines

Talos Makes Discovery, Adds Prospect to Drilling Portfolio in GoM

Talos Energy Inc. made an oil and natural gas discovery at its Ewing Bank 953 (EW 953) well of up to 25 MMboe of resources in the U.S. Gulf of Mexico, the E&P announced Sept. 5.

Separately, the company also said it entered into an agreement to participate in the Sebastian prospect, currently drilling in the GoM’s Mississippi Canyon. Talos did not provide details on what entity it had made the agreement with. Murphy Oil Corp. is the operator.

At Ewing Bank, Talos said the well encountered about 127 ft of net pay in the targeted sand at approximately 19,000 ft of true vertical depth. Preliminary results from the single subsea well show an estimated gross recoverable resource of 15 MMboe to 25 MMboe with an initial gross production rate of 8,000 boe/d to 10,000 boe/d.

"The well logged better than expected rock properties, which we believe should lead to a robust initial flow rate,” Joe Mills, Talos’ interim president and CEO, said in a press release about the discovery. “This discovery follows a series of successful single-well subsea exploitation wells tied back to Talos-owned existing infrastructure, like Venice and Lime Rock, Sunspear and Claiborne sidetrack.”

Talos holds a 33.3% working interest in EW 953. Walter Oil & Gas Corp. is the operator and holds 56.7% working interest and Gordy Oil Co. holds 10% working interest.

First production is expected in mid-2026, with the well tied back to Talos’ partially owned South Timbalier 311 Megalodon host platform.

Talos also said on Sept. 5 that it is participating in the Sebastian prospect in the Mississippi Canyon Block 387 in the GoM, which began drilling in late August. The prospect is targeting the Upper Miocene K-1 reservoir at a true vertical depth of approximately 12,000 ft. Talos described the reservoir as “regionally prolific.”

“We were able to include the Sebastian prospect in our second-half 2024 drilling portfolio without requiring updates to our capital expenditures guidance for the year,” Mills said.

The prospect is targeting an estimated gross resource potential of 9 MMboe to 16 MMboe with an initial production rate of 6,000 boe/d to 10,000 boe/d. Results are expected late in the fourth quarter, and if successful, Sebastian will be tied back to Talos’ partially owned Delta facility.

“These drill-ready projects exemplify our focus on tactical, lower-risk opportunities that can be brought online relatively quickly and supplement our larger, longer lead drilling projects," Mills said.

CNOOC Ltd. Wushi 17-2 Oilfields Begin Production

CNOOC Ltd.’s Wushi 17-2 Oilfields Development Project has commenced production, the company said on Sept. 4.

The project, located in the Beibu Gulf offshore China, is in an average water depth of approximately 28 m. A total of 43 development wells are planned to be commissioned, including 28 production wells, 14 water-injection wells and one appraisal and water source well. The project is expected to achieve a peak production of approximately 9,900 boe/d in 2026.

Operator CNOOC holds 80% interest in the project.

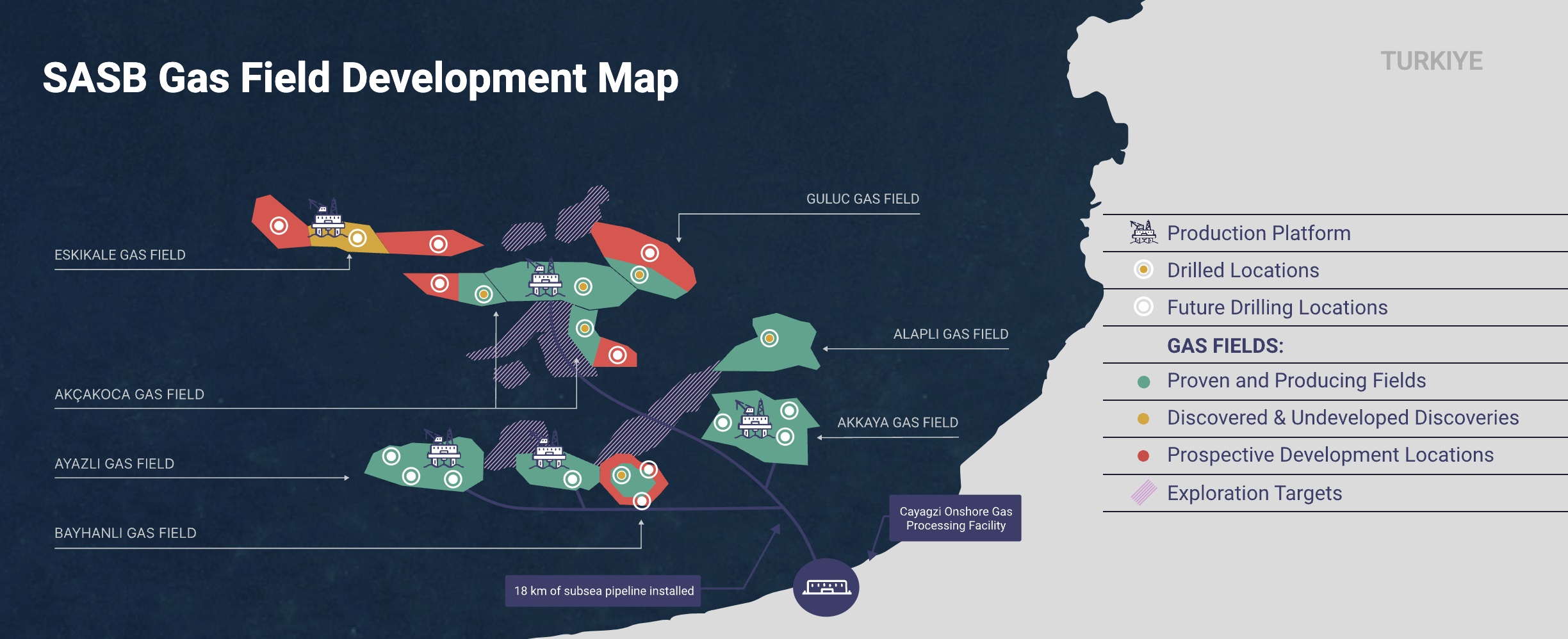

Trillion Energy Achieves Successful SASB Gas Production

Trillion Energy produced 140 MMcf in the SASB gas field in its first 35 days of production, with wells starting production in staggered phases from July 9 to July 28, the company said in an Aug. 14 press release.

SASB is a natural gas field in the southwestern Black Sea that supplies natural gas to Turkey. Trillion’s revitalization program has already realized a complete payback of recent perforation capex, the company said.

All remaining gas pay on the Akcakoca platform was perforated, including three long reach deviated gas wells—Guluc-2, South Akcakoca-2 and West Akcakoca-1 wells— and the recompleted legacy well Akcakoca-3, all drilled in the 2022 to 2023 program.

Guluc-2 averaged 2 MMcf/d before production stabilized at 1.25 MMcf/d. South Akcakoca-2 has been producing for 36 days at a stabilized rate of approximately 2.75 MMcf/d.

West Akcakoca-1 produced an average of 0.60 MMcf/d with some irregularities and has not stabilized yet. Akcakoca-3 was perforated but gas has not flowed yet. Wellhead pressure is steadily increasing from 100 psi to 478 psi, and Trillion said gas production is expected to start soon.

Gas production from the Akcakoca platform averaged 4.6 MMcf/d since the perforation program ended.

Production results have been positive, giving Trillion an indicator to decrease its production tubing size to stabilize gas production at its targeted rates.

“The wells on the Akcakoca Platform have been completed successfully with gas production and WHP continuing to increase,” CEO Arthur Halleran said. “This early return on our investment is a clear indicator of the field’s robust production potential.”

Trillion holds a 49% interest in the SASB Field.

Contracts and company news

Harbour Energy Closes $11.2B Wintershall Deal

Wintershall Dea has completed the transfer of its E&P business, excluding its Russia-related activities, to Harbour Energy.

The $11.2 billion deal includes the transfer of production and development assets and exploration rights in Norway, Argentina, Germany, Mexico, Algeria, Libya (excluding Wintershall AG), Egypt and Denmark (excluding Ravn) as well as Wintershall Dea’s carbon capture and storage licenses.

Harbour financed the acquisition through the issuance of $4.15 billion in equity, the transfer of about $4.9 billion of Wintershall Dea bonds and cash consideration of $2.15 billion.

Harbour expects production to increase to nearly 470,000 boe/d to 485,000 boe/d. The transaction will also grow its interests in the Zama shallow water development offshore Mexico to 32%.

Wintershall Dea's remaining assets include stakes in a JV in Russia, the 51% ownership interest in Wintershall AG in Libya, a 50% interest in Wintershall Noordzee BV in the Netherlands and a 15.5% share in Nord Stream AG.

With the completion of the transaction, Wintershall Dea’s main tasks will include the handling of claims related to the expropriation of the Russian assets, the sale of the remaining assets, the organizational restructuring, and ultimately, the closure of the headquarters’ units in Kassel and Hamburg. Wintershall Dea will also provide transitional services to Harbour Energy for up to 12 months.

Wintershall Dea AG will change its legal form from a stock corporation (Aktiengesellschaft) to a limited liability company (GmbH) in the coming weeks and will then operate as Wintershall Dea GmbH.

The transaction was announced in December 2023.

Archer Well Services and Raptor Enter License Agreement

Archer Well Services has entered into a global exclusive license agreement with Raptor Data Ltd. in an effort to enhance its well integrity and plugging and abandonment offerings.

Raptor is a U.K.-headquartered company dedicated to research, design, engineering and manufacture of downhole tools for plugging and abandonment. The partnership, announced on Sept. 2, integrates Raptor's wireless acoustic telemetry technologies into Archer’s well integrity portfolio, improving monitoring capabilities and expanding Archer’s solutions in the temporary and permanent plug and barriers validation and verification market.

Falcon Oil & Gas to Change Name

Falcon Oil & Gas Ltd. plans to change its corporate name to Beetaloo Resources Corp., the company said on Sept. 3. Falcon also plans to consolidate its share capital on the basis of up to 250 pre-consolidation common shares for each post-consolidation common share.

Falcon is consolidating shares in an effort to pursue a listing on a U.S. stock exchange in the first half of 2025 to expand awareness of the company among U.S.-based investors.

The name change is also expected to be completed at the same time in order to align the company’s name with its strategic focus on appraisal and development activities in Australia’s Beetaloo sub-basin.

The name change and consolidation are subject to obtaining shareholder approval at a special meeting of shareholders to be held on Oct. 29, 2024.

Recommended Reading

California Resources Continues to Curb Emissions, This Time Using CCS for Cement

2025-03-04 - California Resources’ carbon management business Carbon TerraVault plans to break ground on its first CCS project in second-quarter 2025.

BKV Reaches FID, Forms Midstream Partnership for Eagle Ford CCS Project

2025-02-13 - If all required permits are secured, BKV’s CCS project in the Eagle Ford Shale will begin full operations in first-quarter 2026, the Barnett natural gas producer says.

TotalEnergies, STMicroelectronics Ink 1.5 TWh Renewable Power Deal

2025-01-28 - As part of the 15-year contract, TotalEnergies will provide solar and wind power to New York-based STMicroelectronics.

Black & Veatch to Build Two Battery Storage Projects in UK

2025-02-11 - Serving as the projects’ owner’s engineer and technical advisor, Black & Veatch will review and provide technical advice, construction monitoring and schedule tracking services.

Ørsted, PGE Greenlight Baltica 2 Wind Project Offshore Poland

2025-01-29 - Ørsted said Baltica 2 is expected to be fully commissioned in 2027.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.