If you want a good idea of the current state of the oil industry, you need to look no farther than how operators are treating their portfolios of pre-final investment decision (FID) projects. More specifically, how commercial these future projects are going to be in terms of where they sit on the cost curve of future supply and whether they are still going ahead.

Tight oil’s position on the cost curve has been strengthened by low oil prices. In contrast, fewer conventional pre-FID projects are now commercially viable, with new deepwater projects in many parts of the world uneconomic at the current oil price. This changing dynamic has profound implications for the future cost of supply and more generally for E&P companies, with tight oil “haves” increasingly advantaged over the “have nots.” The latter need strategies that keep their portfolios competitive in the future.

Two years ago as oil prices peaked, conventional projects dominated new oil developments and new sources of future global supply. Wood Mackenzie’s analysis of the industry’s hopper of new supply sources at the time projected potential production of 14 MMbbl/d on a 10-year view. Most of this, 8 MMbbl/d, was from conventional projects, with the remaining 6 MMbbl/d, or 43%, from new U.S. tight oil wells.

Cue the price crash that shook things up. Wood Mackenzie’s latest view shows that pre-FID conventional projects have been hit hard by low oil prices. Total potential volumes from these projects have shrunk from 8 MMbbl/d to 5 MMbbl/d in Wood Mackenzie’s 2016 dataset.

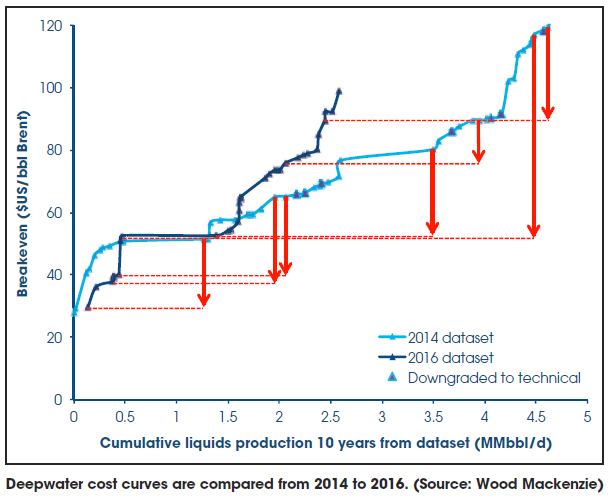

Many pre-FID deepwater and ultradeepwater projects have been hit hard by low oil prices. Their expected contribution to future supply has dropped from a peak of 4.5 MMbbl/d in 2014 to 2.5 MMbbl/d currently, and of that just 1.5 MMbbl/d is from projects that are commercial at $60/bbl oil. Among the worst-affected provinces are Angola (average breakeven Brent price $77/bbl) and Nigeria (ultradeepwater $65/bbl), where numerous projects have been deferred or cancelled.

These statistics mask what might be the start of an underlying positive trend for global supply. Total potential volumes in the hopper of new projects have fallen since 2014, but more are commercial at lower prices than a year ago. About 70% of new investment in U.S. tight oil and pre-FID projects is commercial under $60/bbl, up from 50% a year ago. These projects can deliver 9 MMbbl/d of production compared to 7.5 MMbbl/d a year ago.

Does this tell the whole story?

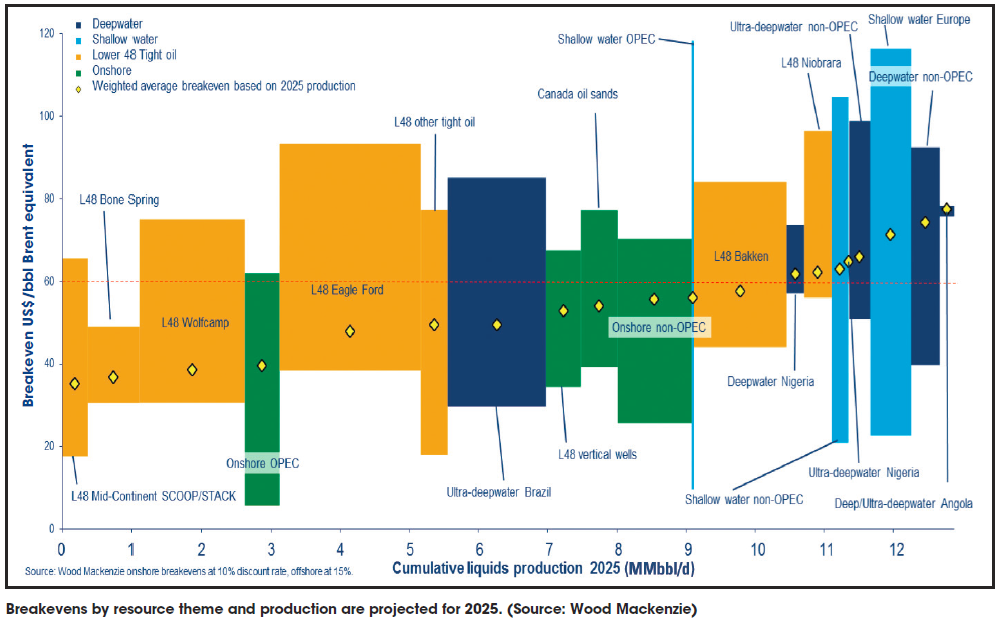

The increase in volumes is largely down to lower cost U.S. tight oil, which dominates new potential supply volumes, contributing 57% of the total. But the oil market still needs deepwater volumes. In fact, by 2025 expected onstream field declines and a projected growth in demand means that the world needs about 20 MMbbl/d of new supply. Tight oil on its own cannot provide all the volumes, no matter how cheap. So when it comes to the future cost of supply, it is worth looking at the right-hand side of the curve—the higher cost themes.

There’s still almost 4 MMbbl/d that requires more than $60/bbl to achieve commerciality. The majority of those volumes are expected to come from largely offshore conventional projects, which means that at some point prices are going to need to incentivize the development of such resources. In fact, 500,000 bbl/d of the pre-FID volumes only achieve a commercial rate of return with prices above $80/bbl. This has big implications in the future cost of supply. When it comes to looking at market fundamentals and the future oil price, it isn’t the cheapest barrel of oil but the more expensive barrels that people should be focusing on.

If operators do not believe oil will reach $80/bbl by 2025, it can be tough to justify developing an asset that can only bring commercial returns at that price. And over the last two years Wood Mackenzie has seen the fallout of operators beginning to realize the mantra of “lower for longer.” FIDs are being deferred at an alarming rate. Historically Wood Mackenzie has seen about 30 to 50 conventional FIDs being made in a year. In 2015 as operators continued to defer capital commitments in an attempt to remain cash flow-positive, Wood Mackenzie saw eight being made. And 2016 doesn’t look much better, with the number of FIDs being made struggling to reach double figures.

Is cost deflation just a buzz word?

How has the U.S. Lower 48 remained so commercially appealing? The key to tight oil’s success has been the great strides in productivity and cost deflation in the big growth plays.

Wood Mackenzie’s analysis shows that well costs have come down by about 30% to 40% in the last two years. Breakevens for the Midcontinent SCOOP/STACK ($35/ bbl), Bone Spring ($37/bbl), Wolfcamp ($39/bbl) and Eagle Ford ($48/bbl) are at the very low end of the global cost curve. Half the reduction is from service costs and half from efficiency/productivity improvements (in some cases spud-to-spud times have been halved). The cost reductions are more sustainable than originally thought due to these efficiency/productivity improvements.

Cost reduction outside U.S. tight oil has been nearer 10% to 15%. Wood Mackenzie expects more progress globally in cost-cutting in conventional projects in the next year or two. Without it, few projects will progress to FID. Wood Mackenzie thinks cuts of 30% to 40% are needed for some deepwater projects to be commercially viable at $60/bbl, though it’s doubtful cuts of that scale are achievable.

Of the conventional projects that have achieved FID recently, operators consistently reference significant cost savings on their project budgets driven by project optimization and supply chain savings. In other words, a significant proportion of cost savings are self-imposed—we have yet to see the required genuine cost deflation for some of these deepwater projects to achieve commerciality.

Who are the winners and losers?

The ascendancy of tight oil is great news for the incumbent operators in the key lower cost growth plays. Preeminent are U.S. independents such as EOG, Pioneer, Continental and Apache, and of the majors, Exxon Mobil and Chevron.

But what about the tight oil “have nots”? All E&P companies need to get lower on the cost curve to build a future portfolio resilient to the vagaries of oil prices. But accessing a position in tight oil material enough to make a difference would be a tortuous process organically and expensive via mergers and acquisitions (M&A). Certainly Tier 1 exposure through an asset or company acquisition would entail a big premium. Wood Mackenzie’s M&A Service observes that bid/ask spreads are wider in tight oil than other asset classes—a reason few deals have happened.

There are other routes. Shell’s acquisition of BG, with its prize presalt deepwater assets in Brazil, is a good example. Breakevens average $50/bbl—on par with the Eagle Ford. Others might recognize that buying into the lower end of the cost curve is a nonstarter and pursue a more gradualist approach.

The priority has to be the structural reduction of costs on pre-FID projects to ensure a conventional oriented portfolio is sustainable at moderate oil prices. Exploration could then also return to a central role again, with lower cost developments ensuring that full-cycle returns are commensurate with the risk.

Recommended Reading

California Resources Continues to Curb Emissions, This Time Using CCS for Cement

2025-03-04 - California Resources’ carbon management business Carbon TerraVault plans to break ground on its first CCS project in second-quarter 2025.

API’s Multi-Pronged Approach to Lower Carbon Operations

2025-01-28 - API has published nearly 100 standards addressing environmental performance and emissions reduction, which are constantly reviewed to support low carbon operations without compromising U.S. energy security.

BKV Reaches FID, Forms Midstream Partnership for Eagle Ford CCS Project

2025-02-13 - If all required permits are secured, BKV’s CCS project in the Eagle Ford Shale will begin full operations in first-quarter 2026, the Barnett natural gas producer says.

Energy Transition in Motion (Week of Jan. 31, 2025)

2025-01-31 - Here is a look at some of this week’s renewable energy news, including two more solar farms in Texas.

GA Drilling Moves Deep Geothermal Tech Closer to Commercialization

2025-02-19 - The U.S. Department of Energy estimates the next generation of geothermal projects could provide some 90 gigawatts in the U.S. by 2050.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.