Liberty Energy CEO Chris Wright said the company is investing in keeping its frac fleet steady as most competitors weather a downturn in oil and gas activity. (Source: Shutterstock)

DENVER—The oil and gas industry’s wild swings in commodity prices is not for the faint of heart, perhaps doubly so for oilfield service companies.

In the past 10 years, U.S. shale players and service companies have withstood the onslaught of OPEC’s 2014 price war and, six years later, the brutal effects of the COVID-19 pandemic.

Now, as E&Ps have sought and claimed the Golden Goose of increased efficiency, shale players are dropping rig counts, hunting for electricity and looking for a use for an irritatingly abundant supply of natural gas, particularly in the Permian Basin.

Chris Wright, CEO of Liberty Energy, is positioning his company to meet all of his customers’ needs—from using natural gas as a cleaner fuel source to keeping the electricity on—while continuing to expand his company’s market share.

Recounting recent ups and downs, Wright said 2022 ended up being a great year.

“Then the industry started to soften,” Wright said at the 2024 EnerCom Denver conference. “Not because activity decline just because it didn't grow anymore.”

The culprit? Efficiency.

“We're getting more done with every rig, more done with every frac fleet. That's progress. That's what we work for every day and we should cheer for,” he said, “but the frac fleet count from ‘22 to the first half of this year is down to about 15%.”

RELATED

Liberty Energy Warns of ‘Softer’ E&P Activity to Finish 2024

Nevertheless, Liberty, North America's fourth largest oilfield service company, has kept its frac fleet count flat.

“We just continue to grow market share in our business, not as a goal,” but because of the relationships and partnerships the company has built, he said.

Liberty’s crews have indeed been moving ahead despite growing weakness in North American E&P activity.

“We're good with that. And we have completed from ‘22 to annualizing the first half of this year, 27% more horizontal lateral feat in the first half of this year than we did in ‘22.”

Wright attributed that success to Liberty’s passion to “try to be differential.”

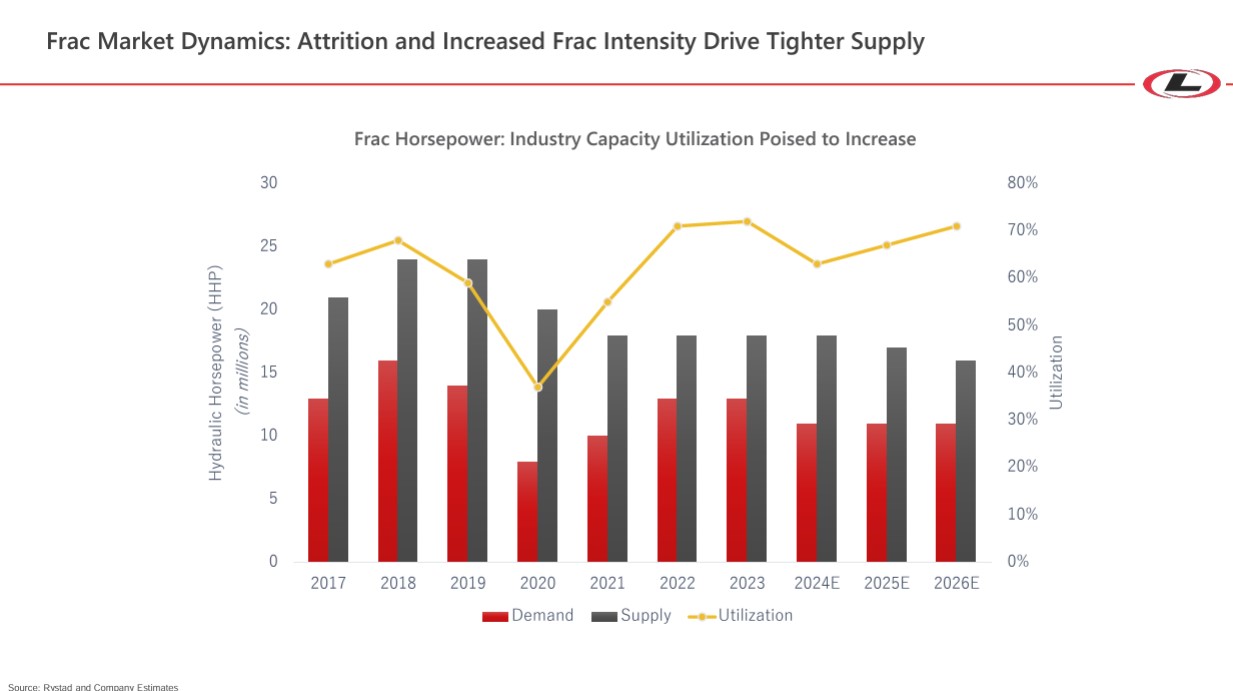

Wright said that the fracking market in 2020 and 2021 was strong because supply tightened before activity dropped off. As Wright noted, “The available frac capacity hasn't shrunk meaningfully this year.”

However, Wright noted that a Rystad Energy analysis expects frac horsepower to increase through 2025 and 2026.

And Liberty’s investments are geared toward maintaining its existing frac fleet.

“Only probably one of our other competitors is doing investing at that level. The others are investing but not at a level to even keep their fleet capacity flat,” he said. “So I think we're going to continue to see available frac horsepower in the next few years.”

But on whether Rystad's projection of a firmer market holds true, Wright was circumspect. “That's a crystal ball,” Wright said. “Who knows?”

Hitting the gas

Wright has nothing but good things to say about diesel engines. He sees them as one of the prime movers of progress through the last century and into the next.

Diesel engines offer high-energy density and they’re easy to work with in all environments around the world, he said.

But natural gas is cheaper than oil. And gas takes less processing to turn it into fuel.

“It burns cleaner too, meaning lower pollution emissions, and it has lower greenhouse gas emissions,” he said. “The problem is, it’s hard to move. You can’t load it in the back of the truck as easily.”

Despite a lack of enthusiasm early on, Liberty has been adding in dual-fuel frac units since building its second fleet.

“No one wanted to burn gas then and we twisted arms and did whatever we could to try to get people to adopt that,” he said.

Things change. By the end of 2024, Liberty expects 90% of its fleets to be primarily natural gas powered, with dual-fuel technologies expected to earn premium pricing.

The gas burning engines save customers money and make for longer engine lives for Liberty.

“Today everyone wants to burn natural gas,” Wright said. “We've also built a sister business to basically be the virtual pipeline for this natural gas." That includes tapping pipelines, gas processing plants or even onsite gas to "process it and deliver it to our frac equipment so we can run ... on natural gas.”

Power to the people

Wright also addressed the electrification trend that, after modest growth in the past 20 years, is now projected to accelerate in the coming years.

“Who knew, more energy?” Wright said to laughs.

“But again, we've made our grid more fragile even with a roughly flat demand,” he said, adding that power is becoming increasingly expensive.

Liberty’s answer is digiPower: mobile power generation.

Several solutions are available in the oil patch, including using a gas turbine or hiring another company to provide electricity.

“At Liberty, that's just not the way we roll,” Wright said.

Liberty developed a portable electric frac fleet as well as capacity to generate electricity.

“When you go down to smaller scale and intermittent loads, turbines are the wrong answer. Reciprocating engine is the right answer,” he said. “So Liberty has developed a gas reciprocating engine with very high thermal efficiency to generate electricity to power our electric frac fleet.”

Wright said Liberty can drive to a location, build a 25-megawatt power plant and have it operational in under 48 hours.

Wright sees other opportunities to serve an array of power needs, including microgrids, power plants, data centers, mining and emergency and disaster relief, among other uses.

“We operate it for a month up and down max power, op power, whatever. We run it for a month. We tear down that power plant, drive it over somewhere else and stand it up,” he said.

Wright said that as the grid becomes increasingly fragile and more people struggle to get firm power at escalating prices, “there's probably going to be an application for that ability to develop, to deliver high-thermal efficiency, natural gas generated electricity.”

“Anywhere you want.”

Recommended Reading

New Texas 30-MW Data Center Begins Construction

2024-11-11 - Dataprana’s 30-megawatt data center in La Marque, Texas will help satiate the growing demand for cloud services, Web3 applications and digital asset mining.

AIQ, Partners to Boost Drilling Performance with AI ROP Project

2024-12-06 - The AI Rate of Penetration Optimization project will use AI-enabled solutions to provide real-time recommendations for drilling parameters.

2024 E&P Meritorious Engineering Awards for Innovation

2024-11-12 - Hart Energy’s MEA program highlights new products and technologies demonstrating innovations in concept, design and application.

From Days to Minutes: AI’s Potential to Transform Energy Sector

2024-11-22 - Despite concerns many might have, AI looks to be the next great tool for the energy industry, experts say.

BYOP (Bring Your Own Power): The Great AI Race for Electrons

2025-01-06 - Data-center developers, scrambling to secure 24/7 power, are calling on U.S. producers to meet demand as natgas offers the quickest way to get more electrons into the taps.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.