[Editor's note: This article originally appeared in the February 2020 issue of E&P magazine. Subscribe to the magazine here.]

Manufacturers of LWD tools are expanding the limits of innovation in meeting demands from operators for more detailed formation data that will allow them to respond to changes in the drilling path and make corrections while drilling.

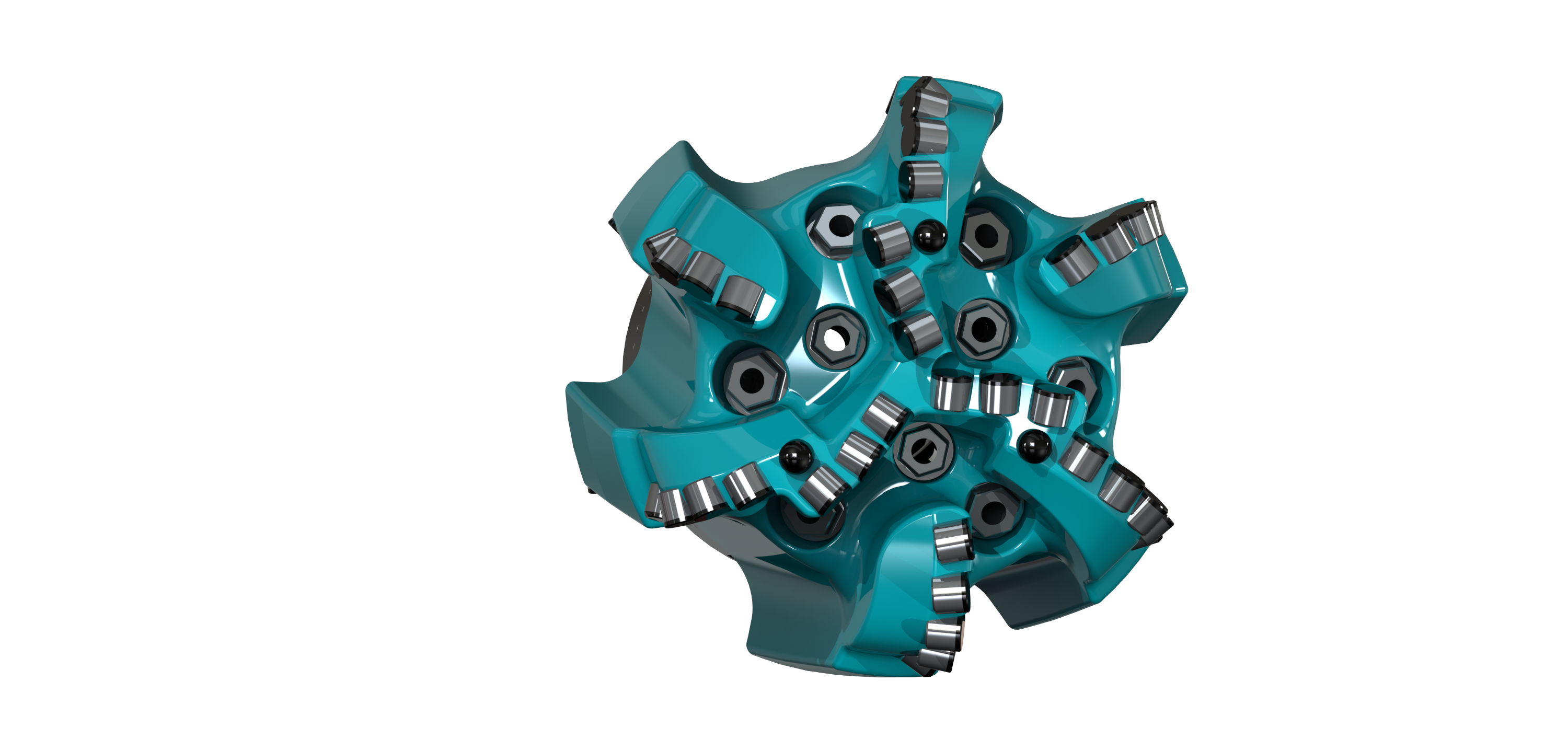

Other innovations include expandable liners that effectively extend already installed liners without the loss of a casing point. Drillbits also are being improved with hydraulic technology that increases durability and provides freedom in bit design.

Rotary steerable systems (RSS) also are being designed for smaller diameters to meet operator demand. The manufacturers are expanding the technology while at the same time lowering costs to benefit the operators.

“The Schlumberger IriSphere look-ahead-while-drilling service was developed as the answer to our customers’ need to reduce drilling risks and improve drilling efficiency through the detection of formation features ahead of the bit. Customers look for technology that enables them to look ahead of the bit so they can manage drilling risks proactively instead of reactively. Drillers can identify locations of hazards like the bottom of a salt layer or the top of a depleted or overpressured zone to avoid stuck pipe, mud losses and kicks by having look-ahead capability,” said Vera Krissetiawati Wibowo, resistivity product champion for Drilling and Measurements at Schlumberger.

Since early 2018, National Oilwell Varco (NOV) has significantly changed its point-the-bit RSS into its push-the-bit VectorEDGE RSS. “Looking into 2020, our engineers have started preliminary work on VectorEDGE 500, a smaller version of the current tool. The 500 will be useful for 57⁄8-inch to 63⁄8-inch holes,” said Kirby Wedewer, product line director for RSS for NOV.

Enventure Global Technology is developing its latest innovation in expandable liners—SameDrift technology, according to Eric Connor, chief R&D engineer for Enventure. “This is what we call monodiameter or monobore. When you need another casing point and don’t want to lose any diameter, the monodiameter means we can achieve the same drift as the casing string above in an openhole clad or tie back to previous casing string. The biggest benefit is being able to have an additional casing point without losing inside diameter [ID].”

Hydraulic improvements in Ulterra’s SplitBlade bit have delivered on the promise of improved cuttings evacuation with durability and cooling improvements for the cutter, according to Christopher Casad, innovation manager for Ulterra. “We saw the durability improvement because of the new degree of engineering freedom we now have with SplitBlade bit designs. We can put cutters in new places and orientations that we couldn’t before because of actual physical limitation,” he said.

Imagine being able to “see” up to 225 ft from the bottomhole assembly (BHA) in any direction while drilling. That is what Halliburton Sperry Drilling’s EarthStar LWD ultradeep resistivity service provides. “You can produce multiple results at the same time from the tool to both steer the well and map the other zones around the wellbore simultaneously,” said Nigel Clegg, Halliburton product champion. “We’re able to identify hazards and changes in geology as quickly as possible.”

From its HALO RSS to its Unconventional Logging Tool (ULT) to its BitSub, Scientific Drilling International (SDI) is doing its best to provide disruptive technology to the downhole drilling industry, said Doug McGregor, senior vice president for the drilling and measurements product lines at SDI. “The latest technology that is really going to make some noise in the market is the ULT. We’ve been working on this for about two and a half years. We’re going to field-test mode with our first copy in [September 2019].” As with all these technologies, SDI is pushing the boundaries to provide operators the data and tools needed to drill and produce, especially shale wells.

Look-ahead detection of hazards

The technology behind the IriSphere look-ahead-while-drilling service is based on electromagnetic (EM) directional resistivity. The look-ahead detection depends on the conductivity contrast on where the BHA is and the formation ahead of it and other parameters. Other drilling targets can be identified as long as there is conductivity contrast, Schlumberger’s Wibowo said.

The IriSphere service utilizes different measurements from the deep EM resistivity. “We have symmetrized directional measurements with full directionality for boundary, antisymmetrized direction measurements with high sensitivity toward formation dip and deep resistivity measurements that are sensitive to resistivity,” she continued.

The IriSphere service uses EM propagation-based deep directional resistivity measurements that detect formation boundaries ahead of the bit. The system uses a deep directional transmitter combined with either two or three receivers and is applicable for hole sizes from 55⁄8 in. to 16 in. Prejob modeling is crucial to understanding reservoir issues and sensitivities to determine how far the customer can look ahead of the bit.

“It is key to properly space the transmitter and receivers when planning the BHA to obtain the desired sensitivity. The further we space the transmitter and receivers, the further the signal propagates,” Wibowo said. “[Prejob modeling] will determine which specific frequencies on the measurements will be transmitted in real time, and as such, specific configuration files will be created for a specific job environment. In the optimal environments where the highest speed of mud pulse telemetry transmission is allowed and with the inversion running in seconds, the tracking system will be able to show boundaries detection without delay.”

The data transmission is done through standard mud pulse telemetry or through wired drillpipe. “When using mud pulse telemetry, the data transmission will depend on the telemetry rate (bit per seconds) and the complexity of the BHA,” Wibowo said.

The service “enables detection of formation boundaries and resistivity profile ahead of the bit. By understanding what is in front of the bit without having to penetrate it, the IriSphere service can assist the geostopping decision to make sure that we stop in the right place, before penetrating the undesired zone or stopping in the right reservoir target that eventually will lead into optimal production,” she continued.

In one success story, the service detected drilling hazards in front of the bit. “We have one operator offshore China where we integrated the IriSphere service with a standard pore pressure prediction workflow, enabling the customer to avoid a high-pressure formation zone. The result was that this not only improved the rate of penetration but overall drilling efficiency of the well,” Wibowo said.

Variable steering aggressivity, inclination hold and higher rpm for RSS

According to NOV’s Wedewer, the VectorEDGE is specifically designed for cost-effective, performance drilling largely focused on horizontal sections in unconventional plays in North America.

“Eighteen months ago we started changing the RSS to a push-the-bit system. The main components for toolface control remain the same; however, the VectorEDGE is a very different tool,” he said. The improvements include variable steering aggressivity. “We can vary the steering from 0% to 100%. That was something that we weren’t able to do in such fine increments,” he continued.

Another improvement was to increase the dogleg capability, which is now at 5 degrees per 100 ft, which meets the needs of the unconventional lateral market.

As operators continue to push for higher and higher ROP, rpm has become a main lever. “We recognized the need to enable our customers to continue to push their performance. We are now stating in our spec sheet that VectorEDGE is good past 250 rpm. We are probably going to take that a little farther to 300 rpm,” he said.

One of the issues that stopped the company from increasing the rpm was face stick/slip. “The toolface control loses its efficiency dramatically with stick/slip. Obviously, at higher rpm, the challenge becomes even bigger. We managed to mitigate those issues with stick/slip in the higher rpms. That’s especially important in the Northeast where there are expectations for higher string rpm, whether it comes from a drilling motor or the top drive,” Wedewer continued.

NOV also designed an automatic inclination hold mode, which prior to 2019 didn’t exist. “That is a closed-loop function. Let’s say you’re drilling a horizontal well at 89.5 degrees. You program 89.5 degrees into the laptop and send a downlink. The tool recognizes and confirms the downlink, and it then automatically holds 89.5 degrees with no intervention from the surface. It is constantly reading the inclination at the bit and making corrections as required. No human intervention from the surface is required,” he explained.

Another improvement in 2019 was real-time feedback. Prior to 2019 the company did not have the capability to verify downlinks, which affects the majority of RSS tools on the market. “Now the moment the tool receives a downlink from the surface, it will uplink confirmation that the message was received loud and clear. Other data uplinked include diagnostics so you know how everything is functioning,” Wedewer said.

In 2019 NOV worked on shorter downlinks for the tool at its test rig in Navasota, Texas, in an effort to eliminate any unnecessary downtime from the drilling operation. “Right now it takes 7 minutes to downlink, and we aim to get that down under 5 minutes. Those tests are going well,” he said. “We are also working on an automatic azimuth hold in addition to the inclination hold.”

In 2020 NOV’s engineers started preliminary work on VectorEDGE 500 for smaller hole sizes. “Currently The EDGE 650 has one of the largest hole-size ranges on the market for a 6½-inch tool. We are one of the only suppliers that can drill 77⁄8-inch holes with an RSS. We are looking to promote this tool capability,” Wedewer said.

“Some operators drill slimhole laterals and would benefit from access to low-cost RSS technology in the 57⁄8-inch to 63⁄8-inch hole sizes, so we have commenced the development of the VectorEDGE 500, which will be the next step-down in size,” he said.

Isolate trouble zones without losing ID

By taking its expandable liner technology to the next level, Enventure Global Technology is using its SameDrift technology to allow an operator to isolate a low- or high-pressure zone and maintain the same bore diameter after the zone is isolated, Connor said.

“We are finding this is hitting a sweet spot. There has been demand in the industry for this technology—the value of adding a casing point without changing the ID is a no-brainer and opens up more opportunities in well construction and production,” he said.

The company is doing 6½-in. drift and 12¼-in. drift development and a little farther than that would be 8½-in. drift. “There are applications in those sizes and others, and we’re seeing a lot of customer interest to isolate trouble zones and enable enhanced oil recovery in long step-out target reservoirs,” Connor continued.

The maximum run length is targeted for the 3,000-ft to 5,000-ft range. “Most of the applications will be closer to 1,000-foot segments,” he added. It can be used for horizontal wells and is good for any inclination.

“We have expandable tubulars we install that reduce the diameter slightly from the prior base casing. That has been our standard technology for years. What this does differently is that it expands beyond the drift of what the tubulars were passed through, allowing the operator to continue to use the same BHA in that section. You don’t have to step down to another size,” Connor explained.

The liners are run with the expansion tool or cone, which acts as the running tool to get the liner in the hole and then acts as the expansion tool to make the liner bigger. “You pull all that expansion equipment out, and you leave the expanded liner behind,” he said.

The main difference between its standard technology and the SameDrift is what the company calls its expansion ratio, which is the amount of expansion relative to its ID. “That expansion ratio needs to be big enough that you go from passing through a certain drift to expanding it to that same drift,” he said.

Connor emphasized that the biggest benefit is being able to have an additional casing point and end up with the same size liner. “Every time you set a casing string or liner you reduce the diameter. If you have too many of those casing points, you either have to start the well really big or you have to live with really small completions for your production,” he said. “When you can add a liner without losing any diameter, that’s a huge benefit in terms of cost of drilling the well and also dealing with uncertainty in the drilling. A lot of times when you encounter trouble that you didn’t expect or it is at a different location than you expected, you end up burning a casing point.”

The SameDrift technology also can be used to install openhole clads, where the tubular expands against the wellbore but doesn’t tie back to the previous base casing. In fact, multiple clads can be installed in the same hole section, due to the ability of the unexpanded clad to pass through previously expanded SameDrift clads.

Another benefit of SameDrift is improved cementing. “When you use standard drilling liners or choose not to isolate a loss zone at all, and eventually you install surface casing that has to be pressure containing and last a long time, the cementing of that subsequent casing is compromised. The cement job is not very good because you have either a very restricted annulus or you are trying to cement when you’re suffering losses,” Connor said. “When you don’t get the good cement job you wanted, that can affect the performance of the well, and it can hinder production years down the road.”

By using SameDrift “when you cement the subsequent casing, you’re going to have much lower equivalent circulation density. You have a much better passageway, and the cement goes where you want it and is not lost to the formation,” he said.

New bit hydraulics provide flexibility

In developing its new SplitBlade bit, Ulterra started by looking at bit damage. There is various bit damage you can get whether to the cutters, blades or hydraulic system. In looking at which one is the most problematic, the company reduced it to the cutters heating up, which leads to a lot of cutter damage, Ulterra’s Casad said.

“We focused on how we could improve cutter cooling on the bit. Focusing on the hydraulics and in turn the cuttings evacuation, and introducing the SplitBlade technology, allowed us to meet our goals and improve cuttings evacuation by creating a dual-channel effect. It is a double-barrel solution for hydraulics where basically on one blade of the bit you are able to get two different channels of evacuation in the center of the bit and from the shoulder of the bit to the outside,” he continued. “By creating that double channel effect, we found evacuation overall to be improved for the entire bit and left the cone sharper and in better condition to give you higher rate of penetration and better steerability. It also left the shoulder in better condition to do all the heavy lifting.”

Ulterra is past the first full year of having the product in the field and has already drilled more than 25 MMft with the SplitBlade. “There are over 200 different designs in our system right now. Operators are using it in all different applications, including vertical, intermediate, curves, laterals, combined curves and laterals, and even full monobore vertical, curve and lateral wells in basins across the world,” Casad said.

The company noticed some additional benefits from the technology. “There was a technique we had in creating that double-barrel effect on the primary blade by taking the middle of the bit and rotating the blade forward. That gave us better mechanical advantage in how the bit transmits torque into the formation. You have a much smoother transition of the torque, which means you can have more reliability, it is more predictable and it will react better to your input,” he said.

In PDC bit design, the cutters sit side by side but can only get so close because, like an iceberg, the cutters are a little bigger under the surface due to how the cutter substrates are mechanically locked into the bit.

“That limits the placement of the actual cutting diamond. It is because of what we’re doing with the blade geometry that has allowed us to do something I call cutter overlap. We’re able to take two adjacent cutters that would normally be at their spacing limit and overlap them to the point where they can even maintain the same physical area during drilling,” he explained.

That design provides durability on the nose of the bit. “If you’re drilling through interbedded formations or transitional formations where you are going back and forth between hard spots like stringers, the nose of the bit is going to be the first part of the bit that penetrates those formations. If the nose of the bit is stronger, you’re able to mitigate and protect against that varying condition,” Casad continued.

The technology provides channels mainly on the primary blade. If there is a six-bladed bit, there can be three instances of SplitBlade around it. “Ulterra and its drillbits are very responsive to each individual customer need and each application. Just because you can put it on three primary blades doesn’t mean you have to. You can get three blades to center and have three SplitBlades in that bit. In certain situations it might be better to drop to two blades and only have two SplitBlades,” he said.

Geosteering, geomapping and geostopping

The EarthStar LWD is an EM tool that measures the EM field around the BHA while drilling. Part of the tool transmits and another part receives. Previously, tools could see 20 ft from the wellbore, while this tool has successfully worked up to 225 ft, according to Halliburton’s Clegg.

Different wells have different priorities. “The idea is to discuss with the customer where exactly they want the well. Maybe it should be placed really close to the top of the reservoir to allow them to produce the attic oil, etc. For those circumstances, we do what is called geosteering,” he explained.

“What we do is use the inversion results to identify changes in the geology that were not accounted for in the well plan before the well started and then react to them as we go. If the top of the reservoir suddenly starts to dip down steeply, we would alter the well path down early to make sure that we didn’t exit the reservoir. That is where the advantage of increased depth investigation helps,” Clegg said.

Geomapping is the same sort of process in which you’re placing the well in a particular path in the reservoir while at the same time assessing the formation farther away. “Say there is a second sandstone and also potentially a reservoir. If you can see that with your ultradeep resistivity tool before you drill that second well, you can actually plan that well path in a much more sophisticated way,” he said. “Knowing exactly where it is, you can plan your well path to intersect it to get the optimal production out of it.”

The EarthStar service extends the sensitive range up to 10 times farther from the wellbore than previously possible. It can illuminate and map reservoir and fluid boundaries up to 225 ft from the wellbore. “You have to be a little careful when using these depths since they are dependent to a degree on the resistivity in the formation. If you are in a good, thick reservoir with good resistivity then you can see a high depth of investigation,” Clegg said.

EarthStar is an omnidirectional tool that has both transmitters and receivers. The transmitters are staggered while the receivers are oriented. As the tool rotates, it records data and ascribes those to a distant point an angle away from the wellbore.

“What you end up with are data all the way around the wellbore stored for each measurement point. That allows you to create azimuth images all around the wellbore and also record the field resistivity,” he said. “You need an omnidirectional source to be able to create a 3-D inversion of the geology as you’re drilling.”

Getting data processed quickly is key to the successful use of the data. “It has to be a matter of minutes from measuring data to recording data to receiving data to processing data at the surface because every minute the well is drilling farther. There is a significant change in location so you need to be able to respond immediately. Effectively it is a real-time process,” Clegg explained.

“In terms of the success of the field, what we do on the surface is collect data from EarthStar and all other tools in the BHA. We then produce a model to show exactly where the well is placed, what the well is doing at that point and exactly what we think the structure is likely to do for the rest of the well,” he continued. “With our geosteering geologists and the customer’s operation geologists, we can decide what the best option is. There is a lot involved in making sure the well is successful.”

Geostopping is the other application, which can detect target zones early and land the production string in a single drilling run. “Normally when you are geostopping, you are just drilling down to the landing section. At the same time you are stopping the well, you can start to map the reservoir,” he said.

The application allows an operator to drill to casing points immediately above critical reservoir boundaries to avoid risks such as overpressured zones.

Logging tool for unconventional reservoirs

“There is always risk in drilling and completing any well. Operators just can’t afford to lose production in this market of $50-per-barrel oil, so why frac a zone that is not going to produce?” SDI’s McGregor asked.

Geophysicists, petrophysicists and completion engineers are starved for information. When something goes wrong with geosteering or fracturing, which can cost an operator a lot of oil, there is often not enough information to know what went wrong.

Enter the ULT, a tool that was “purposely designed and built for the unconventional market,” he said. “This tool provides data that allow operators to optimize well placement and engineer completions for maximum production.”

It has five sensors built into the tool. It has an azimuthal gamma ray and, as part of that, a spectral gamma ray so users can get real-time potassium, uranium and thorium measurements. The ULT also has azimuthal sonic, high-resolution ultrasonic borehole imager/caliper, triaxial vibration and near-bit inclination sensors.

“This is a great geosteering tool for the geology and petrophysics departments. It aids in looking for uranium content to help analyze where to get your total organic content,” McGregor said. “What differentiates it from other tools out there is that we’ve developed a shorter, integrated tool for today’s shale market.”

SDI released its HALO RSS in September 2018. The tool includes an automatic azimuth and inclination hold feature that can lock in the direction and the inclination per the well plan or geosteering requirements. It also features directional sensors closer to the bit.

“Our first directional sensor is within 6 feet of the bit. We’ve drilled a lot of wells, and we are consistently plus or minus 5 feet from the planned well path,” McGregor said. “The HALO comes assembled as one 31-foot tool that contains steering unit, generator, MWD, azimuthal gamma ray sensors and annular pressure sensors. Operators can downlink to the tool to change direction or inclination while drilling, and the tool is capable of building up to a 15-degree dogleg curve.”

He continued, “When combined with the ULT, which gives you spectral gamma ray, sonic, rock strength, images and fractures, you can drill a straight azimuth line and follow the stratigraphy for production. You’re looking for fractures and orientation to complete the well. You can geosteer based on the rock properties.”

The company is ramping up to build on this technology. “This will change the way people do completions. Most operators frac geometrically without regard for variations in rock properties that can leave large parts of stages unstimulated. Today’s frac operations cost more than the drilling of the well, while the cost of running these tools will be less than that of one frac stage. Utilizing the SDI HALO RSS in conjunction with the ULT can address the needs of everyone on the operator’s asset team,” he said. “We have heard anecdotes from the customers that claim some people are weaving back and forth on the line by plus or minus 60 feet. If your wells are wandering all over the place, the potential error in the cone of uncertainty can be quite large as you get out 10,000 feet to 15,000 feet horizontally.

Going plus or minus 60 feet and then plus or minus 100 feet or 200 feet leads to a cone of uncertainty at TD [total depth] where you can suffer frac hits and communicate between your wellbores.”

By having an RSS with built-in 3-D directional navigation, users can achieve better spacing and avoid communicating with wells that have already been fractured. “The HALO/ULT combination is the perfect asset to continue to improve and optimize, getting the best frac and most production out of your well because you now have quality information about the formation that is inexpensive and obtained with minimal risk,” McGregor said.

To enhance the positioning of lateral wells drilled with mud motors, SDI also has released the BitSub, a 29-in.-long inclination, vibration and azimuthal gamma ray sensor placed directly above a bit that uses EM short-hop telemetry to communicate across standard mud motors. “The BitSub gives us immediate, at-bit information on wellbore trajectory and stratigraphic position and can be utilized in a 4¾-inch or 6½-inch BHA,” he said.

Read E&P's other "Drilling Innovations" cover stories from the February issue:

Software Driving Hardware To New Levels Of Efficiency

Hardware Evolution Moving Rigs Toward Automation Revelation

Multilaterals provide an unconventional approach to shale reservoirs

Recommended Reading

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Money Talks: Comerica Bank is ‘Hungry’ for Oil, Gas Business

2025-04-23 - Opportunities may be challenged in the near term, but Comerica Bank remains supportive of oil and gas, says Jeff Treadway, director of energy finance.

Italy's Intesa Sanpaolo Adds to List of Banks Shunning Papua LNG Project

2025-02-13 - Italy's largest banking group, Intesa Sanpaolo, is the latest in a list of banks unwilling to finance a $10 billion LNG project in Papua New Guinea being developed by France's TotalEnergies, Australia's Santos and the U.S.' Exxon Mobil.

Money Talks: Texas Capital Bank on How to Deploy Capital Amid Shrinkage

2025-04-22 - In an uncertain macro environment, caution is necessary in deploying capital, says Marc Graham, managing director and head of energy at Texas Capital Bank.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.