Proppants have a tumultuous life cycle. From the time they arrive on a well pad, they undergo a grueling journey in their mission to aid in releasing hydrocarbons from the reservoir. Proppants, either natural or manmade, are used to prop open natural, primary and secondary fractures downhole as the formation pressure is reduced by drawdown and the fractures attempt to close.

The trend in unconventional wells has been toward drilling efficiencies and more proppant (frequently upward of 10 million pounds to 15 million-plus pounds) with longer laterals driven by a now-documented large increase in IP as a function of proppant mass and fluid volume. Because of the increased role that proppant plays in well productivity, it is important to study the entire “life” of a proppant and how each stage in the completion of a well can affect proppant performance. Significant steps during well completion that impact proppants are:

- Repetitive mechanical handling before downhole placement;

- Exposure to acid, both pre- and post-treatment;

- Multitudes of variable and dynamic stresses within a complex fracture network; and • Scale deposition resulting from fluid chemistry, downhole geology and proppant composition.

Proppant transport safety

Recent increases in proppant consumption per well have highlighted the environmental risks associated with the handling, transport and delivery of proppants. At each point of transfer proppant attrition develops fine dust particles that can affect worker safety. In addition, the Occupational Safety and Health Administration (OSHA) recently released a new crystalline silica rule that limits the permissible exposure limit for respirable crystalline silica to less than 50 μg/cu. m of air in an 8-hr shift. Understanding the risks of proppant transport and how to mitigate them is essential for a safe and environmentally friendly well completion project.

A recent study investigated dust generation related to the transport of three different types of proppants: sand, lightweight kaolin clay proppants and intermediate- density bauxite proppants. The study concluded that all types of proppants generate dust during transport, and the presence of crystalline silica dust was found in both sand and lightweight kaolin clay proppant. Intermediate-density bauxite proppants did not contain any crystalline silica. In addition, a related study considered the impact of created dust on an average well pad that uses 10 million pounds of sand for well completion. At a 15-psi pneumatic transfer pressure (a common transfer pressure used to decrease proppant unloading time), the respirable crystalline silica dust has the potential to reach 200,000 times the allowable amount (Figure 1).

FIGURE 1. According to the new OSHA regulation, the maximum amount of respirable silica dust that can be generated on an average job site is 94.5 g. (Source: Saint-Gobain)

In addition, the created dust can cause significant wear on fracturing equipment, resulting in expensive repairs and shutdowns. In light of these results it is imperative on the industry to develop innovative transfer, collection and disposal protocols to minimize dust from proppant transfer without impeding well completion efficiencies. Current dust control technologies include proppant substitution (using bauxite-based proppants that contain no crystalline silica), proppant coatings, onsite dust collector ventilation systems and self-contained proppant delivery systems.

Fluid exposure

Fracturing fluid composition is unique for each well. Most wells, though, do use some form of acid in their fluids to dissolve minerals downhole and open up fracture initiation tunnels. As proppants are pumped downhole, they can be exposed to any acid used in the pad of the treatment. It is important to identify the influence of acid exposure on the internal microstructure of proppants since it can have a degrading effect on the mechanical performance of the proppant. Proppant selection should take into account the appropriate material and microstructure to meet the requirements for each specific application.

Current American Petroleum Institute (API) testing standards measure acid solubility but offer no guidance on how this number affects proppant mechanical performance or how acid solubility varies as a function of time, temperature and dynamic conditions (i.e., actual reservoir conditions). A recent study indicates that increased acid solubility is not always an accurate indicator of a decrease in mechanical integrity of a proppant in acidizing conditions. Depending on the proppant microstructure, acidizing can, for example, cause “surface pits,” which will result in high-stress concentration regions that promote mechanical failure.

On the other hand, acidizing may only etch intercrystalline matter without affecting the structural matrix of the proppant, thereby allowing the proppant strength to remain largely intact. The presence of silicon oxide phases has been shown to significantly decrease proppant performance under acidizing conditions. When designing a well completion plan, it is important to understand not only the solubility of the proppant in a given acid but also the microstructure of the proppant and how its unique chemical and phase compositions will react under reservoir conditions. Proper planning in this area can have a significant impact on well productivity and return on investment (ROI).

Stress network

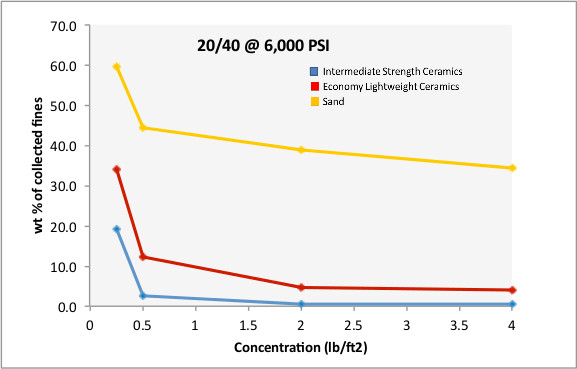

Unconventional completions have become commonplace and are markedly different than previous conventional completions. Unconventional wells show extremely high IP rates and can experience multiple shut-ins early on and throughout the life of the well. In addition, proppant concentrations in unconventional reservoirs are believed to be about 0.25 lb/sq ft to 0.50 lb/sq ft, much less than the standard proppant testing concentration of 4 lb/sq ft. The dynamic stresses and thin-layer fractures that are common in unconventional wells have strong implications for the mechanical strength and conductivity of proppants downhole.

Recent studies found that correlations and conclusions drawn from standard API testing do not accurately predict well production and overestimate the performance of sand and economy lightweight proppants (Figure 2). One study introduces a modified testing procedure that more accurately resembles unconventional fracture widths, which are similar to thin monolayer widths. Another study analyzes the effect of multiple cyclic stresses, which mimic conditions expected during the first six to 12 months of production. The results from the modified testing show a stronger correlation with well production trends, especially past 100 producing days. In addition, all proppants tested have very different proppant failure mechanisms under thin monolayer conditions compared to standard API testing. As shown in the aforementioned studies, pairing field trials with the utilization of unconventional testing protocols may provide the most accurate method for evaluating proppant performance.

FIGURE 2. This graph depicts the evolution of percentage by weight of collected fines for all tested 20/40 mesh proppants as a function of proppant loading for 6,000 psi. (Source: Saint-Gobain)

Scaling

H2S, which is inherently corrosive, can be found in both crude oil and natural gas. This impurity can be detrimental to a well and its lifetime production. In most cases, iron sulfide (FeS) scale occurs when H2S comes in contact with spent acid solutions containing dissolved iron ions, which can cause equipment damage and permeability impairment. In addition, scale buildup can occur due to the reactivity of some proppants in aqueous H2S.

A recent study analyzed the iron-containing compounds in three different bauxite-based ceramic proppants and found they demonstrated high stability in aqueous H2S solution. An iron-bearing shale core sample, though, showed high reactivity with aqueous H2S, resulting in dissolution of the shale core and precipitation of FeS scale. Another study used certain high-strength bauxite proppants from South America that exhibited detectable levels of reactivity with the aqueous H2S solution. The consequences of scale buildup can negatively affect the ROI for any given well. Although the presence of iron-bearing formation is not preventable, the risk associated with certain proppants can be mitigated by choosing the appropriate nonreactive high-strength proppant.

At each crucial well completion step listed above it is important to understand its effect on proppant and, in turn, the well’s sustainable production performance. Current standard testing procedures, developed some 30 years ago, do not take the full life cycle of a proppant into account, especially considering application conditions seen in today’s unconventional wells. In some cases this can lead to under- or overestimated performance of different proppant types. As proppant cost can reach up to 40% of total drilling and completion expense, development of new and relevant proppant- testing techniques promises to lower risk associated with proppant selection and well ROI.

Recommended Reading

Big Spenders: EPA Touts Billions in Clean Energy Spending

2025-01-15 - Nearly $69 billion in funding from the Inflation Reduction Act and Bipartisan Infrastructure Law has been dispersed by the Environmental Protection Agency in its clean energy push.

Congress Kills Biden Era Methane Fee on Oil, Gas Producers

2025-02-28 - The methane fee was mandated by the 2022 Inflation Reduction Act, which directed the EPA to set a charge on methane emissions for facilities that emit more than 25,000 tons per year of CO2e.

Report: Trump to Declare 'National Energy Emergency'

2025-01-20 - President-elect Donald Trump will also sign an executive order focused on Alaska, an incoming White House official said.

US to Withdraw from Paris Climate Agreement, White House Says

2025-01-20 - The announcement, in a document from the White House, reflects President Trump’s skepticism about global warming, which he has called a hoax.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.