During the last 30 years offshore oil and gas developments have moved into increasingly deep, remote and technically demanding regions. However, riser system development has not been static. Hybrid riser systems have gone some way to help exploit these more challenging plays. In the persistent lower-for-longer price environment there is continuing pressure to develop these fields safely while reducing capex and opex.

In short, a technological step change is needed to open up less accessible or economically cost-prohibitive fields.

Field development challenges

The development of challenging oil and gas fields with minimal or no infrastructure typically requires the deployment of floating facilities with storage capabilities. In such fields the FPSO vessel is the preferred option, accounting for about 70% of the floater market.

Semisubmersible units, spar platforms and tension- leg platforms (TLPs) are also common in deepwater regions. TLPs are particularly suited for water depths less than 1,500 m (4,921 ft). But FPSO units and floating LNG (FLNG) vessels have the distinct advantage of having the required storage and offloading capability, while other floating production units such as semisubmersible units, TLPs and spar platforms need a separate storage vessel or existing infrastructure to export production to shore.

However, there are substantial limitations with conventional FPSO and FLNG vessels that, if overcome, could considerably broaden their reach and lead to a significant reduction in field capex and opex.

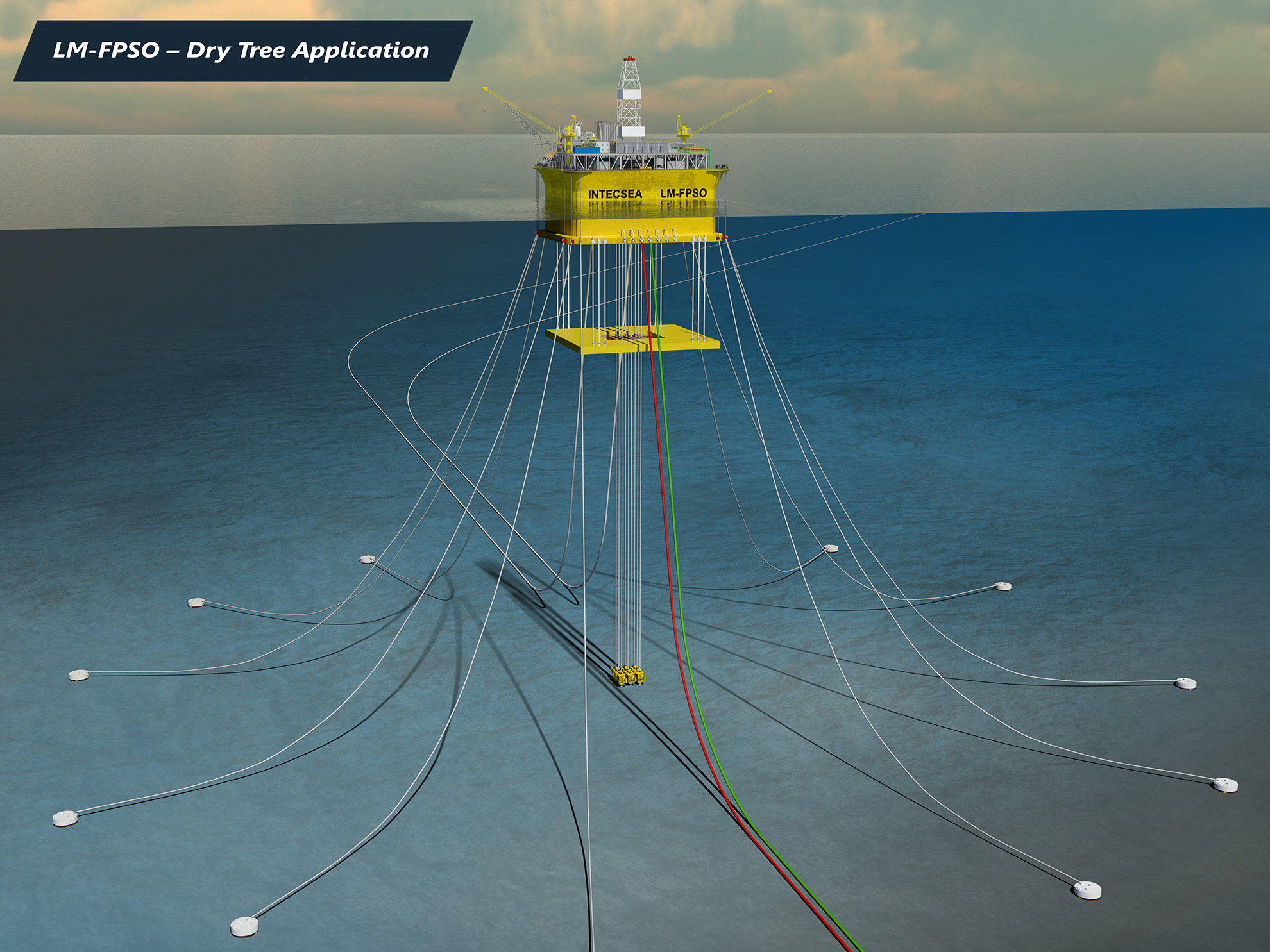

Dry-tree applications

Dry-tree applications

Using top-tensioned risers (TTRs) for direct vertical access to production wells has established technical and economic advantages.

Direct vertical access ensures that all drilling and completion can be carried out from one floater, enhancing reservoir recovery and mitigating flow assurance issues while reducing drilling and completion costs.

However, the stroke limitation of the existing qualified tensioner technologies means TTRs require a floating system with minimal heave response, so they cannot be hosted on FPSO units. As such, in dry-tree applications where storage is required, a wellhead platform is typically used along with an FPSO unit, adding significantly to overall field development costs.

Wet-tree applications

In wet-tree applications steel catenary risers (SCRs) are considered the most robust riser option because of their simplicity, long life cycle and extensive in-service history as well as relatively low combined capex and opex cost. However, the high dynamic motion of FPSO units makes them unsuitable for SCRs apart from in the most benign environmental conditions such as West Africa.

As such, less robust and more complex and expensive riser systems such as flexible risers or hybrid riser towers are typically adopted with these vessels in more challenging environments.

Riser-friendly floater option

INTECSEA’s low-motion (LM) floater technology is set to significantly reduce field development capex and opex. This robust and low-tech solution comprises field-proven components that have been in service for more than 20 years and can be applied to newbuild or conversion FPSO units, FLNG vessels, and semisubmersible units.

Fundamentally, for FPSO and FLNG applications the technology vastly improves field economics through the ability—for the first time—to deploy these vessels with large-diameter SCRs and TTRs in remote, challenging environments as well as reducing costs by eliminating the maintenance turret and swivel system in harsh environments.

In addition, a conventional semisubmersible hull with four columns and a ring pontoon can adopt LM technology to become a suitable host for dry-tree and TTR applications in deepwater and ultradeepwater fields.

The technology is less sensitive to weight and vertical center of gravity variation during construction, historically one of the highest risk elements on the project execution cost and schedule. It maintains quayside integration, and its high stability and superior motion response onsite means reduced deck steel and piping weight and enhanced habitability, crew safety and helicopter operability.

LM technology

Initial work has focused on demonstrating the superior performance of the LM technology when applied to a box-shaped hull (LM-FPSO). The LM-FPSO is a design developed to capitalize on the advantages of conventional FPSO units, including onboard storage and offloading capabilities, high payload suitability, and quayside integration, while offering superior motion response suitable for using SCRs and TTRs in very harsh environments. The shape of the LM-FPSO hull allows the use of conventional mooring systems, eliminating the need for an expensive turret and swivel system.

A five-week model-testing program performed in collaboration with Korea Research Institute for Ships and Ocean Engineering in November 2016 found the LM-FPSO’s motion response was comparable with that of a TLP and better than a spar.

Consistently, in case studies the design demonstrated an economic advantage in both wet- and dry-tree applications, with capex savings estimated to be between $500 million and $1.2 billion over alternative conventional designs.

A wet-tree design West of Shetland saved $800 million in capex by eliminating the turret and using SCRs. Using a dry-tree design in the South China Sea saved $660 million in capex by enabling the use of TTRs and eliminating the need for a wellhead TLP. Another drytree design used offshore West Africa saved $1.2 billion in capex using TTRs, eliminating a wellhead platform and facilitating well completion and workover from the FPSO unit.

The challenge for the industry is whether it can reconcile the seemingly incongruent requirements to develop fields in increasingly greater depths and hostile conditions while at a significantly reduced cost.

INTECSEA modeling estimates that overall field development capex savings of up to 19% is achieved when comparing a conventional FPSO unit with the wet-tree LM-FPSO with SCRs and a dry-tree LM-FPSO with TTRs.

INTECSEA’s LM capability potentially opens up a wealth of prospects around the world, stretching from marginal fields in the U.K. Continental Shelf to the gas basins of the Antipodes.

Recommended Reading

Exclusive: Mesa Minerals IV to Reload in Haynesville, Permian, Other Basins

2025-03-19 - Mesa Minerals IV, backed by NGP funds, is launching to acquire mineral and royalty interests in the Permian and Haynesville, said Mesa President and CEO Darin Zanovich at DUG Gas.

TG Natural Resources Boasts 20 Years of Haynesville Inventory

2025-04-09 - TG Natural Resources President and CEO Craig Jarchow said the company’s valuable Haynesville inventory provides a line of sight for investors 20 years down the line.

Queen’s Chess: Changing the Rules

2025-02-28 - There’s a popular response to the inexplicable: “I don’t know. I don’t make the rules.” But what is known with certainty, as shown throughout history, is that we can change them.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.