The Mancos Shale of the Rocky Mountain Region has long been known as a major source rock for the various producing formations of the Rocky Mountain sub-basins.

In June 2016 the U.S. Geological Survey conducted a new resource assessment of the Mancos within the Piceance Basin of Colorado and Utah. The revised assessment has placed the Mancos in the same playing field as the Marcellus in terms of its technically recoverable shale gas resource potential.

The Mancos is now estimated to contain 1.9 Tcm (66.3 Tcf) of technically recoverable shale gas and 74 MMbbl of shale oil resources within the Piceance Basin, specifically. These numbers are much improved over an earlier estimate of 595 Bcm (21 Tcf) of technically recoverable resources estimated by the Energy Information Administration in 2009.

The Mancos Shale unit is found within the larger Mancos/Mowry Total Petroleum System and spans each sub-basin within the Rockies region. Multiple shale units are found within this system, including several well-known units such as the Mancos, Mowry and Niobrara shales.

The Mancos Shale unit contains an upper and lower member providing Type II and Type II/III kerogen and yielding both gas and oil resources. Historically, the Niobrara Shale is the most explored unit within this total system; however, the Mancos Shale is beginning to show a slight uptick in well completions targeting the specifc Mancos unit.

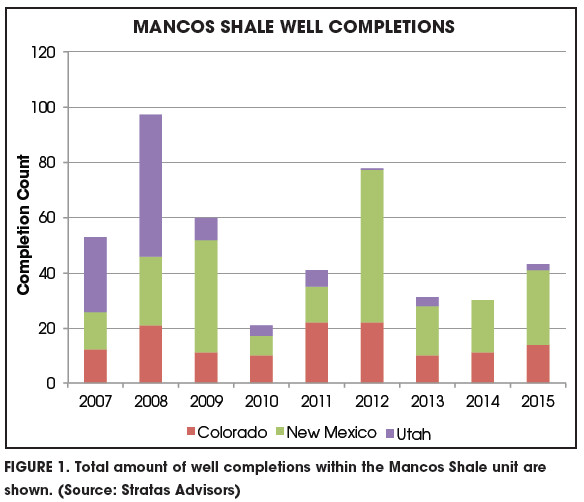

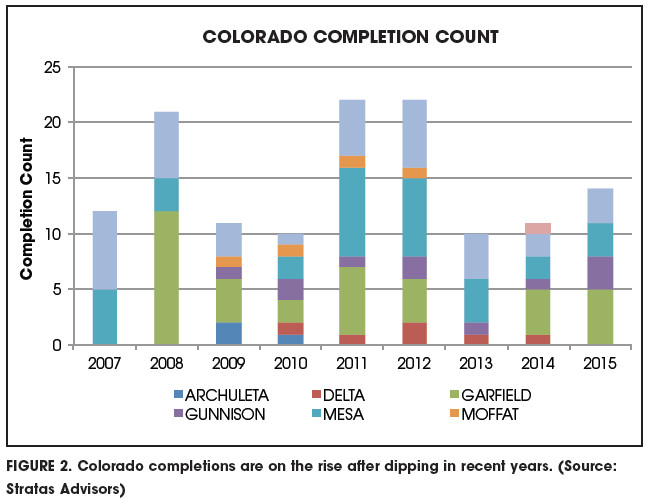

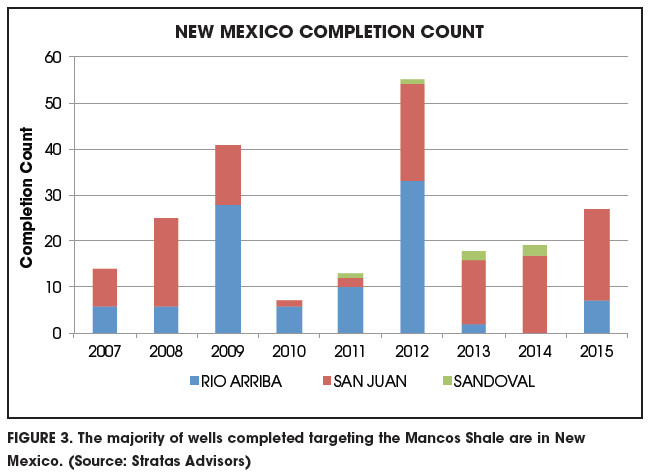

Currently, there are about 450 total wells targeting the Mancos (Figure 1). The majority of these completions have taken place in New Mexico, at 63%, and Colorado, at 33%, respectively (Figures 2 and 3).

About 80% of the wells being completed within the shale unit have used raw sand as the dominant proppant type since 2012. Over the last two years the industry has demonstrated a clear shift in utilizing raw sand as the main source of proppant in new and refracked wells as a potential way to reduce service costs in the downed markets.

Fracturing fluids used within these wells have remained steady since 2012 with 60% of wells using linear gel and 20% using slick water.

As the amount of completions has increased over the last several years, the average lateral lengths also have increased by about 64% since 2014, which had an average lateral length of about 1,402 m (4,600 ft). These laterals then increased to about 2,316 m (7,600 ft) in 2015. The majority of reported lateral length increases have been attributed to Black Hills Exploration & Production (averaging 3,048 m [10,000 ft] in horizontals), Encana Corp. (averaging 2,713 m [8,900 ft] in horizontals) and Gunnison Energy Corp. (averaging 1,676 m [5,500 ft] in horizontals).

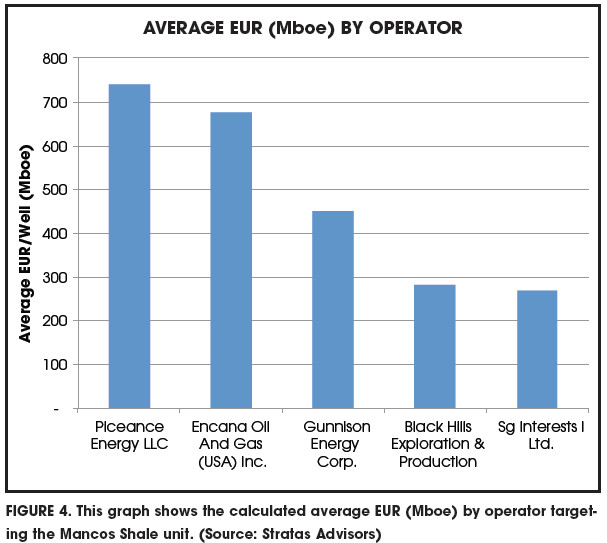

Operators also have shown varying EURs for wells targeting this formation, ranging anywhere from 269 Mboe to 739 Mboe (Figure 4). Private operator Piceance Energy LLC shows the largest average EUR followed by Encana, Gunnison Energy and Black Hills Exploration & Production.

As completions continue to increase in Colorado and operators further delineate and optimize this technique, it is likely that overall costs will be driven further and more operators will enter into this particular shale play. The Mancos Shale provides key resources within each sub-basin of the Rockies region, and with this new assessment of resources present, it is likely that the shale unit will gain more attention as operators cash in on the shale’s potential.

Recommended Reading

US NatGas Dominance Collides with Permitting, Tariffs, Layoffs

2025-03-14 - Executives at BP, Sempra Infrastructure and the American Petroleum Institute weighed in on U.S. natural gas prowess and the obstacles that could stand in the way: snagged permitting, prohibitive steel tariffs and layoffs of federal workers needed to approve projects.

EOG Ramps Gassy Dorado, Oily Utica, Slows Delaware, Eagle Ford D&C

2025-03-14 - EOG Resources will scale back on Delaware Basin and Eagle Ford drilling and completions in 2025.

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-14 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

Diversified Energy Closes $1.3B Maverick Acquisition, Enters Permian

2025-03-14 - Diversified Energy Co. Plc completed its $1.3 billion acquisition of EIG-backed Maverick Natural Resources.

Glenfarne CEO Expects FID on Texas LNG by End of 2025

2025-03-14 - Glenfarne Energy Transition executives are waiting on a re-issue of a vacated FERC permit for Texas LNG.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.