(Source: Shutterstock, Hart Energy)

Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6, compiled by Hart Energy staff.

The following information is provided by EnergyNet, Detring Energy Advisors and PetroDivest Advisors. All inquiries on the following listings should be directed to them. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

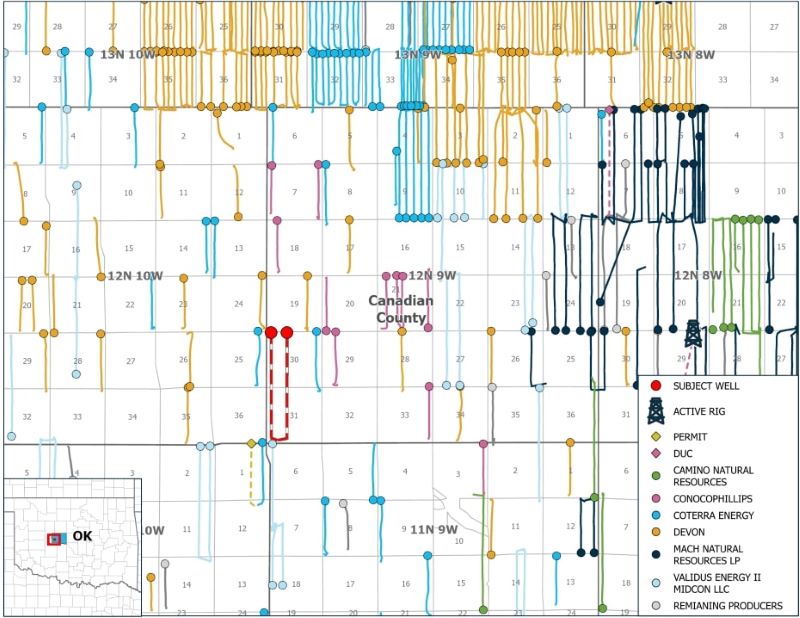

Berlin Resources 2-Well Package in Mississippian Play

Berlin Resources has retained EnergyNet for the sale of a WI participation in two wells located in Canadian County, Oklahoma. Lot# 125171

Opportunity Highlights:

- WI participation option in 2 Hz wells:

- 0.70313% WI / 0.52734% NRI

- Projected formation: Mississippian

- Total participation cost: $139,348.01

- Election to participate is due Jan. 19

- Operator: Validus Energy II Midcon, LLC

- Offset activity:

- 4 DUCs

- Select offset operators:

- Camino Natural Resources

- ConocoPhillips Company

- Coterra Energy

- Devon Energy

- Mach Natural Resources LP

Bids are due Jan. 14 at 4 p.m. CST. For complete due diligence, please visit energynet.com or email

Emily McGinley, director of business development, at Emily.McGinley@energynet.com, or Jessica Scott, buyer relations manager, at Jessica.Scott@energynet.com.

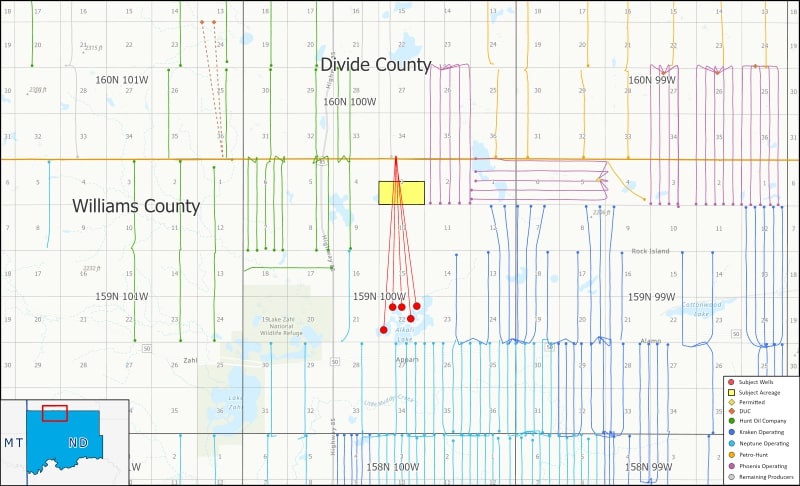

Incline Bakken Minerals 5-Well Package in North Dakota

Incline Bakken Minerals has retained EnergyNet for the sale of a working interest (WI) participation in five wells located in Williams County, North Dakota. Lot#125197

Opportunity highlights:

- WI participation option in 5 Hz wells:

- 97.16738 net mineral acres (Open for lease);

- ~3.79% WI;

- Projected Formation: Middle Bakken; and

- Participation Cost: $1,877,269.35

- Election is due Jan. 22

- Operator: Phoenix Operating LLC

- Offset activity:

- 5 DUCs

- 1 Permit

- Select offset operators:

- Hunt Oil Co.

- Kraken Operating

- Neptune Operating

- Petro-Hunt

Bids are due Jan. 15 at 4 p.m. CST. For complete due diligence, please visit energynet.com or email Zachary Muroff, managing director, at Zachary.Muroff@energynet.com.

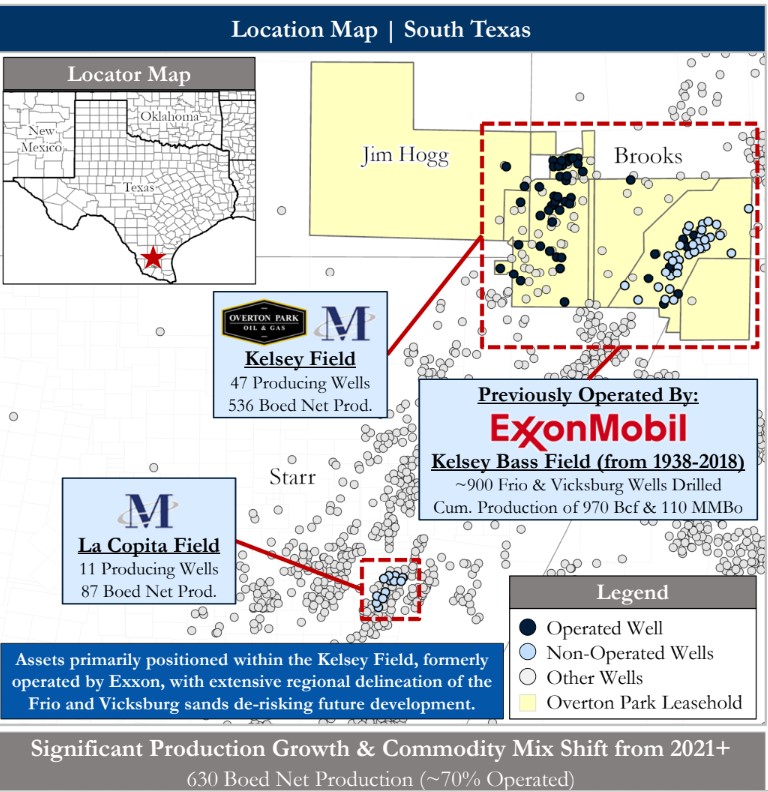

Overton Park Kelsey Bass Conventional Field Opportunity

Overton Park Oil & Gas has retained PetroDivest Advisors for the sale of its oil and gas leasehold and related interests located in Brooks, Jim Hogg and Starr counties in South Texas.

Opportunity highlights:

- Liquids-Rich Production Base | 630 boe/d | ~50% Liquids

- 630 boe/d net production (~50% liquids) from 70 active vertical wells

- PDP PV10: $18.1 million

- PDP Net Reserves: 1.3 MMBoe

- $5.1 million NTM net operating cash flow fully funds ongoing operations and future production enhancements; and

- Successful recompletion, workover, and optimization projects have grown production >3x and shifted commodity composition to ~40% oil

- 630 boe/d net production (~50% liquids) from 70 active vertical wells

- Consolidated operated position | 64,000+ Net acres | Operated average 100% WI

- Contiguous, operated 64,000+ net acre position allows for optionality in field management and development strategy;

- Operated field generates ~70% of net production; and

- Operated assets are 100% HBP

- Attractive operated royalty burden at 87% NRI on an 8/8ths basis (100% WI)

- Additional interest in 78 non-op wells with an average 43% WI and 37% NRI, primarily operated by Merit Energy.

- Contiguous, operated 64,000+ net acre position allows for optionality in field management and development strategy;

Bids are due Feb. 19. For complete due diligence, please visit detring.com/petrodivest, or email Jerry Edrington, managing director, at jerry@petrodivest.com.

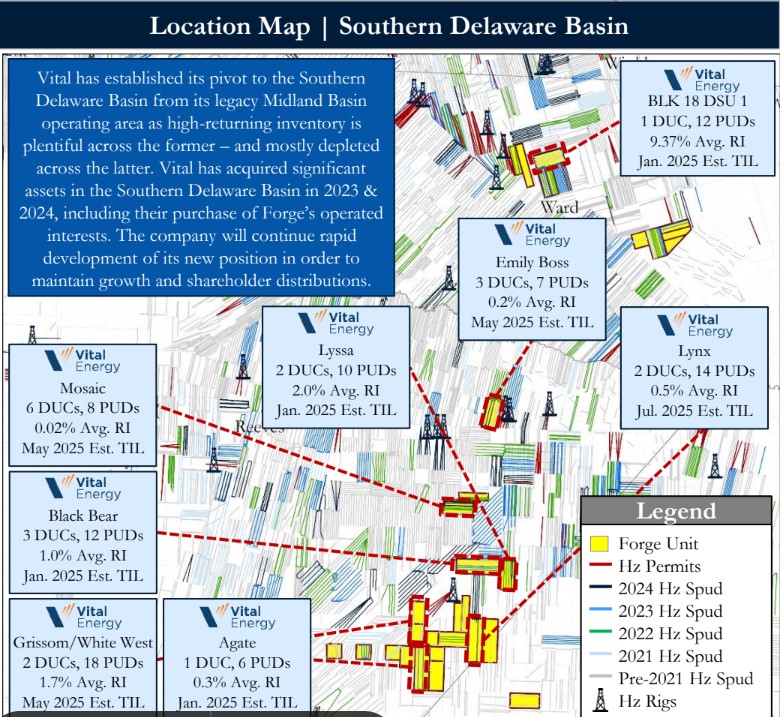

Forge Energy Mineral, Royalty Interests in Southern Delaware Basin

Forge Energy II Interests LLC has retained Detring Energy Advisors for the sale of its mineral & royalty interests in Reeves, Ward and Pecos Counties, Texas in the Southern Delaware Basin.

- $11 million of NTM cash flow from PDP & line-of-sight activity

- ~100 producing horizontal wells offer a stable base of existing cash flow

- High-interest PDP properties drive near-term cash flow (avg. 2.1% RI)

- Net Prod: ~800 Boed (83% liquids)

- PDP PV10: $29MM ($60 million PV0)

- High-interest PDP properties drive near-term cash flow (avg. 2.1% RI)

- Near-term locations accelerate cash flow growth into 2026, averaging 2 wells put on production per month.

- Near-term development plans reflect Vital’s rig schedule with line-of-sight on development through 2025.

- ~100 producing horizontal wells offer a stable base of existing cash flow

- ~4,300 Net Royalty Acres, 90% operated by Vital

- Concentrated under Vital’s recent acquisition of Forge’s operating platform, further highlighted by Vital’s significant ongoing expansion in the Southern Delaware Basin; and

- Vital has shifted focus to the Southern Delaware due to depletion of higher quality inventory across its legacy assets located in the Midland Basin.

- Concentrated under Vital’s recent acquisition of Forge’s operating platform, further highlighted by Vital’s significant ongoing expansion in the Southern Delaware Basin; and

- ~230 PUD locations in core development fairways

- Assets are centrally located to ongoing development by Vital and other regionally focused operators; and

- 3P PV10: $111MM ($266MM PV0)

- Forge’s concentrated position under Vital allows for robust free cash flow from an operator committed to maximizing reserves potential; and

- Vital is perfecting well density and multi-target development efficiencies.

- Assets are centrally located to ongoing development by Vital and other regionally focused operators; and

Bids are due Feb. 19. For complete due diligence, please visit detring.com, or email Melinda Frost, managing director, at mel@detring.com, or Derek Detring, president, at derek@detring.com.

Recommended Reading

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

TechnipFMC Awarded EPCI for Equinor’s Johan Sverdrup Phase 3

2025-03-25 - The Johan Sverdrup Field, which originally began production in 2019, is one of the largest developments in the Norwegian North Sea.

Exclusive: Metal Tariffs Unlikely to Disrupt Lower 48 Supply Chain

2025-03-25 - With tariffs discussions creating uncertainty in the energy sector, Luca Zanotti, Tenaris’ U.S. president, said he sees minimal impact with tariffs on oil country tubular goods, in this Hart Energy exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.