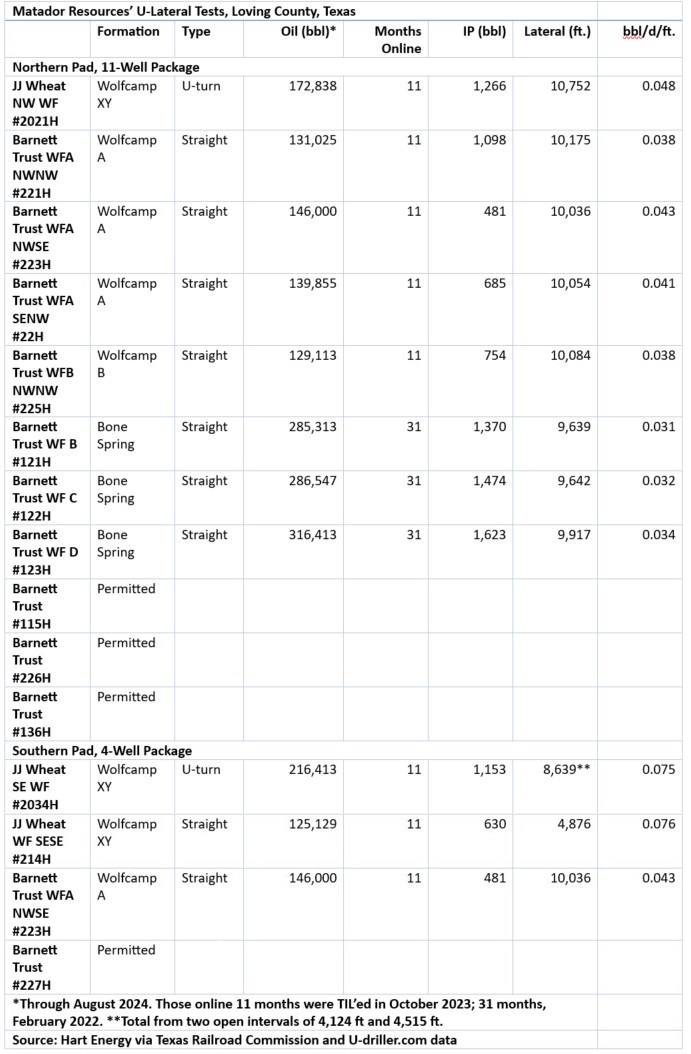

Matador Resources’ results from seven Loving County, Texas, tests include two 2-mile U-turn laterals, four 2-mile straight laterals and one 1-mile straight lateral, according to state data. (Source: Shutterstock, Matador Resources)

Matador Resources’ first two 2-mile U-turn-lateral tests in the Delaware Basin are outperforming adjacent 2-mile straight laterals in their first 11 months online, according to Texas state data.

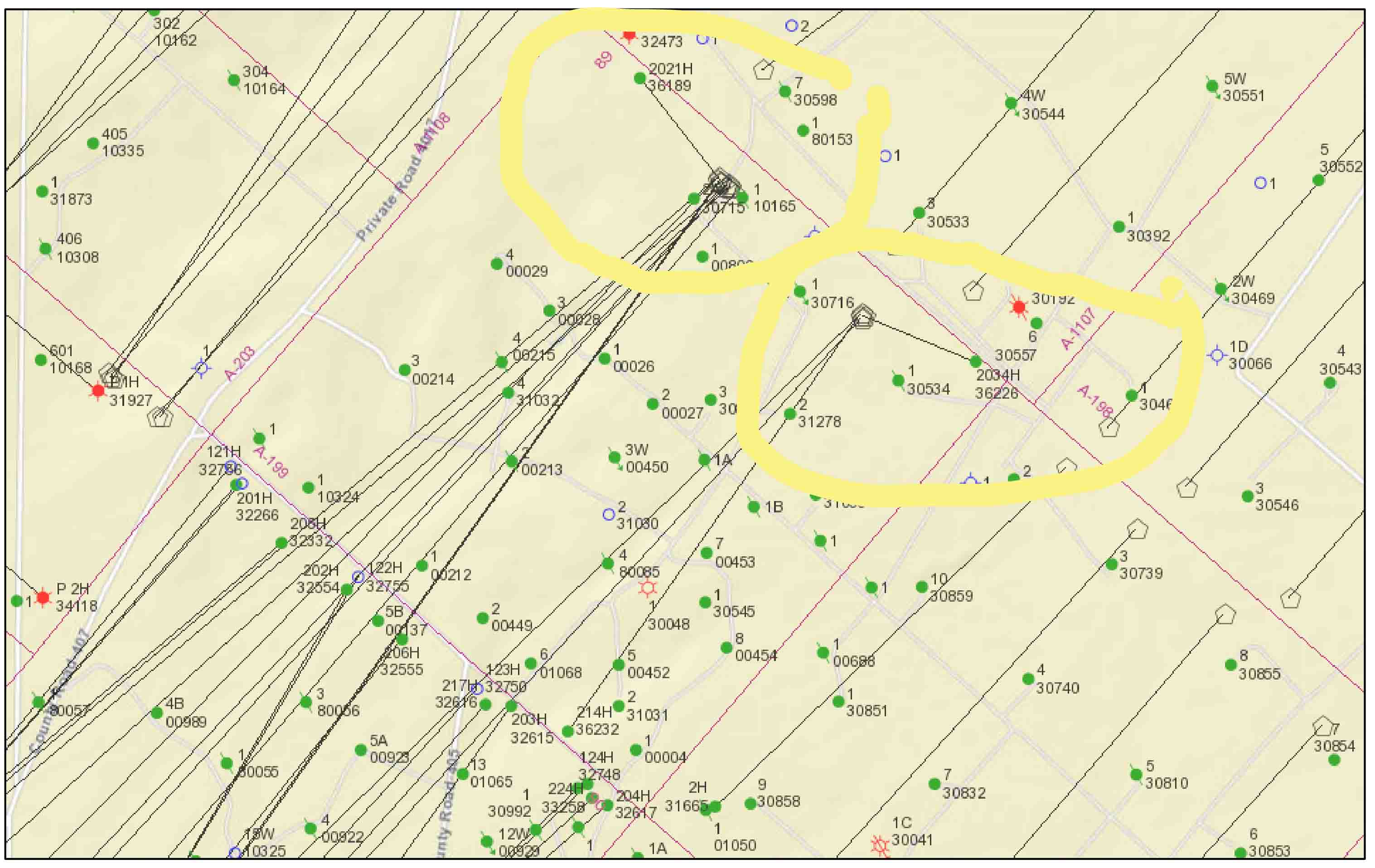

Both U-laterals are in a development of 11 wells to date, about four miles north of Mentone, Texas, in Loving County.

The U-shaped JJ Wheat NW WF #2021H produced an average of 0.048 bbl/d per lateral foot through August, higher than the 0.038 bbl/d per foot to 0.043 bbl/d per foot averaged through August from four adjacent straight-lateral sticks.

It was landed in Wolfcamp XY, while the four sticks are in Wolfcamp A and B, according to Texas Railroad Commission (RRC) data.

Including the #2021H, the five laterals range from 10,036 ft to 10,752 ft.

Next door, Matador varied the project in three tests.

A 2-mile U-turn, JJ Wheat SE WF #2024H, averaged 0.075 bbl/d per lateral foot in its first 11 months online from a total 8,659 ft of hole in Wolfcamp XY, according to the RRC.

An adjacent 1-mile stick, JJ Wheat WF SESE #214H, averaged 0.076 bbl/d per lateral foot through August. It is also landed in Wolfcamp XY. The lateral is 4,876 ft.

In another look from the same pad, Matador made a 2-mile straight lateral, Barnett Trust WFA NWSE #223H, in Wolfcamp A. Production through August from the 10,036-ft hole averaged 0.043 bbl/d per lateral foot, according to RRC data.

U-turns save money

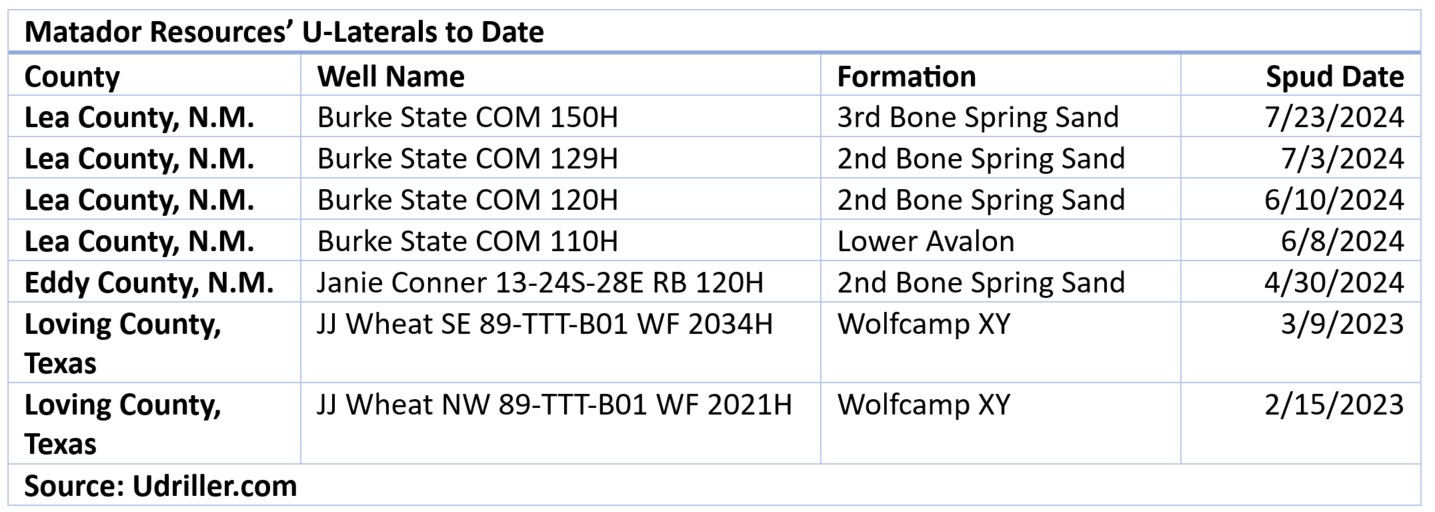

Since turning the wells to sales in October 2023, Matador has made five more U laterals in New Mexico—the Janie Conner #120H in Eddy County, in the Lower Avalon and four Burke State wells, all in Bone Spring, in Lea County—according to U-lateral tracker Udriller.com.

Data was not yet available on those laterals.

Joe Foran, Matador chairman and CEO, told investors on an Oct. 23 earnings call that the five new U-laterals were drilled 30% faster than the first two.

Also, it used remote, simul-frac completions on the four Burke State wells.

The four 2-mile U-lateral Burke State wells are in a 1-mile section where Matador would have needed to make eight laterals to tap the equivalent length of rock.

“The team estimated $3 million in cost savings per U-turn well when compared to the alternative of drilling eight one-mile … wells,” Foran said, by eliminating the vertical sections of four of the eight one-mile holes.

Matador has 196,200 net acres in the Delaware Basin with 1,100 wells producing from 11 intervals in more than 20 zones. It expects to turn to sales 110 net wells by year-end.

U-turn IPs

The initial JJ Wheat U-turn tests’ first-24-hour IPs were also higher than their straight-lateral Wolfcamp counterparts, coming in with 1,266 bbl and 1,153 bbl, according to RRC data.

One of the 2-mile straight laterals IP’ed 1,098 bbl; the other four, fewer than 800 bbl.

“Even though they're U-turn wells, they performed just like a straight 2-mile-long lateral—very high pressures and IP rates of between 2,100 and 2,400 boe/d [including gas],” Tom Elsener, Matador executive vice president of reservoir engineering, said in a mid-February investor call.

At the time, the U-shaped JJ Wheat wells were online more than four months. In addition to oil, they made between 1 Bcf and 1.3 Bcf of casinghead gas each in their first 11 months.

“You wouldn't know the difference if it was a U-turn or 2-mile lateral from the production results,” Elsener said.

In February, Matador estimated making up to 20 U-turn wells in the next two years.

“We’re ready to do a few more of those.” But, at first, “we still are kind of in the learning phase,” Elsener said.

“We're going to learn about some different targets in different areas. … I still think we're kind of in the walking mode. We're not quite in the running mode yet.

“But I think we're very optimistic about it.”

74 U-turn wells

To date, operators have spud 74 U-turn wells across the Lower 48 since a 2019 Shell Oil pilot in Loving County, according to a running tally at Udriller.com.

All but four have been in oil plays: the Permian, Eagle Ford Shale, Denver-Julesburg Basin (D-J Basin), Bakken and Anadarko Basin.

In gas plays, Ascent Resources landed one, Echo S ATH HR #3H, in the Utica’s gas-weighted fairway in eastern Ohio in April 2023. Through this past June, it has produced 5.9 Bcf and 10,739 bbl of oil, according to Ohio Department of Natural Resources data.

Coterra Energy spud one in the Marcellus in Susquehanna County, Pennsylvania, in September 2023, according to Udriller.com.

In the Haynesville Shale, GeoSouthern Energy’s GEP Haynesville spud one in DeSoto Parish, Louisiana, in January.

The results prompted Comstock Resources to put one nearby in July. It plans two U-turns in a one-section lease.

Four one-mile sticks in the isolated section would have involved two pads and cost $40 million, Dan Harrison, Comstock COO, told investors in an August call.

Making two U-turn wells instead will result in a single pad at a cost of $32 million.

If successful, “the majority of all the short wells in our inventory will convert to long laterals,” he said.

Making these wells is a matter of necessity, he added. “Until you kind of ‘have’ to do it—you're looking at your inventory improvement—a lot of people probably just don't push to go there.”

There is some risk in drilling a horseshoe well, though. There is more torque and drag. “I mean, obviously, when you're pushing and pulling pipe around the 180-degree bend, it adds more drag, tripping in and out of the hole.

“So a 10,000-foot horseshoe [is] maybe more like the equivalent of a 15,000-foot straight lateral when you look at the drag going in and out of the hole.”

Recommended Reading

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

EON Deal Adds Permian Interests, Restructures Balance Sheet

2025-02-11 - EON Resources Inc. will acquire Permian overriding royalty interests in a cash-and-equity deal with Pogo Royalty LLC, which has agreed to reduce certain liabilities and obligations owed to it by EON.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Japan’s JAPEX Backs Former TreadStone Execs’ New E&P Peoria

2025-03-26 - Japanese firm JAPEX U.S. Corp. made an equity investment in Peoria Resources, led by former executives from TreadStone Energy Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.