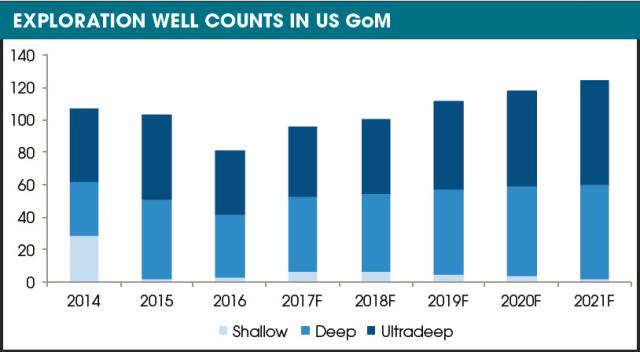

Deep and ultradeep water will continue to account for the bulk of the spending in GoM exploration. (Source: Stratas Advisors, BOEM)

Amid all of the doom and gloom of the last two years, one province stubbornly refused to be thwarted—the deepwater Gulf of Mexico (GoM).

Despite the generally dire news coming out of the offshore sector, that region saw more deepwater exploration wells spudded in 2015 than in 2014 and the same number in 2016 as in 2014, according to a report from Stratas Advisors.

Development drilling took a bigger hit. But the appetite for exploration seems unabated. Already improved prices in 2017 have resulted in an increase in drilling permit applications. “We expect exploration well counts to jump to about 95 in 2017, from 81 in 2016, and reach 125 by 2021,” the report stated. “Most of them will be in deep water.”

Over the next five years there is an expectation that 62% of the wells drilled in the GoM will be exploration wells, and most of them will be in deep and ultradeep waters.

Shell and Chevron are leading the pack, each averaging more than 20 wells per year. The combined investment of the top 10 companies will be about $65 billion and account for about 60% of the total spend in the region.

Based on the recent Central GoM lease sale, there is reason for optimism. The sale garnered almost $275 million in high bids for 163 tracts covering 913,542 acres in the Central Planning Area. Almost 30 companies submitted 189 bids totaling $315.3 million. The Bureau of Ocean Energy Management (BOEM) estimated that the lease sale could result in the production of 460 MMbbl to 890 MMbbl of oil and 54 Bcm (1.9 Tcf) of natural gas. Water depths of the previously unleased blocks are as deep as 3,400 m (11,115 ft).

But the megaprojects that have characterized the GoM in the past are not expected to resurface any time soon. “Based on our projections for spending on exploration and development projects over the next five years, we anticipate that a full recovery of capital expenditures reaching more than $25 billion will not be realized until the end of the decade,” the Stratas report stated. “As oil prices increase, recovery in spending will likely go most heavily to deepwater and ultradeepwater projects, which we expect to control upward of 95% of capital budgets.”

While exploration drilling is expected to remain at about $7 billion over the next two years, it’s likely to reach $11 billion by 2020, the report stated. Field development spending will follow, rising from $8 billion in 2016 to more than $16 billion in 2021.

The GoM has been written off as “the dead sea” too many times. Recent interest suggests that there’s still some life left.

Recommended Reading

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

EOG Ramps Gassy Dorado, Oily Utica, Slows Delaware, Eagle Ford D&C

2025-03-16 - EOG Resources will scale back on Delaware Basin and Eagle Ford drilling and completions in 2025.

Burleson: Rockcliff Energy III Builds on Past Successes

2025-04-09 - Rockcliff Energy III is building on past experiences as it explores deeper in the Haynesville, CEO Sheldon Burleson told Hart Energy at DUG Gas.

Inside Ineos’ US E&P Business Plan: Buy, Build, Buy

2025-01-27 - The E&P chief of U.K.’s Ineos says its oily Eagle Ford Shale acquisition in 2023 has been a profitable platform entry for its new U.S. upstream business unit. And it wants more.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.