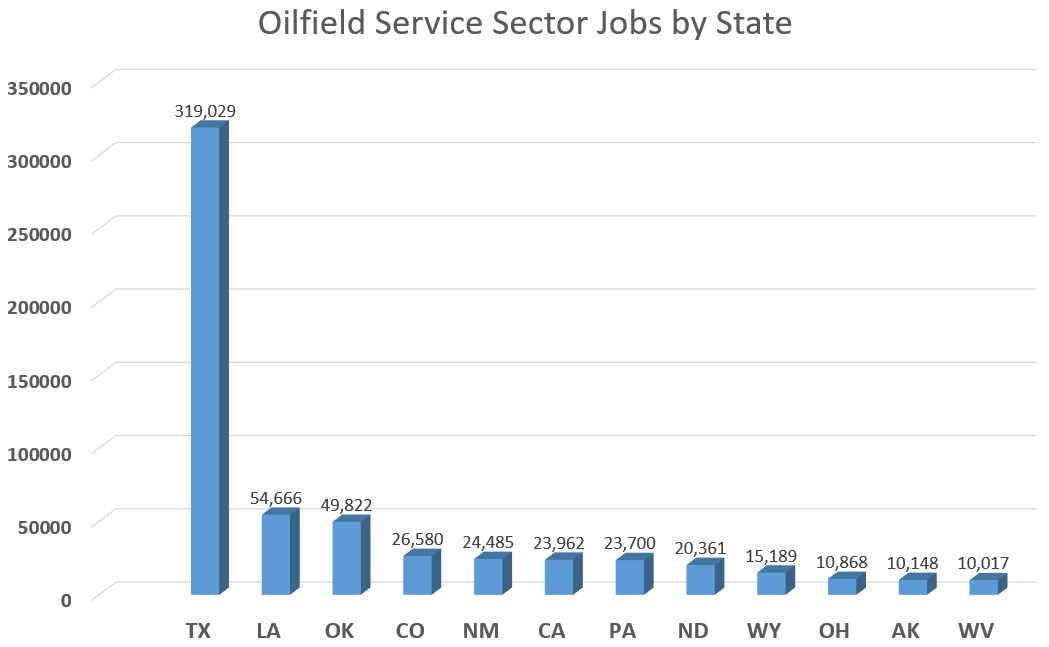

Analysis by the Energy Workforce & Technology Council shows a slight decrease—about 3,260 jobs—in oilfield services sector employment. (Source: Shutterstock)

Preliminary data from the Bureau of Labor Statistics (BLS) and analysis by the Energy Workforce & Technology Council (EWTC) shows a slight decrease—about 3,260 jobs—in oilfield services (OFS) sector employment. The data is based on BLS’ April jobs report, released on May 3.

However, EWTC, a national trade association for the global energy technology and services sector, said the OFS job market may still have potential for growth.

In April, the OFS sector reported 651,424 jobs, a slight decrease from March’s adjusted jobs report of 654,688.

The U.S. job market reported minimal gains at the national scale, with only 175,000 jobs added, according to BLS. The national unemployment rate ticked up from 3.8% to 3.9%.

“With market dynamics continually evolving, EWTC remains dedicated to fostering innovation and resilience within the energy services sector,” said EWTC President Molly Determan. “While our latest report aligns our sector with national employment trends, we see an opportunity to redouble our efforts to advance technology, upskill our workforce and drive sustainable growth.”

Recommended Reading

BP Forecasts Dip in First-Quarter Upstream Production

2025-04-11 - BP anticipates a quarter-over-quarter decline in upstream production when it reports earnings later this month.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Phillips 66 Urges Shareholders to Vote Against Elliott at Annual Meeting

2025-04-08 - Phillips 66’s board of directors is again pushing against one of its largest investors—Elliott Investment Management—with a letter to shareholders detailing how to vote against the investment company at its upcoming annual meeting.

NRG’s President of Consumer Rasesh Patel to Retire

2025-04-07 - NRG Energy anticipates naming a successor during the second quarter. Patel will remain in an advisory role during the transition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.