Presented by:

Current approaches to in-service risk management for equipment assets in oil and gas facilities focus on early identification of potential faults—often by applying proprietary cloud-based analytics solutions to raw data streams. These applications have been effective in helping end-users reduce OPEX and optimize performance. However, for complex rotating assets, such as gas turbines, they are not a direct replacement for original equipment manufacturer (OEM) expertise or engineering know-how.

To maximize the predictive window, gas turbine end-users need the ability to identify and address risks before they become potential faults. Unfortunately, many offshore operators do not have this capability. It can only be derived through decades of real-world operating experience across a fleet comprised of hundreds or even thousands of units.

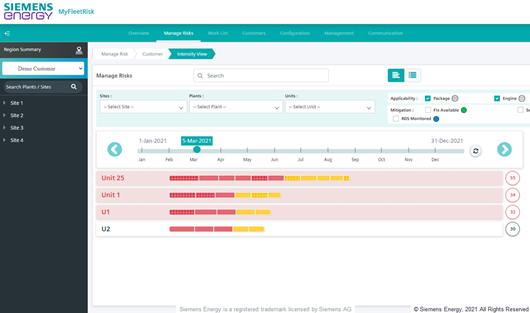

Historically, gas turbine OEMs have been reluctant to openly share their internal fleet-level risk data with customers. None have gone so far as to make it accessible in the form of a user-friendly visualization platform. Siemens Energy set out to change that with the development of MyFleetRisk.

Increasing data transparency

MyFleetRisk is a digital platform created in response to several oil and gas operators’ requests to support a more efficient allocation of OPEX. It leverages OEM engineering expertise and operating experience to identify and prioritize risk across a customers’ fleet. To our knowledge, it is the first time that a gas turbine OEM has provided transparency of internal frame-based risk data directly to customers to support their operations.

Risk visualizations are delivered via a web-accessible cloud-based platform that forms the basis of a highly collaborative approach between the OEM and the end-user. The platform provides an asset hierarchy-based navigation designed to help users understand risks at a unit, plant, site, or fleet level. In addition, solutions for addressing specific risks are provided via links—formalizing both calculated and experiential decision-making into an impactful, easy-to-use, digital service.

Opening up new ways of working

MyFleetRisk is not meant to replace digital condition monitoring approaches but rather as a compliment that provides a contiguous means to address the upstream segment of the P-F curve by putting OEM expertise and know-how at the fingertips of end-users.

Its primary objective is to address failures before they are initiated, providing actionable risk insights so that operators can proactively manage key disrupting factors across their fleet—with the result being a reduction in unplanned downtime. In addition, avoiding unnecessary trips and consequential flaring, fuel venting and compressor depressurizations also enables operators to directly reduce their carbon footprint in key near-term target areas.

The platform can be an effective tool for closing the skills gap and facilitating knowledge and competency retention across an organization. Both have become critical issues with the industry’s departure of experienced personnel.

MyFleetRisk is a recipient of OTC’s 2021 Spotlight on New Technology (SONT) award.

Recommended Reading

RWE Slashes Investment Upon Uncertainties in US Market

2025-03-20 - RWE introduced stricter investment criteria in the U.S. and cut planned investments by about 25% through 2030, citing regulatory uncertainties and supply chain constraints as some of the reason for the pullback.

TXO Partners CEO Bob R. Simpson to Retire

2025-03-20 - Gary D. Simpson and Brent W. Clum will serve as co-CEOs, effective April 1. Bob R. Simpson will remain chairman of the board, TXO said.

US Oil Company APA Lays Off Nearly 15% of Staff, Bloomberg News Reports

2025-03-19 - The news comes days after APA and its partners announced a successful oil discovery on their shared acreage in Alaska's North Slope.

NextEra Energy Resources CEO Rebecca Kujawa to Retire

2025-03-18 - NextEra Energy CFO Brian Bolster will become CEO for NextEra Energy Resources, and NextEra Energy Treasurer Mike Dunne will become CFO, the company says.

Williams Cos. COO Dunn to Retire

2025-03-13 - Williams Cos. COO Micheal Dunn was crediting with helping the company focus on a natural gas strategy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.