The prospect of using higher value microseismic products founded upon the application of advanced location methodologies, mechanism estimation and the increased understanding of the physics of rock failure and its seismogenic expression is an exciting concept. However, current market conditions are pushing service providers back into a low-cost model founded upon overly automated location estimation with undeclared location error, mechanism estimates with questionable robustness and an overly simple understanding of rock physics. This state of the market and its effect on product quality is in turn having a harmful effect on the perception of what is in reality a very useful diagnostic technology.

There is a great opportunity to use the improvements in this understanding to better characterize the hydraulic fracture from its seismogenic interaction with existing discontinuities and thereby constrain fracture models and forecast stimulation behavior.

Cloudy events provide cloudy interpretation

Let’s start with some comment on the subject of error. In the geothermal world, in earthquake seismology and nuclear test ban monitoring the issue of error has been targeted, and systematic research has been carried out that has established straightforward methods for estimating and then reducing it. As Paul G. Richards noted at the Lamont Colloquium in 2002, “Whenever we have achieved orders of magnitude improvement in the accuracy of event locations over a wide area, we have gained new insight into earthquake physics and/or new insight into earth structure and processes.”

The oil and gas industry would do well to follow the lead established by these other seismic disciplines, systematically applying advanced location methodologies and rigorously using error estimation as a metric of quality. Doing so will enable more sophisticated interpretation and decision- making and thereby improve the value of the product.

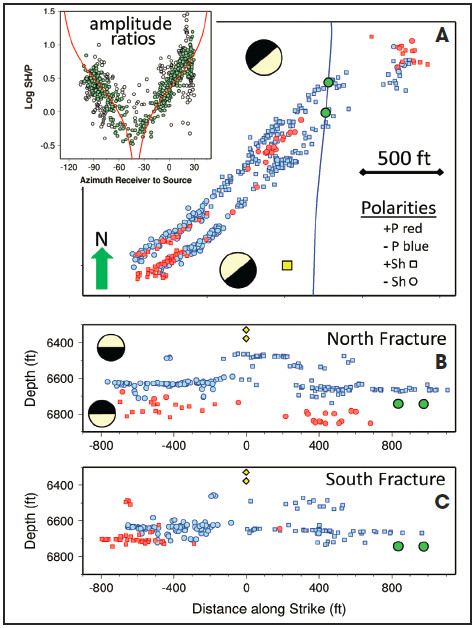

Figure 1 is taken from a paper by Rutledge et al. that shows where advanced location methodologies, source mechanism analysis and sensible interpretation can lead us. The figure illustrates a set of high-precision event locations (mean residual = 0.2 ms) that appear as very clear structural features aligning along bedding surfaces. Most intriguingly, the sense of displacement seems largely specific to each layer. If these active layers mark the upper and lower limits of fracture growth, such interpretation offers great scope for constraining the dimensions of the hydraulic fracture and feeding this information back into the fracture models.

FIGURE 1. Microseismic locations for one stage from the Barnett Shale are shown. Two perforation intervals (green circles) spaced 61 m (200 ft) apart were stimulated simultaneously. Figure A is the plan view. Figures B and C are two separate fractures growing from the isolated perforation intervals that are resolved and displayed separately in depth. The data were acquired on a 20-level vertical array of three-component geophones spanning 290 m (950 ft). The monitor well is shown as the yellow square in figure A; the two deepest geophones are shown by yellow diamonds in the depth views in figures B and C. Figure A inset: The horizontal shear-to-compressional (Sh/P)-wave amplitude ratios averaged over the array are shown with respect to the azimuth from the monitor well. Red curves correspond to the theoretical Sh/P for the dip-slip first-motion fault-plane solutions displayed in plan view. (Source: Rutledge et al., 2015. “Microseismic shearing driven by hydraulic-fracture opening: An interpretation of source-mechanism trends.” The Leading Edge. http://dx.doi.org/10.1190/tle34080926.1)

To improve the quality of microseismic deliverables, the user of such services needs a useful comparative yardstick for quality. The industry is in need of a benchmark synthetic. Given such a yardstick, it will be possible to demonstrate how improved location and mechanism estimation drives interpretation. Operators will be able to establish what good locations and mechanisms are really worth. Furthermore, if the geomechanical sophistication and complexity of the synthetic can be improved over time, products can be tested and validated with the creation of best practice documents and increased understanding.

SEAM is actively pursuing the creation of a suite of synthetic microseismic datasets. The author would welcome any suggestion or comment regarding what the industry feels such a synthetic needs to encompass.

Fracture networks, marketing and science

The industry is enthusiastically trying to figure out how to use microseismic information to constrain understanding of stimulation performance and future production by creating microseismically derived fracture networks.

Although this approach is useful in pushing the boundaries of the technology, as commercial products these fracture network products often are insufficiently grounded in the physics of stimulation to provide meaningful constraint. Presently, the marketing is ahead of the science, yet this need not be the case if the industry can direct its attention to what is important.

Important topics or issues to address include:

- Creating a better understanding of the failure mechanisms and their associated seismogenic expression such that in the models the presence of an event is represented meaningfully.

- This would mean the inclusion of shear events relating to slip on existing features, extensionshear events associated with growth of the hydraulic fracture along existing discontinuities, bedding slip events that explain the propensity of halfmoon mechanisms characteristic of some stimulations and finally the inclusion of the indirectly mapped “superhighway” of flow that is the largely aseismic hydraulic fracture.

- Dealing with the realities of microseismic physics and its detection.

- Presence of multiplets: Reduce each multiplet group to a single feature and thus avoid the conflation of error with spatial separation. This would then remove the problem of populating a volume with a catalog of discontinuities that do not exist;

- Absence of microseismic evidence: Recognize that absence of evidence is not necessarily evidence of absence and then find a method to sensibly fill in the gaps or accept that the constructed network is not an answer; and

- Location error and mechanism robustness: Establish clear location error bounds beyond which such network construction should be avoided.

So where does this all leave us?

Firstly, if readers agree or disagree with any of these statements and have evidence to back them up, they are encouraged to join in on discussions related to this topic on the LinkedIn Microseismic Technology group.

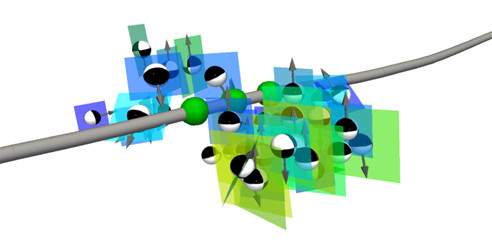

Secondly, those who buy or use microseismic services should not take this article as an excuse for avoiding their purchase. Due diligence and an insistence on the quality shown in Figure 2 will result in a positive outcome.

FIGURE 2. Microseismic events are represented as beach balls, failure planes and displacement vectors. (Source: Seismogenic Inc.)

In terms of the future for microseismic technologies in oil and gas, the industry is at a bit of a fork in the road. On the one side, market conditions are pushing the business down a potentially dark and uninteresting path, but on the other is a potentially bright future as long as resources can be put into better understanding the physics of failure and its seismogenic expression.

There is useful information within microseismic data that is presently underused but that can help constrain fracture models and thereby improve the understanding and forecasting of stimulation performance.

To make this happen will take good benchmark synthetics and the surety that marketing always comes after the science, not before it.

References available.

Contact Rhonda Duey at rduey@hartenergy.com for more information.

Recommended Reading

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.