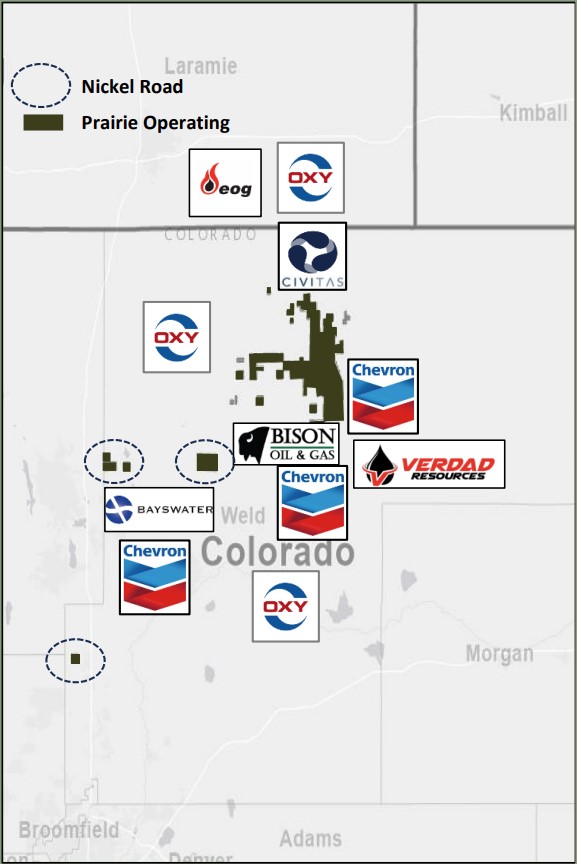

Prairie Operating is closing deals and drilling its first horizontal wells in the Denver-Julesburg (D-J) Basin. (Source: Shutterstock.com, Prairie Operating Co.)

Prairie Operating Co. is getting deeper in the Denver-Julesburg (D-J) Basin after closing an $84.5 million acquisition of private equity-backed E&P Nickel Road Operating.

The transaction included 5,592 net leasehold acres, 26 operated producing horizontal wells and 89 operated well permits in Weld County, Colorado.

When the deal was announced in January, Prairie agreed to pay a total consideration of $94.5 million for Denver-based Nickel Road’s assets.

The companies agreed in August to lower the cash purchase price to $84.5 million and reduce certain spud fees Prairie was required to pay, among other closing adjustments, according to investor filings.

“We are pleased to have closed the divestment of our remaining assets and the strong overall returns provided to our partners through multiple asset sales as well as the distribution of free cash flow over the past three years,” said Andrew Haney, Nickel Road co-president.

Nickel Road is a portfolio company of Fort Worth, Texas-based Vortus Investment Advisors. Vortus closed a sale of a different portfolio company, Delaware Basin E&P Point Energy Partners, for $1.1 billion in cash in late September.

Under the terms of the sale, Vital Energy acquired 80% of Point Energy’s assets, while Northern Oil & Gas (NOG) acquired the remaining 20%.

RELATED

Vital, NOG Close $1.1B Acquisition of Delaware Basin’s Point Energy

Prairie Operating

Houston-based Prairie Operating Co., which uplisted its shares to the Nasdaq exchange last December, has been steadily adding to its D-J Basin footprint.

Production from the Nickel Road assets was expected to average 3,370 boe/d (84% liquids, 66% oil) in February, Prairie said when announcing the deal.

The Nickel Road deal was funded through proceeds from a private placement of common stock, an equity facility and cash on hand.

Prairie formed last year between the merger of Creek Road Miners Inc., a publicly traded company using stranded gas assets to power cryptocurrency mining operations, and Prairie Operating, a vehicle to acquire and develop oil and gas assets. The company divested its crypto mining assets in January 2024.

For its E&P business, Prairie initially picked up undeveloped acreage in Weld County through the acquisition of Exok Inc. The Exok deal included 24,351 net mineral acres “in, on and under” 37,985 gross acres, according to SEC filings.

Since picking up the Exok acreage and announcing the Nickel Road deal, Prairie has focused on obtaining drilling permits to begin developing its initial “Genesis” assets, according to filings.

The company announced starting its drilling program in September, spudding the first of an eight-well pad on its 1,280-acre Shelduck South development. Prairie acquired the drilling spacing unit and drilling locations from a private seller for $900,000 in February.

The eight-well pad will feature 2-mile laterals alternating between the Niobrara B and C Chalks. Drilling for all eight wells is expected to be completed by late October.

“With our Shelduck South development now drilling well four of the eight-well pad, we expect the production from both these assets, combined with our permitted Genesis locations, to provide a significant cashflow engine for growth through 2025 and beyond,” Prairie Chairman and CEO Edward Kovalik said Oct. 2.

After closing at $8.52 per share on Oct. 1, Prairie’s stock was trading up 6% at $9.03 per share near midday on Oct. 2. Prairie has a market value of approximately $111 million.

Prairie’s executive team has several ties to Delaware Basin E&P Rosehill Resources. Prairie President Gary Hanna previously led KLR Energy, a special purpose acquisition company (SPAC) that merged with Tema Oil & Gas to form Rosehill Resources in 2017.

Rosehill filed for Chapter 11 bankruptcy during the COVID-19 pandemic in 2020, as did several other E&Ps, and reemerged as a private company. In 2021, Rosehill sold its assets in Loving and Pecos counties, Texas, to Lime Rock Resources for around $500 million.

Hanna previously led Gulf of Mexico producer EPL Oil & Gas Inc., which sold for $2.3 billion to Energy XXI Ltd. in 2014.

Prairie CEO Edward Kovalik was the founder and managing member of KLR Group, which founded the KLR Energy SPAC.

RELATED

Prairie Operating Acquires More D-J Basin Assets for $94.5MM

Recommended Reading

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

TechnipFMC Awarded EPCI for Equinor’s Johan Sverdrup Phase 3

2025-03-25 - The Johan Sverdrup Field, which originally began production in 2019, is one of the largest developments in the Norwegian North Sea.

Exclusive: Metal Tariffs Unlikely to Disrupt Lower 48 Supply Chain

2025-03-25 - With tariffs discussions creating uncertainty in the energy sector, Luca Zanotti, Tenaris’ U.S. president, said he sees minimal impact with tariffs on oil country tubular goods, in this Hart Energy exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.