(Source: Shutterstock)

The current macro outlook for the energy industry suggests times are good. Oil prices are relatively high —well above Rystad Energy’s breakevens for offshore shelf ($37/bbl), deepwater ($43/bbl) and North American shale ($45/bbl). And energy demand continues to increase. But offshore, a closer look tells a slightly different story: Globally, offshore rig utilization is stumbling.

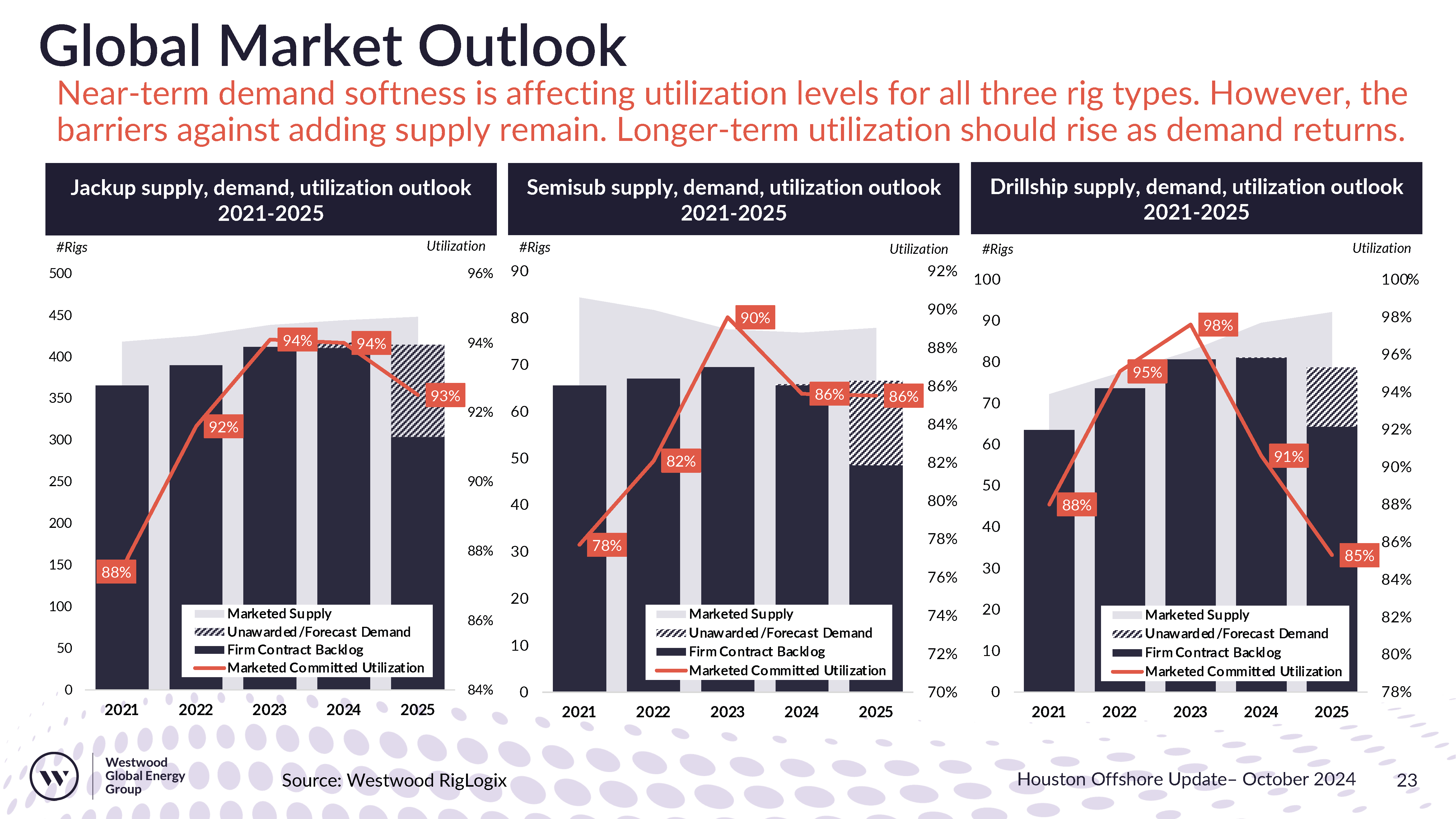

During Westwood’s Oct. 17 Offshore Rig Update Luncheon, analysts said the use of all types of offshore rigs—jackups, semisubmersibles and drillships— is down. Oil prices have also recently dropped to $74/bbl, primarily on weaker demand, said Cinnamon Edralin, Americas Research Director for Westwood Global Energy Group.

Only four new jackup rigs were added to the global fleet in 2024, raising the count to 501. However, contractual activity has decreased by 75%, largely driven by declines in the Middle East, offset by a slight increase in northwestern Europe.

Among drillships, the sector has seen some expansion, with four new deliveries this year and no retirements, bringing the active fleet to 103. Contracting remains strong, with opportunities for additional tenders in the near future, said Edralin. However, year-to-date, drillship award activity has dropped 11% compared to full year 2023.

The semisub sector is experiencing the weakest demand, with total retirements rising to six this year. Contracting activity is down 77% from last year, particularly affected by regulatory pressures in Northwest Europe.

Declines may be driven in part by energy profit taxes, she said.

“We’re also seeing environment perspective and pressures in that direction,” she said. “The new conversation for northwest Europe is when they decide they are going to do the P&A [plug and abandonment], where are they going to find the rigs? If they’ve all left or been retired, they may get to a point where they’ll pay a much higher rate to bring a rig in just to do P&A work.”

Day rates skewed

Average day rates have generally improved for jackups and drill ships compared to 2014, although semi-subs have seen a drop due to prolonged demand weakness. However, Edralin acknowledged that higher-spec drillships can sometimes inflate day rate data: “Sometimes when you include the 8th-generation and the highest spec drillships in with some of the other drillships, you kind of skew things and makes rates much higher because there is such a difference in what an eighth-generation drill ship can earn versus a sixth- or seventh-generation drill ship.”

Demand slippage, not destruction

In 2025, utilization rates are expected to fall for jackups (93%), semisubs (86%) and drillships (85%). Market fundamentals remain strong, particularly in the Americas, with Brazil being a significant driver of floating rig demand. And while global rig utilization decline might seem ominous, that is not the case, Edralin said, as the market is showing signs of “demand slippage, not demand destruction.”

“We are likely going to see a few more rates coming down as the contracting discussions catch up to the contracting announcements,” she said.

Production grows, but FIDs slow

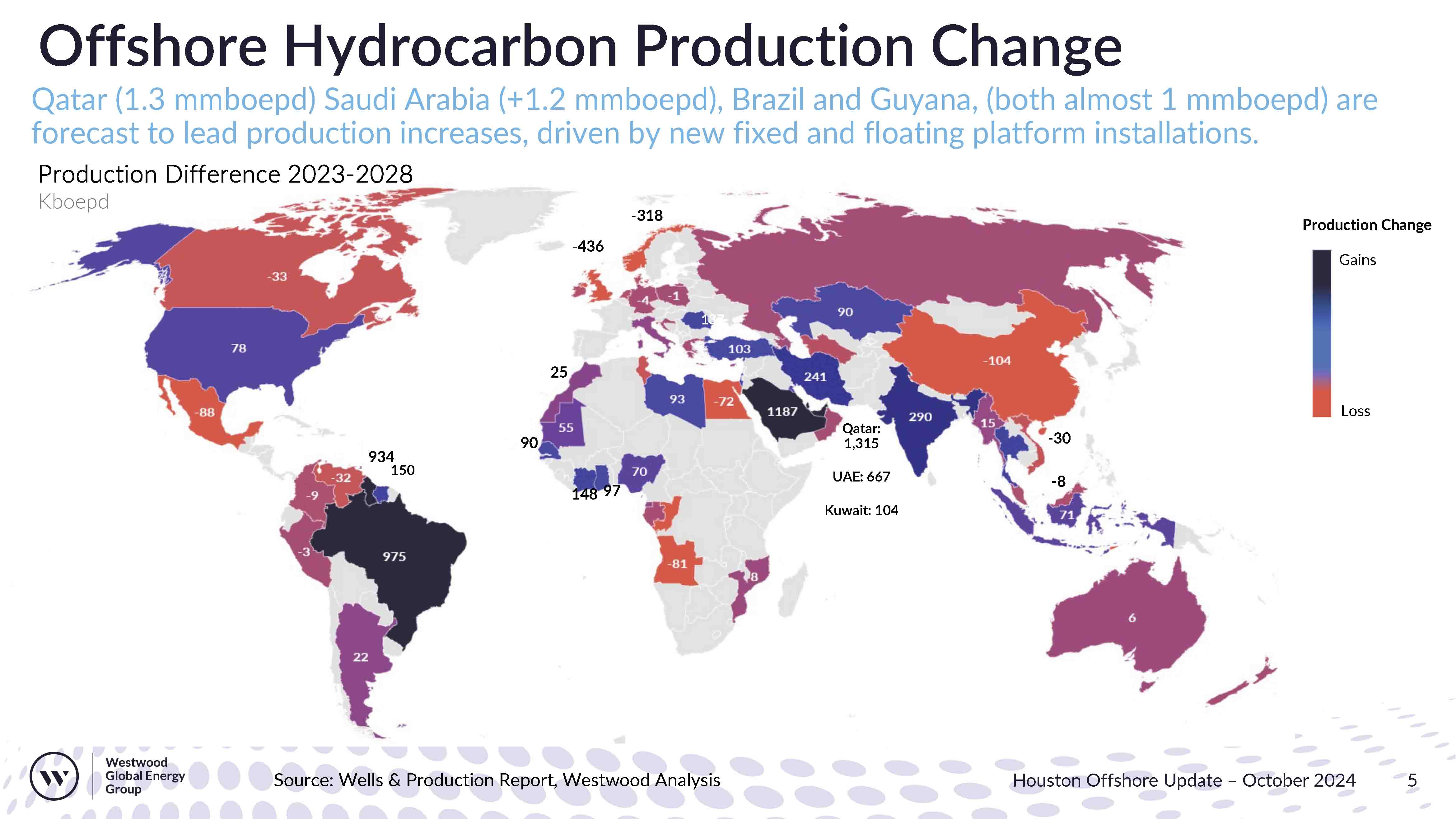

Mark Adeosun, Western Hemisphere Offshore Manager for Westwood, concurred, revealing that production is actually expected to rise globally.

A lot of that production growth is due to an increase in projects coming online in the Middle East, with Qatar expected to add 1.3 MMboe/d and Saudi Arabia to add 1.2 MMboe/d by 2028. Brazil and Guyana are also forecasted to increase production—both by approximately 1 MMboe/d—driven by new fixed and floating platform installations.

“From the international players you can see a significant increase here from Brazil where you compare 2023 to 2028 and a significant increase as well from Guyana,” Adeosun said. “Because shallow water keeps depleting, we see a lot of deepwater production coming into the marketplace in the Gulf of Mexico. Obviously this year we had the Vito Field and we had at the Sparta Field that was sanctioned last year, expected to come extremely over the forecast period and the likes of the Shenandoah Field and the Kaskida Field that was sanctioned earlier this year.”

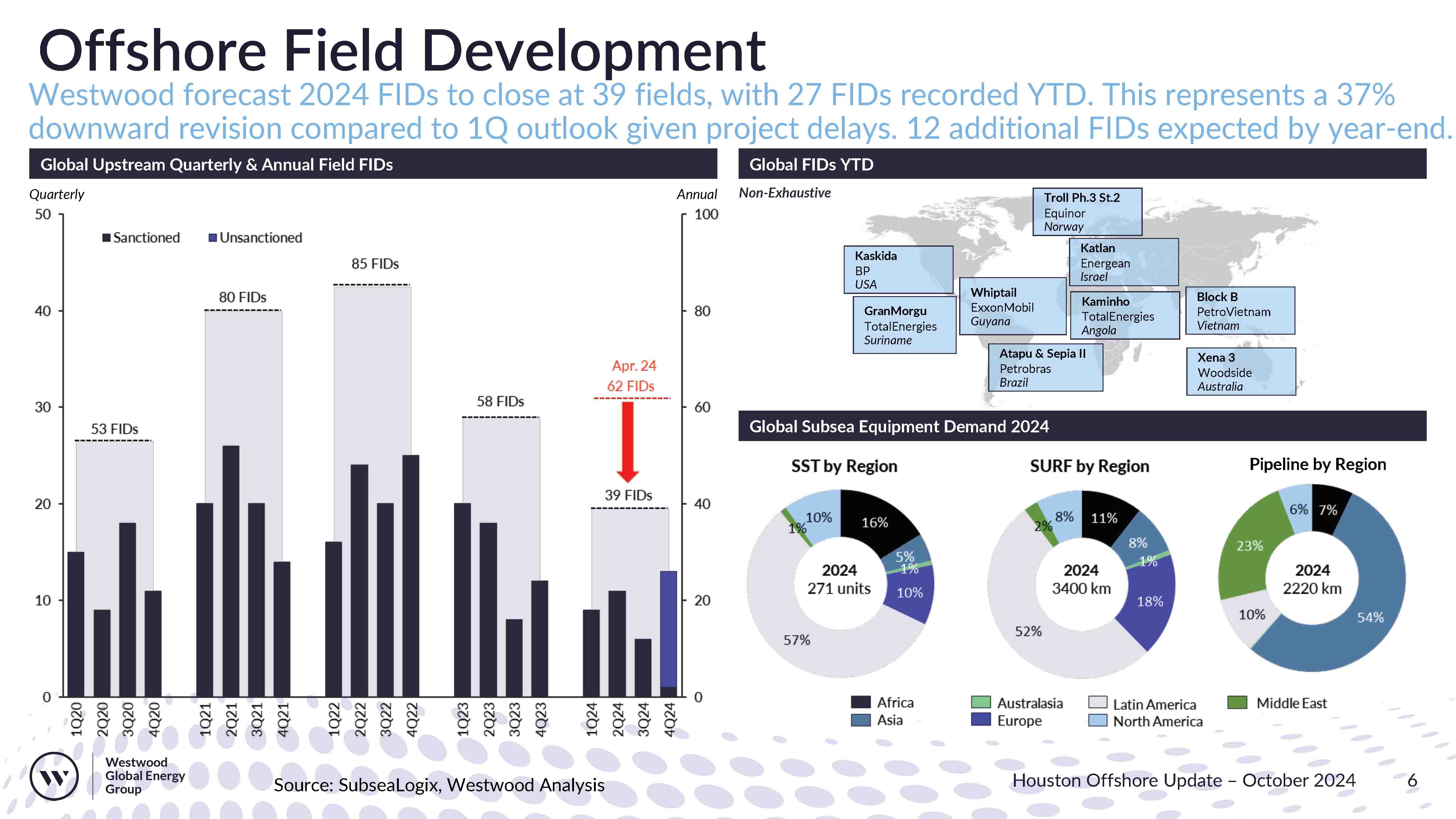

Including BP’s Kaskida project and other large projects such as Exxon Mobil’s Whiptail in Guyana and TotalEnergies’ GranMorgu in Suriname, Westwood forecasted 39 total final investment decisions (FID) on the year, which represents a 37% downward revision from their initial outlook in first-quarter 2024. So far, 27 FIDs have been recorded.

The downward revisions have resulted from project delays within the industry. Delays have come from many factors like political instability, Adeosun said. But the biggest factor has been supply chain costs nearing historic highs that ended about a decade ago.

“During the 2011 to 2014 period, oil prices were very high [and] industry costs [were] significantly high as well. The most recent black swan event within the oil and gas industry happened over the 2014 [to] 2016 period as oil prices fell and industry costs also fell, and that maintained till the end of COVID. But overall that has started to increase significantly... Now industry costs are definitely creeping up to where we were before the 2014 to 2016 downturn,” Adeosun said.

For supermajors, rising industry costs have begun to affect operating cash flows, causing a slowdown in FID counts, he said.

While the pace of FIDs has slackened, recently sanctioned projects look to bolster the industry. In the U.S., BP’s Tiber project is expected to be a big producer. Likewise, the fast-tracked Longclaw and Ewing Bank 93 projects from Murphy and Talos are both expected to reach FID and come online within 18 months, said Adeosun. So far the engineering, procurement and construction (EPC) award value in the region has totaled $1.3 billion.

In Latin America, Petrobras accounts for half of the regions $75 billion of offshore EPC spend in the area, primarily driven by the Atapu-2, Sepia II and Roncador projects. Overall, 75 billion in offshore EPC spend. Offshore Trinidad and Tobago also has sizeable potential and recent deepwater discoveries in Columbia hold major upside.

“There’s been indication before that they were going to sanction 10 FPSOs [to] be able to account for those reserves that were discovered. Six of those have been sanctioned. So there’s a possibility for four more and beyond because there’ve been new reserves that have been made in the last few years,” Adeosun said. “Overall, it’s painting a very promising picture for contracting activities in the Americas over the next five years.”

Recommended Reading

Hess Corp. Bucks E&P Trend, Grows Bakken Production by 7%

2025-01-29 - Hess Corp. “continues to make the most of its independent status,” delivering earnings driven by higher crude production and lower operating costs, an analyst said.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Chevron Names Laura Lane as VP, Chief Corporate Affairs Officer

2025-01-13 - Laura Lane will succeed Al Williams in overseeing Chevron Corp.’s government affairs, communication and social investment activities.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

BP Cuts Renewable Investment, Boosts Oil and Gas in Strategy Shift

2025-02-26 - BP aims to grow oil and gas production to between 2.3 MMboe/d and 2.5 MMboe/d in 2030.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.