There’s a widely quoted nugget of insight that the only way to get into New York City’s Carnegie Hall is to “practice, practice, practice.” Along those same lines, former New York Yankee Reggie Jackson compared the swing of a baseball bat to that of a finely tuned instrument. To develop and perfect, it requires “repetition and more repetition, then a little more after that.” It’s been proven time and time again that practice and repetition lead to success. Add to that mix relentless preparation and planning, and records are sure to fall.

Take, for example, the wells under construction by Pennsylvania-based independent Eclipse Resources in Ohio’s Utica Shale. Through practice, repetition, preparation and planning the company drilled a well with a record-breaking lateral in 2016 only to return in 2017 to drill four more in the play’s condensate window.

Preparing for the future

In 2013 the company drilled its first operated horizontal shale well—the Tippens No. 6HS—in the Utica Shale dry gas window. That well featured a lateral of 1,783 m (5,850 ft) at a total vertical depth of 3,017 m (9,900 ft) drilled in 49 days and was completed in 19 fracture stages, according to a corporate filing with the U.S. Securities and Exchange Commission.

Data from the Tippens well and others played a key role in paving the company’s way to successful drilling campaigns in 2016 and 2017, according to Benjamin W. Hulburt, Eclipse chairman, president and CEO.

“Between our drilling and other operators involved in the effort we had a couple hundred wells that had varying lengths, from probably as short as 5,000 ft [1,524 m] up to about 11,000 ft or 12,000 ft [3,352 m or 3,657 m] before we really started the super-lateral program,” Hulburt told E&P. “In analyzing that database we could not detect a drop-off in recovery per foot as we went longer. It also was easy to see cost efficiencies by going longer.”

Those cost efficiencies, along with the market decline, were key to going longer.

“We kept pushing out the lateral length to determine if we saw a drop-off in recovery per foot and where the law of diminishing returns would be among the laterals in the Utica,” he said.

“After getting to the point where we were confident out to 13,000 ft [3,962 m] that we weren’t seeing any drop-off, the decision was made to determine how long we could go from a technical perspective just to set the upper boundary of what was feasible. At the same time, I could see that the commodity prices were plummeting. The initiation of the first of those laterals in the Purple Hayes No. 1H well was really an attempt to figure out how low we could get the cost per foot of lateral to make wells in the Utica work while the commodity prices were severely depressed.”

Going longer provided the company with a way to spread out the cost of the drilling program while also maximizing the contact with the reservoir. By Eclipse standards super laterals are classified as being a lateral longer than 4,572 m (15,000 ft).

“There was a six- to eight-month engineering R&D process for the Purple Hayes well,” Hulburt said. “We worked to identify all of the potential pitfalls in drilling a well like that and create redundant systems when possible to address those risks and pitfalls. We also worked to determine a fracture design that enabled placement of fracture stages that far into a lateral.”

Drilling long, reducing costs

The application of the data collected and lessons learned during the last four years of working exclusively in the Utica and Marcellus shales contributed significantly to the engineering and planning for the drilling of the Purple Hayes well in 2016 in eastern Ohio’s Guernsey County.

The well featured the company’s first super lateral, reaching a final lateral distance of 5,652 m (18,544 ft), or 5.6 km (3.5 miles). In addition, the well was drilled to a total measured depth of 8,244 m (27,048 ft) in less than 18 days and was completed with 124 fracture stages. The company’s 2017 plans call for the drilling of 11 super-lateral wells, with four already drilled. In the first quarter the company drilled its Great Scott No. 3H well that featured a lateral extension of 5,821 m (19,100 ft) at a total measured depth of 8,352 m (27,400 ft) in less than 17 days.

On the same Guernsey County well pad as the Great Scott sits the current record holder, the Outlaw C No. 11H well. This well was drilled in less than 17 days in the second quarter and features a lateral extension of 5,944 m (19,500 ft) at a total measured depth of 8,458 m (27,750 ft).

Also drilled in the second quarter was the Yanosik A No. 2H well, also in Guernsey County, to a total measured depth of 7,333 m (24,060 ft) with a lateral extension of 4,760 m (15,620 ft) in 12 days.

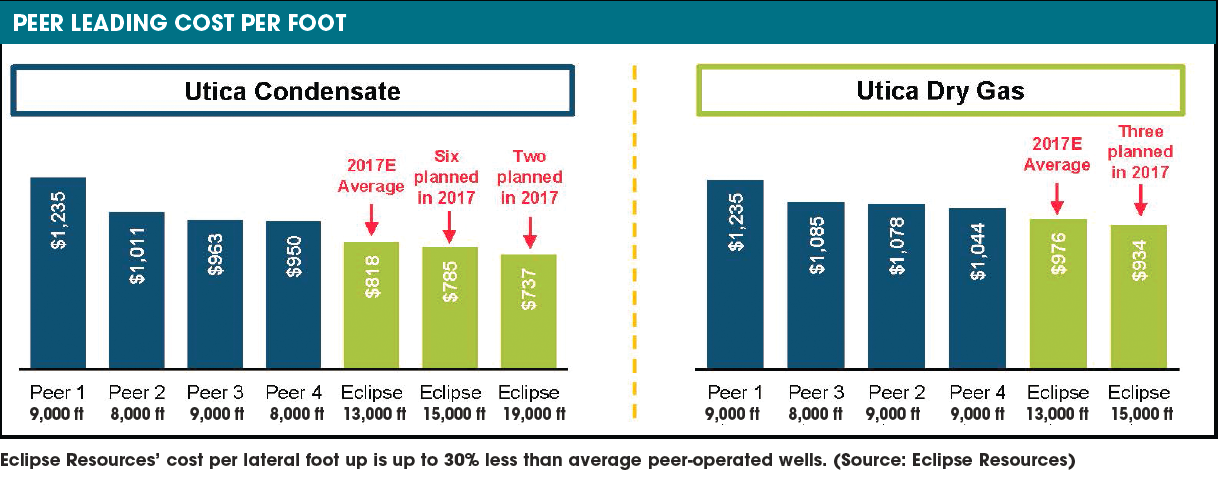

The use of a super lateral is “an effort to bring the cost down, and it’s very successful doing that,” Hulburt noted, adding that “for the Purple Hayes well, the final cost was approximately $840 per foot. For the Outlaw and Great Scott wells we’ll have to see, but for planning purposes we expect them to be closer to $750 per foot.”

Cost savings between the wells can be attributed to a variety of factors, Hulburt said. “Some of it is due to efficiency gains that we’ve garnered since drilling the Purple Hayes well,” he said. “Also, the Great Scott and Outlaw wells are on a four-well pad as opposed to the Purple Hayes well being on a single well pad. Also, the Great Scott and Outlaw wells will be zipper-fracked, which helps us pick up quite a bit on the efficiency side, resulting in a cost savings.”

Another factor to the success in the drilling program is realizing and putting to work the value that experience— rooted in years of consistent practice, repetition, preparation and planning—provides.

“We have an outstanding engineering team that consistently performs very well. At least for the time being all we have focused on is the Utica Shale for the last several years. Having that experience in the formation is a tremendous help when you’re undertaking something like this,” he said. “I guarantee if we had attempted this 40 years ago, it would not have gone as smoothly. Focusing on this particular formation for so long and with so many wells is what gave us the confidence to undertake this.”

Recommended Reading

Confirmed: Liberty Energy’s Chris Wright is 17th US Energy Secretary

2025-02-03 - Liberty Energy Founder Chris Wright, who was confirmed with bipartisan support on Feb. 3, aims to accelerate all forms of energy sources out of regulatory gridlock.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.